01/13/2026

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

Markets are starting 2026 with less tolerance for political noise and a sharper focus on inflation and employment data. Central banks remain firmly on pause, but bond yields are proving sensitive to any signal that inflation or labour markets are not cooling fast enough. For brokers, this remains an execution-driven market where structure, preparation, and expectation-setting matter more than rate forecasting.

1️⃣ Inflation Focus: Markets Are Tuning Out the Noise

Early-week volatility was driven by political headlines, but markets quickly refocused on upcoming inflation data. Bond yields moved higher before stabilizing as investors shifted attention toward U.S. CPI and other inflation-sensitive releases. The takeaway is clear: inflation data — not political commentary — is driving rate direction.

Source: MortgageLogic News – Markets Tune Out Politics, Tune Into Inflation Data (Jan. 13, 2026)

🔑

Broker Strategy: Help clients separate headlines from fundamentals. Inflation prints are what move lender pricing and bond desks. Keeping clients focused on data reduces reactive decision-making and builds trust during volatile weeks.

2️⃣ Bond Yields & Rate-Cut Odds: The Pause Is Here

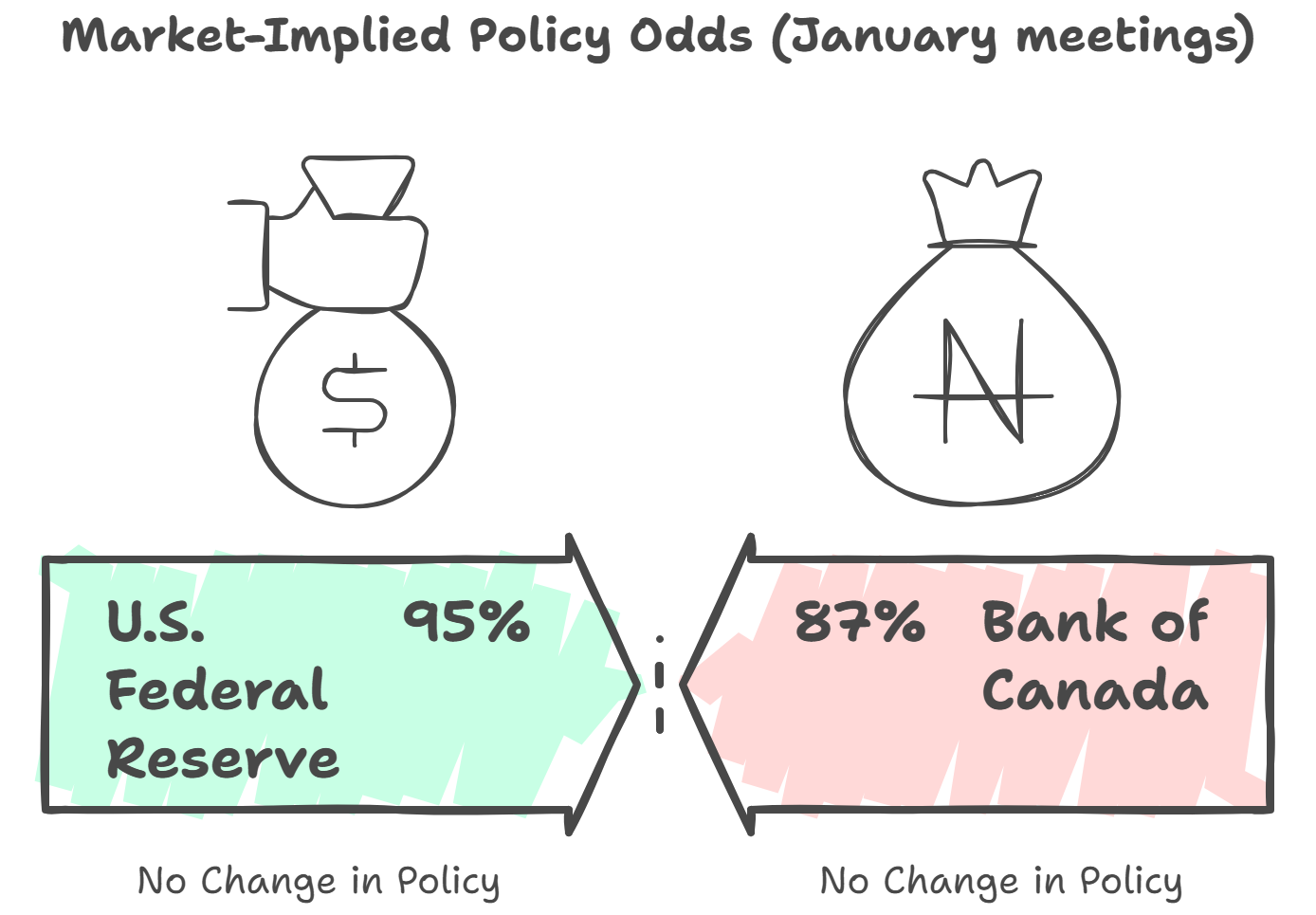

Bond markets remained steady despite elevated headline noise, with yields continuing to trade in narrow ranges. The Canada 5-year bond yield is holding just under 3.0%, while the 4-year swap remains firm, reflecting persistent inflation caution. Rate-cut expectations remain muted, with markets pricing a strong likelihood that both the Bank of Canada and the U.S. Fed stay on hold near term. This is a textbook policy-pause setup: stable ranges, data sensitivity, and no clear trend lower yet.

Source: MortgageLogic News – Markets Tune Out Politics, Tune Into Inflation Data (Jan. 13, 2026)

Canada 5-Year Bond Yield and Swap Rates Signal a Firm Policy Pause, Not an Imminent Pivot

🔑 Broker Strategy: Frame this environment as one of stability, not opportunity cost. When yields move sideways, lenders price selectively and unpredictably. Encourage clients with upcoming purchases or renewals to secure optionality early — not because rates are about to rise or fall sharply, but because preparation matters most when momentum is absent. This is a strong window for disciplined term selection and proactive file management.

3️⃣Employment Data: Cooling, But Not Weak Enough

Canada’s December jobs report showed +8,200 jobs, an unemployment rate increase to 6.8%, and slower wage growth (3.4% YoY, down from 3.6%). While the data confirms easing momentum, it also supports the Bank of Canada’s view that policy is “about right” for now and that patience remains warranted.

Source: Integrated Mortgage Planners – How Canadian Mortgage Rates Will Be Impacted by Lukewarm Employment Data (Jan. 12, 2026)

🔑 Broker Strategy: Use this data to counter expectations of rapid rate cuts. Slower growth alone isn’t enough. Reinforce that fixed rates are likely to remain supported unless labour conditions deteriorate more meaningfully.

4️⃣ Mortgage Pricing Reality: Penalties Are Part of the Trade-Off

Canada’s lower fixed mortgage rates compared to the U.S. come with a cost: prepayment risk is priced in through penalties. While borrowers often dislike these restrictions, they are a key reason Canadian fixed rates remain materially lower than U.S. equivalents. Removing penalties would likely push rates meaningfully higher.

Source: MortgageLogic News – Prepayment Penalties (Jan. 13, 2026)

🔑 Broker Strategy: Shift penalty discussions from complaints to context. Help clients understand that flexibility and price are a trade-off. This is especially important when comparing short- vs. long-term fixed options.

5️⃣ Broker Performance in 2026: Action Beats Intention

Early-2026 success is less about market timing and more about consistency. The brokers gaining momentum are those setting daily standards, initiating conversations, and staying visible — not waiting for “perfect” conditions. Momentum is being built through disciplined action, not forecasts.

Source:

The Better Broker Blog (Jan. 11, 2026)

🔑 Broker Strategy: Don’t wait for rates to move to justify outreach. Proactive contact during stable markets builds pipeline, trust, and referrals — long before the next cycle shift.

📢 Final Thought:

This is a market defined by restraint. Inflation is easing but not resolved, bond yields are stable but elevated, and central banks are firmly on hold. For brokers, this creates opportunity — not through bold predictions, but through structured advice, disciplined execution, and consistent client engagement.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via the ABW Agent Intranet under our corporate plan.

EPISODE 57: Behind the Broker with Alfredo Torres

Guest: Alfredo Torres

Hosts: Dean Lawton & Jason Marshall

Alfredo Torres joins Behind the Broker to share a journey shaped by service, growth, and genuine human connection. Long before mortgages, Alfredo’s career was built on systems, consistency, and customer experience—from his early years at McDonald’s to nearly a decade at TD, where he developed deep expertise across lending, investments, and client communication. That foundation ultimately set the stage for a natural transition into mortgage brokering.

When bank “optimization” created uncertainty, Alfredo chose to take control of his path. What started as casual conversations with mortgage brokers quickly turned into a clear opportunity to grow beyond the constraints of traditional banking. Brokering gave him the freedom to serve clients more holistically while continuing to evolve personally and professionally—something he sees as essential to long-term success.

A key theme of the episode is culture and communication. Alfredo shares why A Better Way’s supportive, judgment-free environment has been a game-changer, and how structure—like the Perfect Loan Process—only works when paired with discipline. He also dives into his relationship-first approach, explaining how understanding how clients communicate builds trust faster, reduces stress, and creates better outcomes, especially in complex or emotional transactions.

From powerful client success stories to the tools he relies on daily—Velocity, Gold Rush, lender relationships, and AI-powered learning—Alfredo reinforces a simple truth: brokering is still a people business. This episode offers practical insight on building trust, creating lifelong clients, and staying motivated through growth, making it a must-listen for brokers focused on long-term impact and balance.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.