02/03/2026

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

The Bank of Canada has already made its move — or rather, chosen not to. With policy now firmly on hold, markets are shifting their focus to growth, global inflation pressure, and fiscal risk. Bond yields are steady, client uncertainty remains high, and this is increasingly a market where explanation and structure matter more than forecasts.

1️⃣ Growth Update: Weak, Known, and Largely Priced In

Canada’s economy flatlined in November and barely grew in December, leaving Q4 GDP tracking slightly negative. Manufacturing and other goods-producing sectors remain under pressure, and it took an $8 billion federal deficit in November alone just to produce zero month-over-month growth. Despite this softness, bond markets barely reacted — a sign that weak growth is no longer a surprise.

Source: RMG Morning Bru – Bank of Canada GDP Expectations, Actual GDP and Friday Is Jobs Day (Feb. 2, 2026)

🔑

Broker Strategy: Use this to reset expectations. Weak growth does not guarantee lower rates when inflation risk, global yields, and fiscal deficits are still in play. This supports stable mortgage pricing — not emergency easing.

2️⃣Bond Yields & Rate-Cut Odds: Markets Signal Patience, Not Urgency

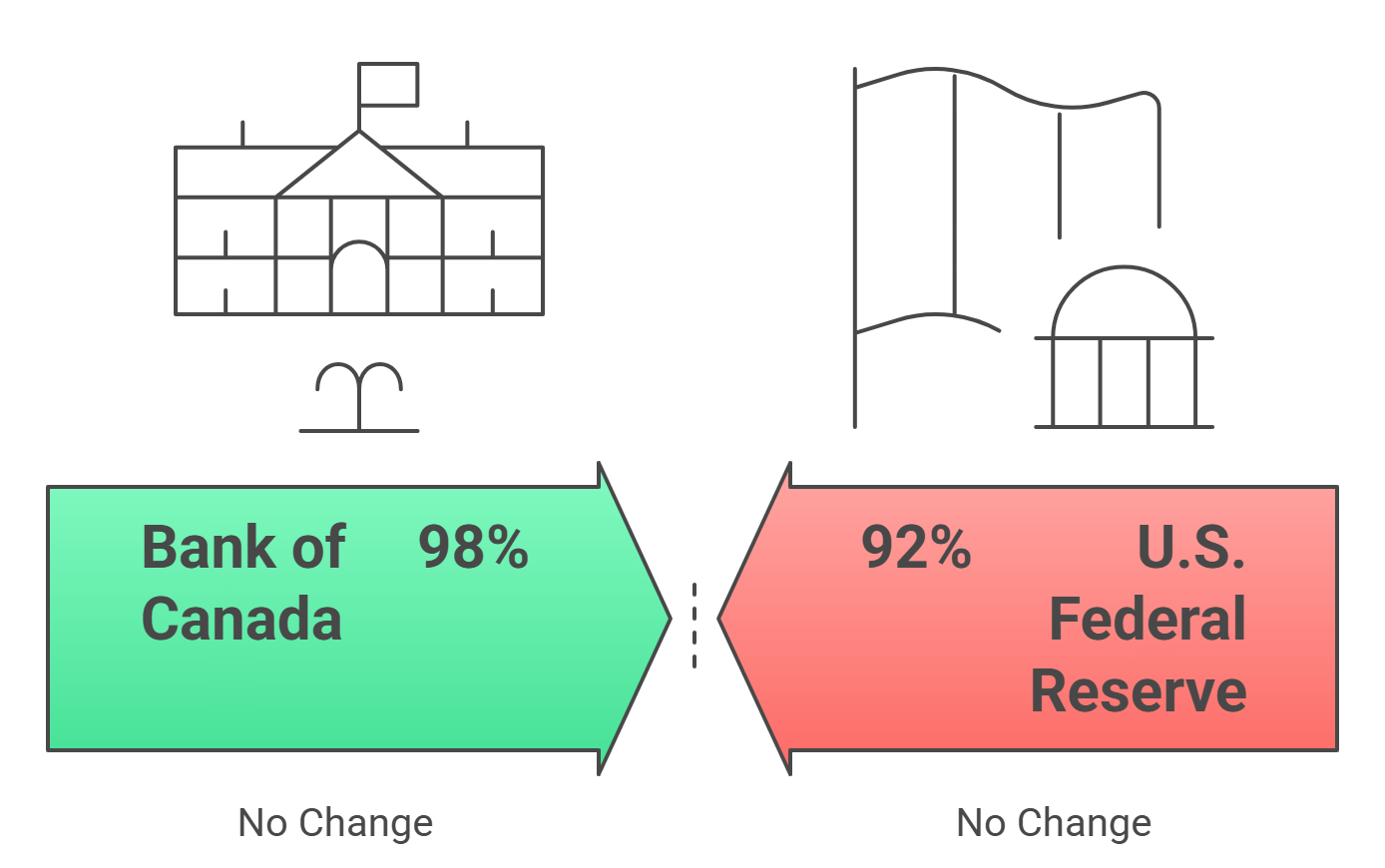

Despite weak Canadian growth data, bond markets remain calm. Funding costs are tightly range-bound, reflecting broad consensus that monetary policy is appropriately set for now. Markets are overwhelmingly priced for no near-term changes from either the Bank of Canada or the U.S. Federal Reserve, reinforcing a prolonged policy-pause environment rather than an imminent pivot.

Source: MortgageLogic News – Markets Barely Blink at Limp Canadian Growth (Feb. 2, 2026)

Bond Markets Reinforce a Firm Policy Pause as Rate-Cut Odds Remain Low

Markets are overwhelmingly priced for no near-term changes from either the Bank of Canada or the U.S. Federal Reserve.

🔑 Broker Strategy: This is a stability window. Encourage early renewals, rate holds, and disciplined term selection. Sideways markets reward preparation, not prediction.

3️⃣BoC Messaging: Uncertainty Is Now the Signal

Last week’s Bank of Canada decision reinforced a defensive stance. The word “uncertainty” appeared 22 times in the Monetary Policy Report and 7 times in Governor Macklem’s opening statement. Trade tensions, CUSMA renegotiation risk, and threats to U.S. central bank independence dominated the narrative. While policy was described as “about right,” the Bank emphasized it is ready to respond quickly if conditions deteriorate.

Source: Integrated Mortgage Planners – No Move Last Week by an Increasingly Uncertain Bank of Canada (Feb. 2, 2026)

🔑 Broker Strategy: Use this to calm clients worried about hikes. The BoC’s bias remains toward caution and downside protection, not renewed tightening.

4️⃣ Fixed vs. Variable: Why Five-Year Still Works

Rate simulations continue to favour five-year fixed mortgages, largely because markets are pricing higher-for-longer risk into the curve. Variable discounts have improved slightly (about 5 bps recently), but history shows that in sideways markets, variable borrowers often absorb pain before relief arrives.

Source: MortgageLogic News – Mortgage Tidbits (Feb. 2, 2026)

🔑 Broker Strategy: Frame this as risk management, not rate direction. Five-year fixed remains an effective default for clients prioritizing certainty. Variable works only when flexibility and cash flow are truly strong.

5️⃣Broker Advantage in 2026: Trust Is the Differentiator

In an environment flooded with polished explanations and AI-generated competence, trust has become scarce. Clients don’t want brilliance — they want consistency, speed, and follow-through. Brokers who are predictable, calm, and clear will outperform those chasing optionality or clever narratives.

Source:

Be The Better Broker – Rep by Rep Outtakes: Trust Is the Scarce Resource (Feb. 1, 2026)

🔑 Broker Strategy: Do the boring things well. Return calls. Flag risks early. Don’t oversell outcomes. Reliability compounds faster than insight in uncertain markets.

📢 Final Thought:

This is a market defined by patience. The Bank of Canada has confirmed it is in wait-and-see mode, growth is weak but well understood, and bond markets are showing little urgency in either direction. For brokers, the opportunity isn’t in predicting the next move — it’s in helping clients plan confidently through a period where rates may simply go nowhere for longer than expected. In environments like this, consistency and clarity matter more than conviction.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via the ABW Agent Intranet under our corporate plan.

EPISODE 59: Broker Armor — FINTRAC One Year Later (Are You Protected?)

Hosts: Dean Lawton & Justin Noda

Dean Lawton is joined by Justin Noda, Chief Compliance & Operations Officer at A Better Way Mortgage Group, to launch Broker Armor—a new podcast series dedicated to helping mortgage brokers navigate compliance, regulation, and risk with clarity and confidence. This first episode sets the foundation by tackling one of the most important (and misunderstood) shifts in the industry: FINTRAC compliance, one year after implementation.

The conversation focuses on a critical distinction many brokers still struggle with—the difference between brokerage responsibilities and agent responsibilities under FINTRAC. Justin walks through what it truly means to be a “reporting entity,” why most FINTRAC obligations sit at the brokerage level, and where brokers still play a vital role inside each file. Using real-world examples and plain language, the episode breaks down common gaps, misconceptions, and risks that surface during audits.

A practical FINTRAC checklist anchors the discussion, covering key pillars like compliance leadership, policies and procedures, risk-based assessments, training, ID and beneficial ownership, PEP and sanctions screening, record keeping, suspicious activity reporting, and upcoming effectiveness reviews. Rather than treating compliance as a box-checking exercise, Dean and Justin frame it as a form of professional protection—for brokers, brokerages, and the industry as a whole.

This episode is an essential listen for brokers who want to protect their license, understand where liability truly sits, and prepare for increased regulatory scrutiny ahead. Broker Armor sets the tone for a series focused not on fear, but on education, readiness, and doing business the right way in a more professionalized mortgage landscape.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.