01/27/2026

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

With the Bank of Canada set to announce tomorrow, markets have largely made up their mind already. Inflation data continue to send mixed signals, bond yields remain range-bound, and geopolitical noise has failed to materially move rates. For brokers, this is a classic pre-decision pause — where client confidence, preparation, and positioning matter far more than the announcement itself.

1️⃣ Inflation Update: Headline Noise, Core Progress

December inflation data confirmed a familiar pattern: headline CPI moved higher, while core measures cooled where it mattered most. Headline CPI rose to 2.4%, largely due to base effects from the temporary GST/HST holiday rolling out of the data. At the same time, the Bank of Canada’s preferred core measures continued to decelerate, with CPI-trim falling to 2.7% and CPI-median to 2.5% year over year. On a short-term basis, both measures are now running below the BoC’s 2% target.

Shelter inflation remains elevated but is expected to cool further in 2026 as lagged rent and mortgage-interest effects work their way through the data.

Source: Integrated Mortgage Planners – Canadian Inflation Cooled Where It Mattered Most in December (Jan. 26, 2026)

🔑

Broker Strategy: Help clients separate optics from substance. Headline inflation grabs attention, but cooling core inflation is what shapes policy. This supports the BoC staying on hold now — with the door still open to cuts later in 2026, not tomorrow.

2️⃣ Bond Yields & Rate-Cut Odds: Markets Have Already Decided

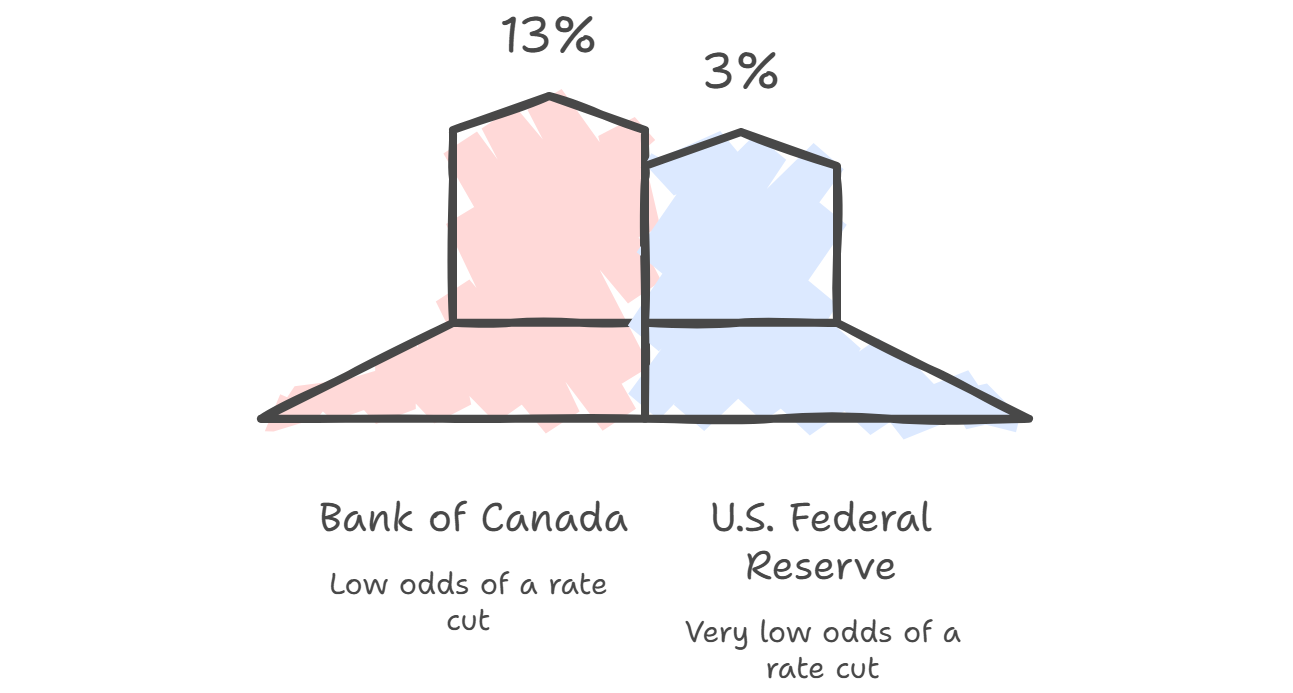

Bond markets were largely unfazed heading into the BoC decision. Despite geopolitical headlines and oil price volatility, funding costs remain tightly range-bound. The Canada 5-year bond yield has slipped modestly, while markets continue to price an overwhelming probability that the BoC holds steady this week.

Source: MortgageLogic News – 5yr Yield Slides 4 bps on Trump Risk Premium (Jan. 27, 2026)

Market-Implied Policy Odds (Jan. 28 meetings)

🔑 Broker Strategy: Set expectations clearly before tomorrow’s announcement. A “no change” decision is already priced in. The real risk isn’t the rate decision — it’s misinterpreting the tone. Encourage clients to focus on planning and optionality, not headline-driven reactions.

3️⃣BoC Outlook: Hold Now, Talk Later

Economists are nearly unanimous that the BoC will hold tomorrow, with 75% now expecting no rate moves at all in 2026 — up sharply from December. Policymakers continue to cite labour-market slack, weak business investment, trade uncertainty, and fragile consumer sentiment as reasons to stay patient. If there’s any shift tomorrow, it’s more likely to show up in language, not action.

Source: MortgageLogic News – Trump Trolls Canada, Oil Jumps, Bond Markets Barely Blink (Jan. 26, 2026)

🔑 Broker Strategy: Prepare clients for a messaging-driven reaction. Reinforce that hikes are not the base case, and cuts will depend on further progress — not one meeting. This supports confidence in locking terms without fear of missing an imminent drop.

4️⃣ Product Strategy: Fixed Still Does the Heavy Lifting

Mortgage pricing remains steady. Fixed rates are holding near long-term averages, while variable-rate discounts have widened modestly. Although variable rates may still produce the lowest long-term borrowing cost on paper, sideways markets historically punish floating-rate borrowers before any relief arrives. With spreads between 3- and 5-year fixed terms still tight, five-year fixed continues to offer slightly better value for many clients.

Source: Integrated Mortgage Planners – Canadian Inflation Cooled Where It Mattered Most in December (Jan. 26, 2026)

🔑 Broker Strategy: Position this as a risk conversation, not a rate call. Fixed rates provide certainty in a market that isn’t trending. Variable works — but only for clients with real flexibility and risk tolerance, not just optimism.

5️⃣Broker Performance in 2026: Optionality Is Losing Its Edge

Away from headline rates, lender competition is heating up in specific niches. Reverse mortgage providers are rolling out aggressive switch incentives, new product features, and more broker-friendly pricing — a sign that growth is accelerating in underserved segments. With traditional volumes still pressured, high-margin, advice-driven products are becoming harder to ignore.

Source:

MortgageLogic News – Reverse Mortgage Competition Gets Spicy (Jan. 27, 2026)

🔑 Broker Strategy: This is a reminder to widen the lens. Brokers who expand product knowledge and proactively educate clients will find opportunity even in flat markets. Specialization and positioning matter more than ever.

📢 Final Thought:

Tomorrow’s Bank of Canada decision is unlikely to deliver drama — and that’s the point. Inflation is improving but uneven, bond yields are calm but constrained, and policymakers are firmly on pause. In this environment, brokers don’t win by predicting the next move. They win by setting expectations early, structuring deals conservatively, and guiding clients through uncertainty with clarity and confidence.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via the ABW Agent Intranet under our corporate plan.

EPISODE 58: Year in Review — The Mortgage Broker Podcast

Hosts: Dean Lawton, Jason Marshall & Deryk Williamson

Dean Lawton, Jason Marshall, and Deryk Williamson come together for a special Year in Review episode to reflect on a milestone year for A Better Way Mortgage Group—and for the broker channel as a whole. The conversation looks back on a record-breaking 2025, shaped by resilience, adaptation, and a noticeable shift in industry sentiment after several challenging years.

A central theme of the episode is how brokers found opportunity in a changing market. As rates normalized and traditional approvals became more difficult, the team highlights a meaningful increase in alternative, private, reverse, and business-for-self lending. Rather than chasing headlines or waiting for “easier” conditions, brokers who leaned into education, product knowledge, and new strategies were able to grow—even in a market often labeled as difficult.

The hosts also unpack what it takes to scale responsibly. From compliance and AML readiness to onboarding, operations, and technology, they share how investing in infrastructure and people allowed the brokerage to grow to $4.1B in annual volume while serving over 1,900 additional families. Training, collaboration, and consistent communication—through events, lender sessions, and weekly market updates—are positioned as key drivers behind both performance and confidence.

Beyond the numbers, the episode emphasizes culture and community as true differentiators. From in-person events and charity initiatives to the evolution of the podcast itself, the discussion reinforces a simple idea: brokers thrive when they feel supported, connected, and empowered to keep learning. It’s a candid look at what worked in 2025—and a roadmap for brokers preparing to build momentum in the year ahead.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.