01/28/2026:

BoC Holds at 2.25%: A Measured Pause as Policy Nears Its Destination

At today's announcement, the Bank of Canada (BoC) held its overnight interest rate at 2.25%, keeping the Bank Rate at 2.50% and the deposit rate at 2.20%. Today’s decision reinforces a message that has been building for months: monetary policy is now well-positioned, and further moves will depend on how the economy evolves rather than on momentum from the prior easing cycle.

After a period of aggressive rate cuts through 2024 and 2025, the Governing Council signalled that it is comfortable pausing to assess how those policy adjustments are working their way through the economy.

Why the BoC Held: Four Key Drivers Behind Today’s Decision

Inflation: Close to Target and Contained

Inflation remains near the Bank’s 2% target, providing policymakers with confidence that price pressures are under control. Headline inflation has moderated meaningfully, and more importantly, core inflation measures—which strip out volatile items—do not point to renewed inflationary risk.

With inflation no longer the primary threat it was in earlier years, the BoC sees little need to either tighten further or rush into additional cuts.

Economic Growth: Soft, But Holding Together

Canada’s economic performance remains subdued, but it is not deteriorating sharply. Growth is modest, household spending remains cautious, and business investment is uneven—but the economy is not showing signs of a deep or disorderly downturn.

This “soft-but-resilient” backdrop supports a pause. The Bank sees enough stability to wait, but not enough weakness to justify immediate stimulus through lower rates.

External Risks: Trade Uncertainty Looms Large

One of the clearest themes in today’s communications is uncertainty around external risks, particularly trade. Ongoing concerns tied to global tariffs and the upcoming review of the U.S.–Mexico–Canada Agreement (USMCA) continue to weigh on business sentiment and investment decisions.

With these external risks unresolved, the BoC is reluctant to adjust policy prematurely. Holding steady allows policymakers to respond later if global developments materially impact Canadian growth or inflation.

Policy Has Already Eased Significantly

Perhaps the most important reason for today’s hold is timing. After multiple rate cuts over the past two years, the Bank believes much of that easing has yet to fully filter through the economy.

Monetary policy works with long and variable lags. Pausing now gives households, businesses, and financial markets time to absorb earlier changes before the BoC decides whether additional adjustments are necessary.

Economic Context and Market Impact

Financial Markets: Calm and Orderly

Markets had largely anticipated today’s decision, and the reaction has been muted. Bond yields and credit spreads showed limited movement, reflecting broad agreement that policy is now “about right.”

This stability supports a more predictable environment for borrowing and planning, particularly for fixed-rate products, which remain closely tied to bond market dynamics.

Business Confidence and Investment

Business sentiment remains cautious, shaped by trade uncertainty and slower global growth. However, investment tied to modernization and productivity improvements continues to provide pockets of support. The BoC expects activity to remain uneven in the near term, with gradual improvement as uncertainty clears and global conditions stabilize.

Impact on Borrowers

Today’s hold means no immediate changes for borrowers:

- Variable-rate mortgage and HELOC holders will see no change to payments, with prime remaining at

4.45% at most institutions.

- Fixed-rate borrowers

can expect relative stability in pricing, barring significant moves in bond yields.

- Static-payment variable borrowers

benefit from improved amortization predictability as rates stabilize.

- Adjustable-rate variable borrowers will experience no payment changes but gain clarity heading further into 2026.

For many borrowers, this pause creates an opportunity to reassess payment strategies, amortization timelines, and upcoming renewals in a more stable rate environment.

What’s Next?

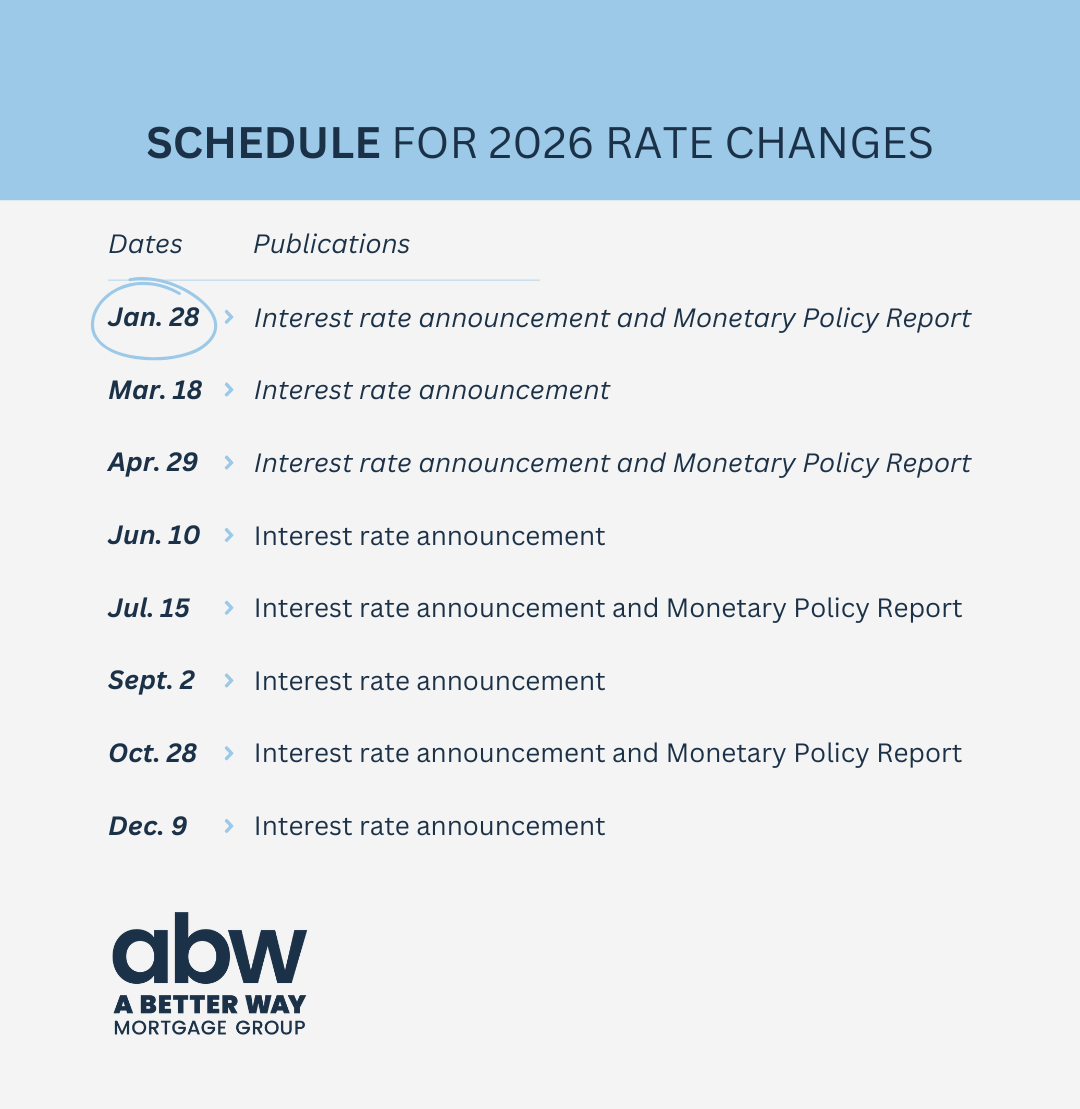

The next Bank of Canada rate announcement is scheduled for March 18, 2026.

Looking ahead, policymakers remain firmly data-dependent. Inflation trends, labour market conditions, and global trade developments will determine the next move. While markets see limited urgency for further cuts in the near term, unexpected economic weakness or renewed global disruptions could still alter the outlook.

For now, the message is clear: the BoC is comfortable waiting.

Opportunities for Mortgage Brokers

Today’s decision reinforces a strategic shift—from reacting to rate moves to planning within a stable policy environment:

- Proactive Client Outreach: Use today’s hold to reset expectations with variable-rate and HELOC clients and begin early renewal conversations for 2026 maturities.

- Education-Focused Messaging: Explain why the BoC is pausing—near-target inflation, moderate growth, and external uncertainty—helping clients understand why large rate swings are less likely in the near term.

- Targeted Marketing: Focus outreach in regions showing renewed buyer interest, particularly Ontario and British Columbia. Emphasize that stable policy rates provide clarity for planning, and encourage clients to secure pre-approvals while fixed-rate pricing remains steady.

- Renewal & Refinance Strategy: Encourage clients within 120 days of renewal to review options early. Stable rates allow for thoughtful term selection, cash-flow planning, and potential consolidation strategies.

- Stay Data-Driven: Monitor upcoming inflation prints, labour market data, and global trade developments. These will be the key signals shaping the BoC’s next move.

TAKE ACTION!

At ABW Mortgage Group, we’re here to help you navigate this period of renewed stability with confidence. Whether you’re buying, refinancing, or renewing, our team can help you make informed decisions in a calmer rate environment.

Now is the time to plan ahead—secure favourable terms, protect your borrowing power, and position yourself strategically for 2026.

Let’s make stability work for you!

EPISODE 58: Year in Review — The Mortgage Broker Podcast

Hosts: Dean Lawton, Jason Marshall & Deryk Williamson

Dean Lawton, Jason Marshall, and Deryk Williamson come together for a special Year in Review episode to reflect on a milestone year for A Better Way Mortgage Group—and for the broker channel as a whole. The conversation looks back on a record-breaking 2025, shaped by resilience, adaptation, and a noticeable shift in industry sentiment after several challenging years.

A central theme of the episode is how brokers found opportunity in a changing market. As rates normalized and traditional approvals became more difficult, the team highlights a meaningful increase in alternative, private, reverse, and business-for-self lending. Rather than chasing headlines or waiting for “easier” conditions, brokers who leaned into education, product knowledge, and new strategies were able to grow—even in a market often labeled as difficult.

The hosts also unpack what it takes to scale responsibly. From compliance and AML readiness to onboarding, operations, and technology, they share how investing in infrastructure and people allowed the brokerage to grow to $4.1B in annual volume while serving over 1,900 additional families. Training, collaboration, and consistent communication—through events, lender sessions, and weekly market updates—are positioned as key drivers behind both performance and confidence.

Beyond the numbers, the episode emphasizes culture and community as true differentiators. From in-person events and charity initiatives to the evolution of the podcast itself, the discussion reinforces a simple idea: brokers thrive when they feel supported, connected, and empowered to keep learning. It’s a candid look at what worked in 2025—and a roadmap for brokers preparing to build momentum in the year ahead.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.