12/02/2025

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

This week brings meaningful movement across GDP, bond yields, and market expectations as global signals collide with Canadian fundamentals. Despite a strong headline GDP print, underlying indicators remain soft, and rising yields are pushing lenders to re-evaluate pricing. Brokers should prepare clients for volatility as we approach the December 10 BoC decision.

1️⃣Q3 GDP: Strong on Paper, Weak Under the Hood

Canada’s Q3 GDP surprised at +2.6% annualized, sharply beating the 0.5% consensus. But underneath, the details look far less encouraging. Imports plunged 8.6%, household spending dropped 0.4%, and business investment fell again — leaving government capital spending as the primary driver of growth. Economists warn that this “rebound” masks continued structural weakness, especially with October’s advance estimate showing –0.3% GDP. The BoC now faces a complicated setup: a strong headline but weakening momentum into Q4.

Source: DLC – Sherry Cooper Economic Insight (Nov 28, 2025)

🔑 Broker Strategy: Tell clients the GDP print “looks better than it is.” Emphasize that the BoC will look through one-off boosts, keeping rate-cut timing dependent on softer Q4 data — not the headline beat.

2️⃣ Bond Yields Jump as Global Pressure Overrides Domestic Data

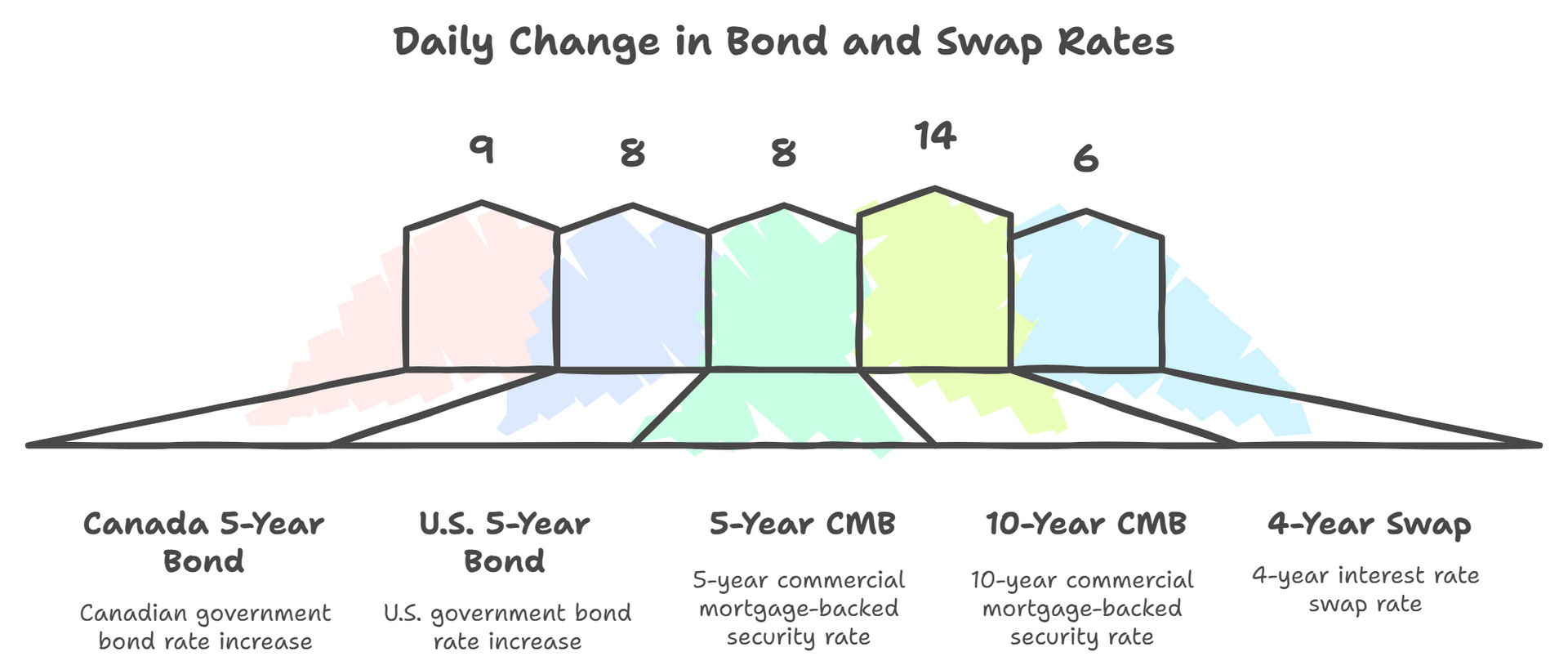

The five-year Government of Canada bond yield surged 9 bps on Monday—its sharpest move in weeks—after the Bank of Japan signaled possible tightening, triggering a global bond sell-off. This spike came despite weaker manufacturing data in both Canada and the U.S., underscoring how global forces are overpowering domestic softness. The curve steepened as 4-year swaps hit a three-month high, and CMBs rose sharply, with the 10-year up 14 bps. Rising funding costs now increase the likelihood of near-term fixed-rate adjustments by lenders.

Source: MortgageLogic News – Yield Vaults 9 bps (Dec 2, 2025)

Daily yield and swap movements on Dec 2, 2025 show a sharp global-driven repricing, led by a 9 bps jump in the Canada 5-year bond and a 14 bps surge in 10-year CMBs

🔑 Broker Strategy: Encourage rate-sensitive clients to secure pre-approvals or lock-ins sooner rather than later. Lenders respond quickly to rising funding costs, and this week’s yield spike makes short-notice fixed-rate increases more probable than decreases.

3️⃣Variable vs. Fixed: The 3-Year Still Models Best

MortgageLogic’s national leaderboard shows limited pricing changes this week, but modeling continues to favour the 3-year fixed as the strongest value term, with the 5-year a close second. Variable is lagging as markets push expected hikes forward slightly, but forward-rate projections show modest improvement into 2026–2027 even with a flat Prime until mid-2027. Rates in the 3.5%–3.9% range (insured) are appearing selectively from lenders, though these remain discretionary and file-dependent.

Source: MortgageLogic — Mortgage Tidbits (Dec 2, 2025)

🔑 Broker Strategy: Position the 3-year vs. 5-year as a flexibility decision: similar pricing, similar outcomes — with shorter terms giving clients optionality in a choppy rate environment.

4️⃣ Lender Behaviour: Discretion Returns & Channel Shifts Begin

Brokers are reporting renewed discretionary pricing from Scotiabank, especially on insured files with strong TDS profiles, and National Bank is diverting some broker-submitted files to retail due to overwhelming volume. This marks a subtle shift: lenders are tightening control over channel mix while selectively rewarding high-quality deals. Several brokers note rates “in the 3.5s” appearing for renewals, while underwriting turnaround times remain lender-dependent. Marathon Mortgage has also launched a broker incentive contest with a $10,000 prize.

Source: DLC Network News (Dec 2, 2025)

🔑 Broker Strategy: Leverage your relationships: lenders are rewarding clean files and insured business. Submit well-prepared packages to access the best discretionary offers.

5️⃣ December 10 BoC: Odds Steady, Narrative Shifts

Markets continue to price an 89–92% chance of no cut at the Dec 10 BoC meeting, while the U.S. Fed is expected to deliver another cut the same day. Diverging paths may weaken the Canadian dollar and add upward pressure to mid-term yields. RMG notes that despite the 2.6% GDP beat, October’s drop and rising unemployment expectations (7.0% consensus for Friday’s report) argue for caution. Any further weakening in jobs data will intensify pressure on the BoC heading into Q1 2026.

Source:

RMG – Monday Morning Bru (Dec 1, 2025)

🔑 Broker Strategy: Tell clients: “Cuts aren’t cancelled — they’re delayed.” Manage expectations toward stability, not rapid easing.

📢 Final Thought:

This week continues the theme of noisy headlines and meaningful signals: a strong-but-misleading GDP print, bond yields jumping on global pressures, and the December 10th rate announcements now days away. But despite the volatility, remember: this remains a broker’s market, where guidance outperforms guesswork. Clients don’t need bold predictions — they need calm translation and structured choices. Use the real data to steady emotions, highlight risk tolerance, and build financing plans that work even if rates move. In markets like this, clarity beats certainty every time.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via the ABW Agent Intranet under our corporate plan.

EPISODE 55: Behind the Network with Chad Gregory, Dominion Lending Centres

Guest:

Chad Gregory

Hosts: Dean Lawton & Jason Marshall

Chad Gregory, VP of National Sales at Dominion Lending Centres, joins Behind the Network to share how DLC grew from a small startup into Canada’s largest mortgage brand. Chad reflects on DLC’s early days—building the network from the ground up in Ontario, knocking on doors, pitching real estate brokerages, and pushing a bold vision: establish the first nationally recognized mortgage-broker brand. He explains how DLC’s branding strategy, recruiting efforts, and relentless belief in the model helped shift consumer behaviour from 88% bank loyalty to a near 50/50 split between banks and brokers today.

The conversation dives into the tools that now fuel DLC’s competitive edge, including Velocity, the My Mortgage Toolbox app, and the Gold Rush CRM. Chad details how secure document portals, refinance analyzers, automated campaigns, and emerging AI integrations are helping brokers become more efficient, more professional, and better equipped to convert and retain clients. He emphasizes that in a fast-changing market, brokers who embrace technology—and invest in systems that buy back their time—will outperform those who resist change.

Chad also shares timeless sales and business-development strategies, from handwritten cards and emotional deposits to using scripts, practicing role plays, and delivering unexpected post-close touches. These simple habits, he says, turn clients and referral partners into long-term raving fans. Looking ahead, Chad believes DLC’s biggest years are still to come, driven by innovation, consumer demand for advice, and a network committed to helping brokers grow.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.