12/16/2025

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

Canada’s latest inflation data delivered a welcome downside surprise, easing immediate rate pressure — but not enough to restart a cutting cycle. With core inflation still elevated and global uncertainty rising, both the Bank of Canada and the U.S. Fed have firmly shifted into wait-and-see mode. For brokers, this creates a near-term window of rate stability where proactive outreach and clear positioning matter more than predicting the next cut.

1️⃣ Inflation Update: Headline Relief, Core Still Sticky

Canada’s November inflation report came in softer than expected, offering some relief to markets. Headline CPI held at 2.2%, below the 2.3% consensus, while gasoline prices fell 7.8% year-over-year, easing transportation costs. Rent inflation also slowed to 4.7%, down from 5.2% in October. However, the Bank of Canada’s preferred core measures remain uncomfortable: CPI Median and Trimmed Mean both printed at 2.8%–2.9%, keeping underlying inflation pressure just below the Bank’s informal 3% ceiling.

Source: RMG Monday Morning Bru – Inflation Below Market Expectations and 5Y Bond Yield Back Below 3% (Dec. 16, 2025)

🔑

Broker Strategy: Frame this as progress, not victory. Use the softer headline CPI to calm client anxiety, but be clear that core inflation near 3% means the BoC is unlikely to rush into further cuts. Planning conversations should assume steady rates into early 2026, not a renewed easing cycle. This is a good moment to refocus clients on term structure, flexibility, and cash-flow resilience rather than chasing rate timing.

2️⃣ Bond Yields & Rate-Cut Odds: The Pause Is Here

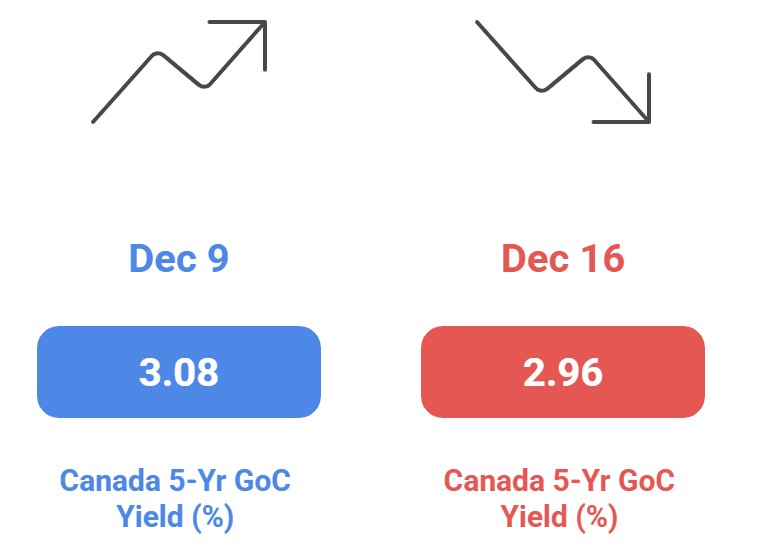

Bond markets responded calmly to the CPI beat. The Canada 5-year bond yield slipped roughly 3 bps, falling back just below 3.0%, while the 4-year swap remained elevated, hovering near recent highs. Markets are now pricing virtually no chance of a BoC move at the next meeting, and U.S. Fed expectations have cooled significantly as policymakers push back against premature easing. This is classic policy-pause territory: narrow ranges, headline-driven noise, but no clear downward trend yet.

Source: MortgageLogic News – 5yr Yield Slips 3 bps as CPI Beats Expectations (Dec. 16, 2025)

Canada 5-Year Bond Yields Ease After CPI, Reinforcing a Policy-Pause Environment

🔑 Broker Strategy: Coach clients to expect stability, not momentum. In pause environments, lenders adjust pricing selectively and unpredictably. Encourage clients with upcoming purchases or renewals to lock optionality early — not because rates are about to spike, but because sideways markets reward preparation. This is also a strong setup for short- and mid-term fixed conversations where certainty has tangible value.

3️⃣BoC Messaging: Actively Pushing Back on Hike Talk

Following its December decision, the Bank of Canada has made a deliberate effort to push back against market speculation around rate hikes. Governor Macklem emphasized that Q3 GDP strength was largely technical, forecast weak growth in Q4, and reiterated that uncertainty remains high. Importantly, the BoC reaffirmed that policy is “about right,” that it is not considering hikes, and that it remains open to cutting again if conditions deteriorate.

Source: Integrated Mortgage Planners – The Bank of Canada Pushes Back Against Rate-Hike Speculation (Dec. 15, 2025)

🔑 Broker Strategy: Use this to counter client fears that “rates are going back up.” Reinforce that while cuts may be delayed, hikes are not the base case. This supports confidence in locking terms without fear of missing a sharp drop — and reassures variable-rate clients that policy risk is skewed toward patience, not tightening.

4️⃣ Fixed vs. Variable: Narrow Spreads, Boring Wins

Mortgage pricing changed little this week. Fixed rates remain under modest upward pressure due to earlier bond moves, while variable-rate discounts have widened slightly. Nationally, 3- and 5-year fixed terms remain closely priced, and modeling continues to show limited difference in long-term cost between them under most scenarios. Variable still offers the lowest projected lifetime cost — but only for borrowers who can tolerate payment volatility.

Source: MortgageLogic News – Mortgage Tidbits (Dec. 16, 2025)

🔑 Broker Strategy: Position this as a flexibility conversation, not a rate call. When pricing is tight between terms, the real decision is about risk tolerance and future options. For many clients, “boring” mid-term fixed rates remain highly effective in uncertain environments. Variable works — but only when clients fully understand and can absorb the swings.

5️⃣ Lender Behaviour: Selective, Quiet, File-Dependent

Despite calmer bond markets, lenders remain cautious. Fixed-rate specials are limited, discretionary pricing is highly file-dependent, and insured deals continue to receive preferential treatment. Turnaround times vary widely by lender, and year-end capacity constraints are beginning to show. In short: the best pricing is still available, but only for clean, well-packaged submissions.

Source:

RMG Monday Morning Bru (Dec. 16, 2025)

🔑 Broker Strategy: Execution matters more than ever. This is not a market where sloppy submissions get exceptions. Encourage clients to move early, prepare documentation in advance, and lean on insured or lower-risk structures where possible. Relationships, packaging, and timing are doing more work than rate forecasting right now.

📢 Final Thought:

This is a market defined by restraint. Inflation is easing but not conquered, bond yields are calmer but not falling, and central banks are firmly on pause. For brokers, that’s an opportunity. Clients don’t need bold predictions — they need structured guidance, realistic expectations, and financing plans that work even if nothing changes for months. In periods like this, discipline beats drama every time.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via the ABW Agent Intranet under our corporate plan.

EPISODE 56: Behind the Lender with Alex Dey, Scotiabank

Guest:

Alex Dey

Hosts: Dean Lawton & Jason Marshall

Alex Dey, VP of Portfolio Optimization at Scotiabank, joins Behind the Lender to unpack how one of Canada’s largest banks manages pricing, capital, and broker strategy behind the scenes. With 22 years at the bank and over a decade in mortgages, Alex explains how his team balances growth, profitability, and risk—while ensuring Scotiabank stays competitive and deeply connected to brokers through its SMA model. He highlights why nearly half of Canadians now choose brokers and how complexity in the market has only strengthened the need for expert advice.

Alex takes listeners inside the creation of Mortgage Plus, now one of the most impactful programs in the broker channel. Born from rising capital pressures and the need for deeper client relationships, the idea was shaped collaboratively with SMA brokers during a national rewards trip—an example of Scotiabank’s relationship-driven approach. The result has been stronger customer depth, streamlined onboarding, and a program that aligns long-term bank strategy with broker success.

The episode also breaks down one of the industry’s most misunderstood topics: pricing. Alex clarifies why rate movements can’t be explained by the bond market alone, introducing brokers to the concept of liquidity premiums, hedgeable vs. non-hedgeable risk, and how volatility throughout the year forced rapid adjustments behind the scenes. His explanation gives brokers essential context for setting client expectations in a fast-moving rate environment.

Finally, Alex shares how Scotiabank is transforming the renewal experience through a dedicated Renewal Specialist team and a broker concierge program that protects both the client relationship and the broker’s reputation. He also offers an outlook on rates, the economic factors shaping future policy decisions, and why brokers should look beyond purchases—renewals, switches, and refinances will continue to drive opportunity in 2025–2026.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.