02/10/2026

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

With the Bank of Canada set to announce tomorrow, markets are unusually calm given the amount of noise in the data. Job losses, falling participation, global bond pressure, and geopolitical risk are all present — yet bond yields remain restrained. For brokers, this is a reminder that central banks are reacting to directional risk, not headlines, and client guidance needs to reflect that restraint.

1️⃣ Labour Market Update: Weaker Than It Looks

Canada lost 24,800 jobs in January, badly missing expectations for a gain of 7,000. While the unemployment rate fell to 6.5%, that improvement came entirely from a sharp drop in labour force participation — the lowest since May 2021. Full-time employment rose by 44,900, but nearly 70,000 part-time jobs were lost, with manufacturing taking the biggest hit, particularly in Ontario.

Source: Integrated Mortgage Planners – The Bank of Canada Needs to Get Off the Bench (Feb. 9, 2026)

🔑

Broker Strategy: Help clients understand that a falling unemployment rate doesn’t equal economic strength. This kind of labour data supports caution — but not urgency — from the BoC, reinforcing stable rate expectations rather than immediate cuts.

2️⃣ Bond Yields & Policy Expectations: Calm Ahead of the Decision

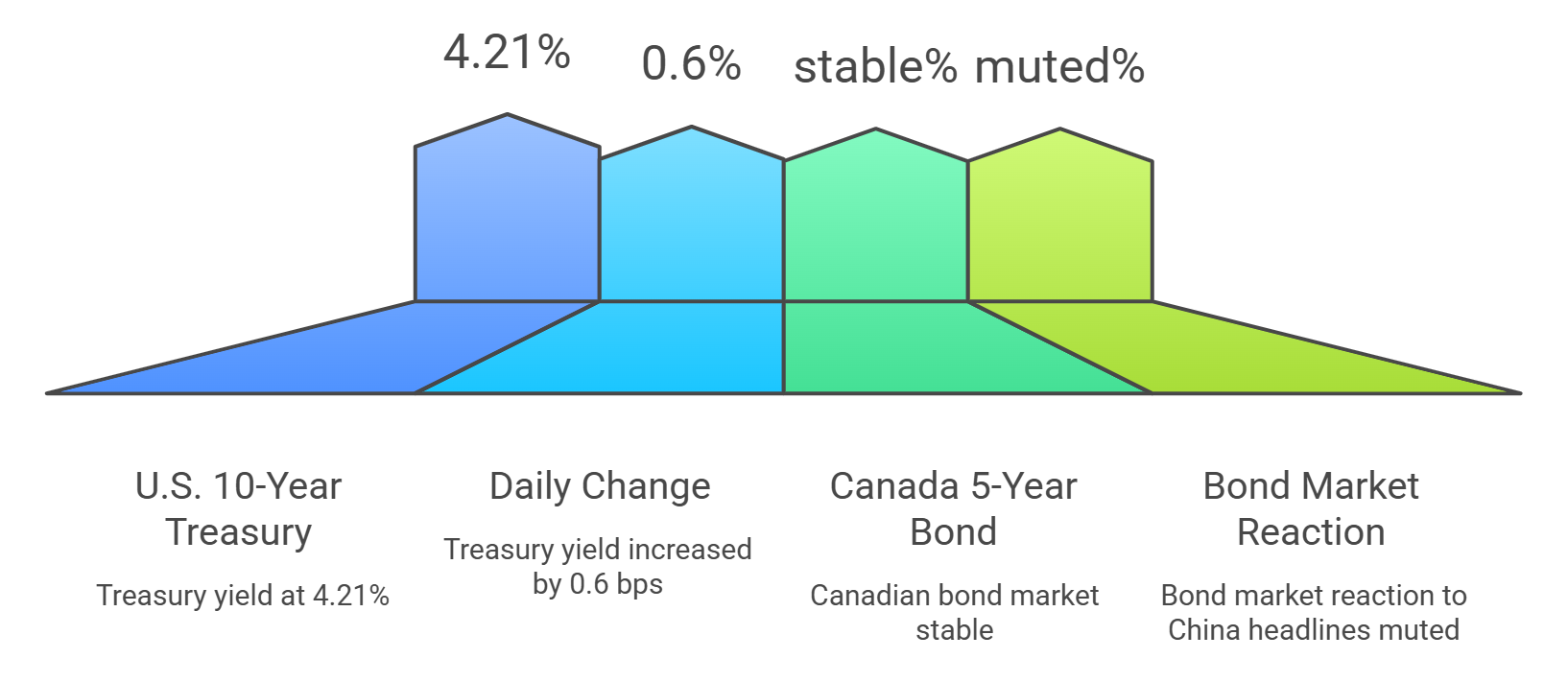

Despite weak job data and fresh concerns around foreign demand for U.S. Treasuries, bond markets remain notably muted. Canada’s 5-year yield continues to track U.S. yields closely, but neither market is signaling stress ahead of tomorrow’s BoC announcement.

Source: RMG Monday Morning Bru – Bond Yields, the Canadian Job Market and the Week Ahead (Feb. 9, 2026)

Key Market Signals (as of Feb 10)

🔑 Broker Strategy: This supports steady pricing conversations. Encourage clients to focus on preparation — renewals, pre-approvals, and documentation — rather than trying to trade tomorrow’s announcement.

3️⃣BoC Context: Why “Doing Nothing” Is the Likely Move

David Larock’s analysis highlights the tension facing the Bank of Canada. Growth is slowing, inflation has cooled into target ranges, and job losses are mounting — yet the Bank remains concerned that cutting too early could reignite inflation if weakness reflects structural constraints rather than cyclical demand. That explains why policy has stayed on hold despite worsening data.

Source: Integrated Mortgage Planners – The Bank of Canada Needs to Get Off the Bench (Feb. 9, 2026)

🔑 Broker Strategy: Position tomorrow’s decision as a confirmation, not a catalyst. The BoC is more focused on avoiding mistakes than sending signals. This helps calm client anxiety around surprise moves.

4️⃣ Fixed vs. Variable: Familiar Trade-Offs, Familiar Answer

Bond yields remain range-bound, and fixed mortgage rates were unchanged last week. Variable discounts also held steady. While variable rates may still produce lower long-term costs, bond markets continue to price the risk that the next move — eventually — could be higher, not lower.

Source: Integrated Mortgage Planners – The Bank of Canada Needs to Get Off the Bench (Feb. 9, 2026)

🔑 Broker Strategy: Five-year fixed remains the cleanest “sleep-at-night” option for most borrowers. Variable works — but only for clients with strong cash flow and emotional tolerance for volatility.

5️⃣Broker Discipline in 2026: Constraint Is the Advantage

This week’s BTBB post makes a timely point: in uncertain markets, constraint beats flexibility. The brokers who perform best are not the ones chasing every option — they’re the ones with clear processes, defined lender lanes, and consistent standards. Constraint reduces errors, builds trust, and creates reliability for clients.

Source: Be The Better Broker – Rep by Rep Outtakes: Constraint Is the New Advantage (Feb. 8, 2026)

🔑 Broker Strategy: Say no more often. Narrow focus. Standardize execution. In a market that punishes hesitation, clarity compounds faster than creativity.

📢 Final Thought:

With the Bank of Canada set to decide tomorrow, markets ae sending a clear message: this is not a moment for urgency. Growth is softening, jobs are slipping, but bond yields remain composed. For brokers, the opportunity lies in helping clients plan confidently through a period where policy may stay unchanged longer than expected. In environments like this, calm guidance beats bold predictions.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via the ABW Agent Intranet under our corporate plan.

EPISODE 59: Broker Armor — FINTRAC One Year Later (Are You Protected?)

Hosts: Dean Lawton & Justin Noda

Dean Lawton is joined by Justin Noda, Chief Compliance & Operations Officer at A Better Way Mortgage Group, to launch Broker Armor, a new series focused on helping mortgage brokers navigate compliance with confidence. In this episode, they break down what FINTRAC compliance really looks like one year in—clearly separating brokerage responsibilities from agent obligations, and addressing common misconceptions that create risk during audits. Through practical examples and a step-by-step checklist, the conversation covers reporting entities, training, risk assessments, ID and sanctions screening, suspicious activity reporting, and upcoming effectiveness reviews. The key takeaway: compliance isn’t about box-checking—it’s about protecting your license, your livelihood, and the long-term professionalism of the broker channel.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.