11/25/2025

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

A calm but pivotal week ahead: markets are fixated on Friday’s Canadian GDP print and the December 10th policy meetings, with Fed expectations swinging sharply and BoC signals still cautious.

1️⃣All Eyes on Friday’s GDP: The Key Input for the December 10 BoC Call

Q3 GDP is the single most important domestic data point before the next Bank of Canada announcement. After its last 0.25% rate cut, Governor Macklem made it clear the Bank is “comfortable” with current policy as long as GDP tracks their expected weak-but-positive path—roughly 0.75% average growth in 2H 2025, rising toward 1.5% in 2026. Friday’s number will validate—or challenge—that outlook. Brokers should note that Macklem explicitly framed further cuts as dependent on subdued economic momentum. As Bruno Valko reminds brokers: bad economic news often leads to good mortgage-rate news. If GDP disappoints, cut expectations will strengthen; if GDP surprises upward, the BoC may hold steady even if the Fed eases.

Source: RMG – Your Monday Morning Bru (Nov 24, 2025)

🔑 Broker Strategy: Tell clients “inflation is improving, not conquered.” Use the softer headline to calm nerves, but make it clear that core at 2.9% means the BoC is unlikely to rush more cuts — planning should assume steady, not falling, rates into early 2026.

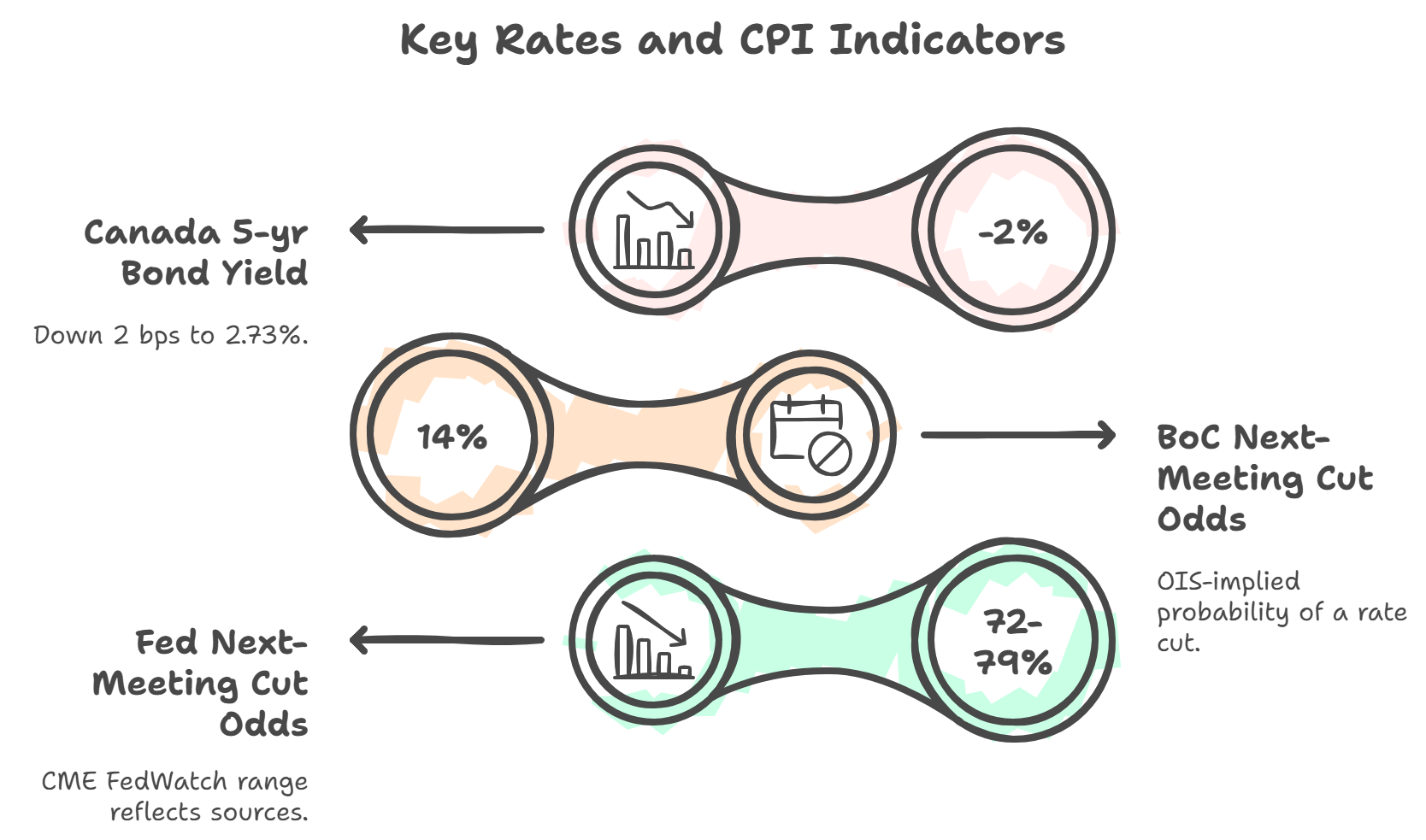

2️⃣ Fed Cut Odds Surge Again—While BoC Odds Stay Flat

Interest-rate expectations swung dramatically in the U.S. over the past week. CME FedWatch now places 79% odds on a 0.25% Fed cut on Dec 10, up from 42% a week ago, following dovish commentary from NY Fed President John Williams and Governor Waller. In contrast, Canadian OIS markets show the BoC largely on hold: 86% chance of no change, 14% chance of a cut. Bond yields responded modestly—Canadian and U.S. 5-year yields both drifted ~2 bps lower, consistent with a slightly more dovish tone. MLN notes that implied BoC rates are “flatlining,” typical of markets expecting sideways movement rather than an imminent shift.

Source: MortgageLogic.News – Fed Cut Odds Swing Wildly (Nov 24, 2025)

Rate Expectations Diverge: U.S. easing odds surge while Canada remains steady. Bond yields reflect a cautiously dovish tone heading into December 10.

🔑 Broker Strategy: Use this divergence to position variable-rate conversations: U.S. easing may pressure Canadian yields even if the BoC holds. Highlight that rate cuts do not need to be domestic to lower fixed-rate pricing—bond markets move first.

3️⃣Factory Sales Slow and GDP Concerns Grow

Canadian factory sales fell 1.1% in October, the weakest since April, reinforcing the narrative of a sluggish domestic economy. This softness, paired with subdued business investment and weak productivity metrics, adds pressure to Canada’s growth outlook ahead of Friday’s GDP. MLN notes that the market remains sensitive to even modest data misses given the narrow path the BoC is walking: keeping policy tight enough to guide inflation back to target but not so tight that it derails the recovery. With U.S. equity markets rebounding and bond money rotating into stocks, yields saw upward intraday pressure—another reminder that global sentiment can override domestic softness.

Source: MortgageLogic.News – Fed Cut Odds Swing Wildly (Nov 24, 2025)

🔑 Broker Strategy: For December closings or pre-approvals, encourage clients to secure rate holds now. Economic data is volatile, and short-term yield swings can quickly tighten promotional rate windows.

4️⃣ Mortgage Tidbits: Variable Edges Back Into the Lead

MLN’s forward outlook shifted slightly more dovish this week, pushing variables back into the lead for lowest projected 5-year borrowing cost—but only by a razor-thin margin. On a $300,000 loan, projected interest costs between variables, 3-year fixed, and 5-year fixed remain within ~$1,000 of each other over five years. Meanwhile, insurers’ rate moves were mixed: True North cut its insured 2-year to 3.59%, while insured 10-year rates nudged higher. The takeaway: product suitability—not headline rate—matters most right now.

Source: MortgageLogic.News – Mortgage Tidbits (Nov 24, 2025)

🔑 Broker Strategy: Use MLN’s Amortization Simulator to run personalized comparisons. Present clients with 2–3 side-by-side scenarios to shift the conversation from “chasing the lowest rate” to “choosing the right risk profile.”

5️⃣ Lender Strategy Spotlight: Education as a Sales Engine

A key theme emerging from this week’s industry commentary: lenders who educate win market share. MLN’s profile of UWM shows how consistent broker education, sales huddles, and operational tools help brokers convert more business. RMG’s own Bruno Valko is highlighted as a Canadian leader—his weekly “Morning Bru” briefings demonstrate that brokers gain business when they can speak confidently about economic trends and rate direction. UWM’s U.S. model goes further, providing realtor fly-ins, advanced training, and performance-based perks. While not directly transferable to Canada, the underlying message is clear: knowledge + consistency = broker loyalty.

Source:

MortgageLogic.News – A Winning Lender Sales Strategy That Most Overlook (Nov 25, 2025)

🔑 Broker Strategy: Lean into regular market education with your referral partners. A 5-minute weekly update to realtors or planners can meaningfully differentiate you—especially heading into a volatile 2026.

📢 Final Thought:

This is a week where macro news matters—GDP on Friday, the Fed and BoC on December 10th, and bond markets reacting by the hour. But remember: we’re in a broker’s market, not a speculator’s market. Clients need clarity more than predictions. Use data to anchor conversations, frame decisions around risk tolerance, and guide borrowers toward stable, well-planned financing choices. Consistency and education are the real differentiators as rate volatility persists.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via the ABW Agent Intranet under our corporate plan.

EPISODE 54: Behind the Lender with Steven Lang, VWR Capital

Guest:

Steven Lang

Hosts: Dean Lawton & Deryk Williamson

Steven Lang, National Sales Manager at VWR Capital, joins Behind the Lender to give brokers an inside look at one of Canada’s most established and steadily growing private lenders. With nearly two decades across credit unions, wealth management, small-business lending, and broker-channel development, Steven brings a rare 360° perspective on how private lending really works behind the scenes.

In this episode, Steven shares his journey from teller to regional manager to leading VWR’s national sales and marketing team. He explains how VWR doubled its assets under management—from $390M to nearly $800M—by focusing on one thing: disciplined, consistent lending. With a simple one-year product, low fees, conservative LTVs, and a “boring is good” approach, VWR has built a reputation for fairness, clarity, and investor protection.

The discussion dives into what brokers value most today—speed, communication, and predictability—and how VWR is responding through technology upgrades, 24-hour commitments, refined underwriting workflows, and clearer lending-area tools. Steven also covers shifting borrower profiles, the rise in developer and presale challenges, and why strong exit strategies matter more than ever in this rate environment.

From managing risk and evolving compliance requirements to strengthening broker relationships and enhancing borrower support, Steven offers practical insight into how VWR operates—and what brokers can do to submit cleaner files, avoid surprises, and build long-term partnership with a stable, proven MIC.

A must-listen for brokers who want to understand how conservative private lenders think—and how consistent communication, education, and alignment can unlock smoother deals in any market.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.