11/18/2025

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

Canada’s latest inflation report eased some pressure, but core readings and global uncertainty have pulled the BoC and Fed firmly into “wait-and-see” mode. For brokers, that means a window of rate stability where smart outreach and positioning matter more than trying to guess the next cut.

1️⃣October Inflation: Good Headlines, Tricky Core

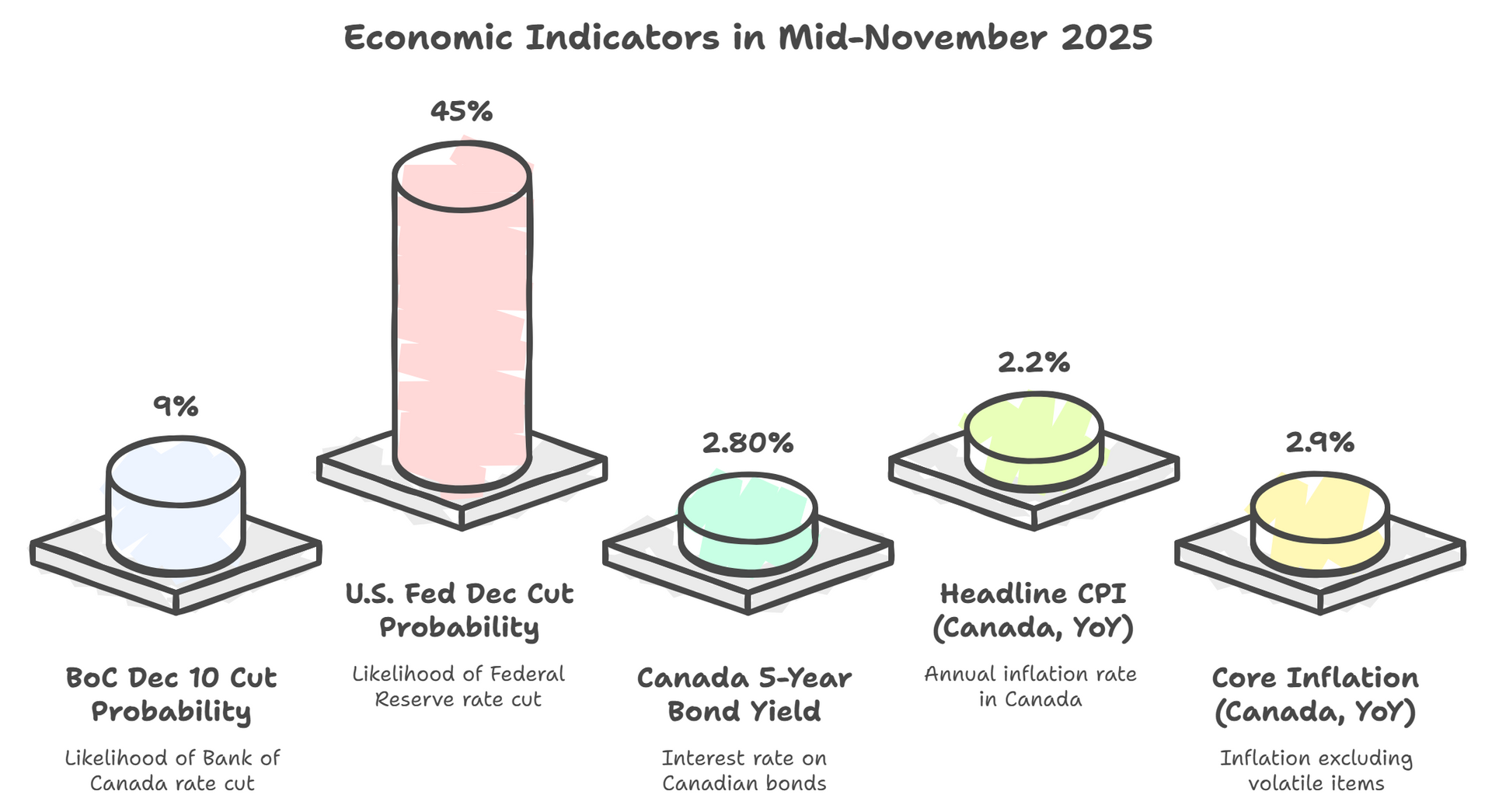

StatsCan’s October print was mostly a good-news story: headline CPI slipped to 2.2% from 2.4%, food inflation eased to 3.4%, and shelter slowed slightly to 2.5%. Gasoline prices fell 9.4% year-over-year, cooling transportation costs. But under the surface, the BoC’s preferred gauges were less friendly: core inflation rose to 2.9%, its highest year-over-year reading since August 2023, keeping it just a hair under the Bank’s informal 3% “red line.”

Source: RMG Your Monday Morning Bru – “Canada Inflation Numbers, and Watch the Fed” (Nov. 17, 2025)

🔑 Broker Strategy: Tell clients “inflation is improving, not conquered.” Use the softer headline to calm nerves, but make it clear that core at 2.9% means the BoC is unlikely to rush more cuts — planning should assume steady, not falling, rates into early 2026.

2️⃣ Rate-Cut Odds and Bond Yields: The Pause Comes Into Focus

Since the BoC’s October cut, markets have dramatically repriced expectations. Bond investors now assign less than a 10% chance of another BoC cut on December 10, while U.S. Fed cut odds for its December meeting have dropped from about 95% to below 50% as policymakers talk down expectations. At the same time, the Canada 5-year bond is trading around 2.80% and the Canada 5-year was 2.795% at Monday’s open, a muted reaction to the latest CPI data. For brokers, this is classic “policy pause” terrain: small day-to-day moves, but no clear trend down.

Source: Integrated Mortgage Planners – “Rate Cut Odds Are Being Significantly Pared Back” (Nov. 17, 2025)

Markets have shifted from expecting more cuts to pricing in a pause: inflation has cooled at the headline level, but core and global risks keep central banks on hold.

🔑

Broker Strategy: Use these odds to reset expectations with rate-sensitive borrowers. Emphasize that we’re likely at (or near) the bottom for this cycle—so the play now is to secure well-priced terms and protect against future bumps, not to hold out for a big final cut.

3️⃣Housing: October Rebound Challenges the “Doom” Story

Mortgage Logic News reports that October benchmark home prices rose 0.2% after falling in 8 of the previous 9 months, on the back of a 0.9% month-over-month sales increase and a balanced 52.2% sales-to-new-listings ratio nationally. Debt-service metrics have quietly improved too: the average gross debt service ratio is down about 11 points from the peak, and mortgage payments on an average home are roughly $190/month lower than a year ago, assuming 20% down. That doesn’t mean every market is healthy — Ontario and B.C. remain soft, with tiny investor condos particularly challenged — but it does undercut the narrative that a broad crash is inevitable.

Source: Mortgage Logic News – “October’s Market Rebound Ruins the Doom Narrative” (Nov. 18, 2025)

🔑 Broker Strategy: For qualified buyers with a 3–5 year horizon, this is a chance to buy into normal valuations, not peak froth. Use the $190/month affordability improvement and national “balanced” conditions to re-engage fence-sitters who have been waiting for a crash that may never come.

4️⃣ Fixed vs. Variable: How to Position Clients in a “Pause” Environment

Integrated Mortgage Planners notes that 3- and 5-year fixed rates are hovering around their long-term averages, and in many cases are priced similarly to one another. Variable rates are still expected to win on total cost over the full term, but only for borrowers who can tolerate volatility and potentially higher payments if this truly is the last cut of the cycle. With the BoC and Fed both signaling a high bar for additional easing, today’s decision isn’t “fixed vs. variable” so much as “stability vs. flexibility plus risk.”

Source: Integrated Mortgage Planners – “Rate Cut Odds Are Being Significantly Pared Back” (Nov. 17, 2025)

🔑 Broker Strategy: For payment-sensitive, first-time buyers → lean to shorter or mid-term fixed. For well-qualified, higher-buffer clients → variables or 5-year fixed can be positioned as “own the full cycle” plays.

Frame the decision around cash-flow comfort and time horizon, not headline rate alone.

5️⃣ Watching the Fed: Why U.S. Data Still Drives Canadian Decisions

Larock points out that the U.S. Fed is now “driving in the fog” after the recent government shutdown delayed more than a month’s worth of key data — and that’s made policymakers more cautious. Fed Chair Jerome Powell has warned that another cut at the December meeting is “not a foregone conclusion,” while Boston Fed President Susan Collins says the bar for additional easing is now “relatively high.” With the U.S. still Canada’s largest trading partner, this more hawkish Fed tone reinforces the BoC’s own pause messaging and limits how far Canadian rates can diverge before currency and trade become an issue.

Source:

Integrated Mortgage Planners – “Rate Cut Odds Are Being Significantly Pared Back” (Nov. 17, 2025)

🔑 Broker Strategy: Use the Fed story to explain to clients why “good Canadian data” doesn’t automatically mean cheaper mortgages. It’s a great way to position yourself as the advisor who connects the dots between global events and local borrowing costs.

📢 Final Thought:

This is a broker’s market, not a speculator’s market. The BoC has likely finished cutting for now, U.S. policy is shifting to neutral, and housing is quietly normalizing rather than collapsing. Your edge isn’t in predicting the next 10 bps — it’s in helping clients understand this new plateau, structure the right product mix, and move confidently while others stay frozen by old doom narratives.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 54: Behind the Lender with Steven Lang, VWR Capital

Guest:

Steven Lang

Hosts: Dean Lawton & Deryk Williamson

Steven Lang, National Sales Manager at VWR Capital, joins Behind the Lender to give brokers an inside look at one of Canada’s most established and steadily growing private lenders. With nearly two decades across credit unions, wealth management, small-business lending, and broker-channel development, Steven brings a rare 360° perspective on how private lending really works behind the scenes.

In this episode, Steven shares his journey from teller to regional manager to leading VWR’s national sales and marketing team. He explains how VWR doubled its assets under management—from $390M to nearly $800M—by focusing on one thing: disciplined, consistent lending. With a simple one-year product, low fees, conservative LTVs, and a “boring is good” approach, VWR has built a reputation for fairness, clarity, and investor protection.

The discussion dives into what brokers value most today—speed, communication, and predictability—and how VWR is responding through technology upgrades, 24-hour commitments, refined underwriting workflows, and clearer lending-area tools. Steven also covers shifting borrower profiles, the rise in developer and presale challenges, and why strong exit strategies matter more than ever in this rate environment.

From managing risk and evolving compliance requirements to strengthening broker relationships and enhancing borrower support, Steven offers practical insight into how VWR operates—and what brokers can do to submit cleaner files, avoid surprises, and build long-term partnership with a stable, proven MIC.

A must-listen for brokers who want to understand how conservative private lenders think—and how consistent communication, education, and alignment can unlock smoother deals in any market.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.