01/20/2026

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

Canada’s latest inflation data delivered a mixed message: headline inflation moved higher, while core measures continued to cool. Bond markets reacted calmly, reinforcing that central banks remain firmly on pause — but not yet comfortable. For mortgage brokers, this remains a market defined by restraint, narrow ranges, and selective opportunity, where proactive guidance matters more than predicting the next rate move.

1️⃣ Inflation Update: Headline Up, Core Still Cooperating

Canada’s December inflation report surprised slightly to the upside on the headline, with CPI rising to 2.4% year-over-year, up from 2.2%. However, the Bank of Canada’s preferred core measures continued to ease. Average core inflation slowed to 2.6%, its lowest level in a year, while trimmed and median measures are now running below the BoC’s 2% target on a short-term annualized basis. Shelter inflation cooled modestly, and mortgage interest costs finally posted a month-over-month decline.

Source: RMG Monday Morning Bru – Canada’s Inflation: A Good News / Bad News Story (Jan. 20, 2026)

🔑

Broker Strategy: Frame this as progress, not victory. Rising headline CPI will grab attention, but cooling core inflation is what matters for policy. Help clients understand why rate cuts are still possible later in 2026 — but not imminent. Planning should continue to assume stable rates in the near term.

2️⃣ Bond Yields & Rate-Cut Odds: Mixed Signals, Firm Pause

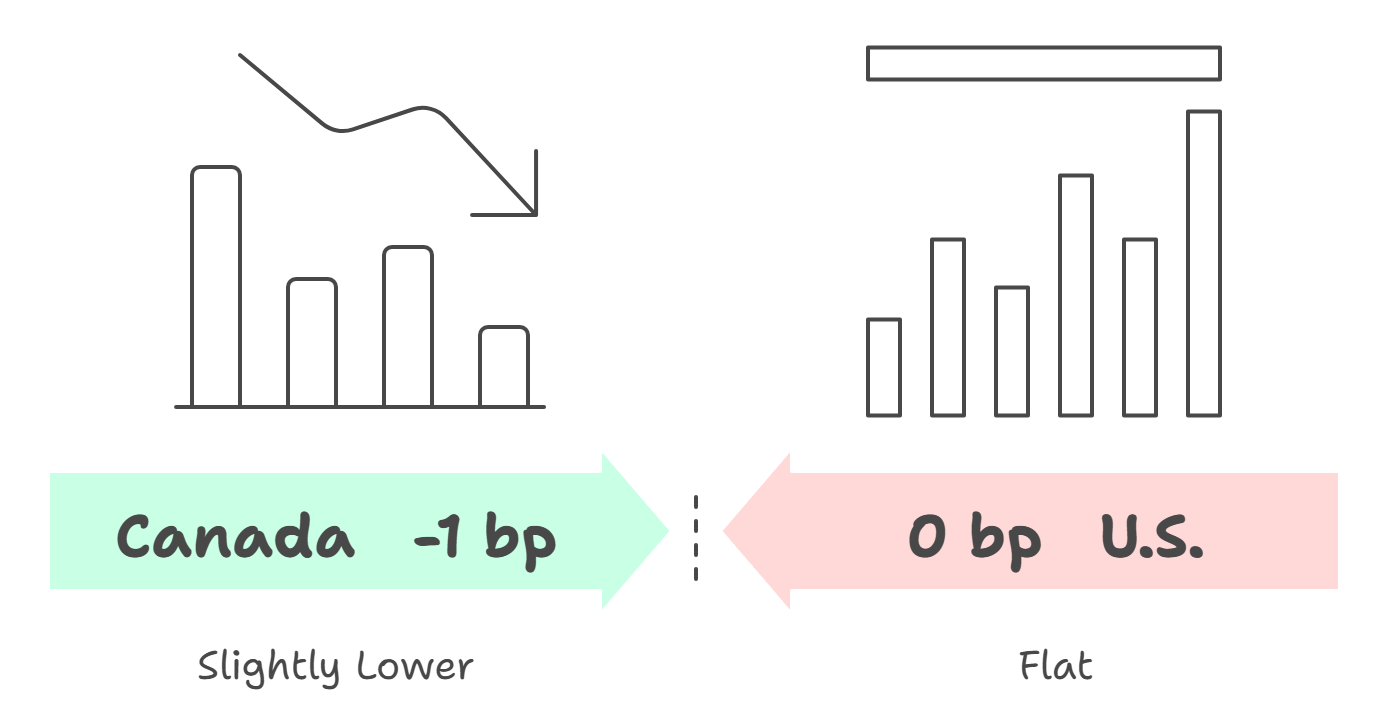

Bond markets absorbed the CPI data with little drama. The Canada 5-year bond yield slipped just 1 bp, while swap rates and mortgage funding costs remained largely unchanged. Markets are still pricing a high probability that central banks hold steady at upcoming meetings, reinforcing a classic policy-pause environment.

Source: MortgageLogic News – 5yr Yield Slips 1 bp After CPI Sends Mixed Signals (Jan. 20, 2026)

5-Year Bond Yields Reinforce a Policy Pause as Markets Price Stability, Not Cuts

🔑 Broker Strategy: Coach clients to expect stability, not momentum. Sideways markets reward preparation. Rate holds, early renewals, and thoughtful term selection matter more than trying to time a breakout that hasn’t arrived yet.

3️⃣EInflation Expectations: Why the BoC Isn’t Relaxing Yet

While core inflation is cooling, inflation expectations remain elevated. Consumer one-year inflation expectations rose to 4.1%, and business expectations ticked up to 3.0%. Inflation breadth also increased, with 46% of CPI components still rising above 3%, a level that historically keeps central banks cautious even when averages improve.

Source: MortgageLogic News – Today’s CPI Surprise Was Dovish, Or Was It? (Jan. 19, 2026)

🔑 Broker Strategy: This explains why the BoC is patient. Use this data to manage client frustration about “why rates haven’t dropped yet.” Expectations drive policy — and they’re still too high for comfort.

4️⃣ Fixed vs. Variable: Sideways Markets Favour Discipline

Variable-rate uptake is rising again, with 43% of borrowers choosing variable in November, the highest since early 2025. Early January data suggest that roughly half of new prime borrowers are now floating. History shows this usually reflects pricing appeal, not improved odds of success. In sideways-rate environments, variable borrowers often absorb higher costs before any relief arrives.

Source: MortgageLogic News – 5yr Yield Slips 1 bp After CPI Sends Mixed Signals (Jan. 20, 2026)

🔑 Broker Strategy: Reframe the decision away from “rate direction” and toward risk management. Variable can still work — but only when flexibility is essential and clients can absorb volatility. Mid-term fixed rates remain highly effective when uncertainty dominates.

5️⃣Broker Performance in 2026: Optionality Is Losing Its Edge

The message from the latest BTBB commentary is blunt: optionality has become avoidance. Too many choices, half-decisions, and delayed commitments are hurting execution. In tighter, more disciplined markets, brokers who simplify systems, commit to clear processes, and act decisively will outperform those trying to keep every door open.

Source:

The Better Broker Blog – Rep by Rep Outtakes: The End of Easy Optionality (Jan. 18, 2026)

🔑 Broker Strategy: 2026 will reward commitment over complexity. Fewer products, clearer workflows, and stronger client positioning will beat endless flexibility. Calm, decisive brokers will win trust in uncertain markets.

📢 Final Thought:

This is a market defined by mixed signals. Inflation is improving but uneven, bond yields are stable but not falling, and central banks are firmly on pause. For brokers, that’s an opportunity. Clients don’t need bold predictions — they need structured advice, realistic expectations, and financing plans that still work if rates go nowhere for months.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via the ABW Agent Intranet under our corporate plan.

EPISODE 58: Year in Review — The Mortgage Broker Podcast

Hosts: Dean Lawton, Jason Marshall & Deryk Williamson

Dean Lawton, Jason Marshall, and Deryk Williamson come together for a special Year in Review episode to reflect on a milestone year for A Better Way Mortgage Group—and for the broker channel as a whole. The conversation looks back on a record-breaking 2025, shaped by resilience, adaptation, and a noticeable shift in industry sentiment after several challenging years.

A central theme of the episode is how brokers found opportunity in a changing market. As rates normalized and traditional approvals became more difficult, the team highlights a meaningful increase in alternative, private, reverse, and business-for-self lending. Rather than chasing headlines or waiting for “easier” conditions, brokers who leaned into education, product knowledge, and new strategies were able to grow—even in a market often labeled as difficult.

The hosts also unpack what it takes to scale responsibly. From compliance and AML readiness to onboarding, operations, and technology, they share how investing in infrastructure and people allowed the brokerage to grow to $4.1B in annual volume while serving over 1,900 additional families. Training, collaboration, and consistent communication—through events, lender sessions, and weekly market updates—are positioned as key drivers behind both performance and confidence.

Beyond the numbers, the episode emphasizes culture and community as true differentiators. From in-person events and charity initiatives to the evolution of the podcast itself, the discussion reinforces a simple idea: brokers thrive when they feel supported, connected, and empowered to keep learning. It’s a candid look at what worked in 2025—and a roadmap for brokers preparing to build momentum in the year ahead.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.