7/01/2025:

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

With inflation data, central bank clues, and volatile geopolitical factors shaping bond market sentiment, brokers must stay alert. This week offers a mix of clarity and complexity—here’s what to watch and how to act:

1️⃣ GDP Slips Into Negative Territory—Canada Enters Mild Contraction

Canada’s GDP fell by 0.1% in April and is estimated to have declined another 0.1% in May. Manufacturing took the biggest hit (-1.9%) as auto production slumped under tariff pressures. Public sector spending and consumer activity offset some losses, but overall momentum has clearly stalled. Many economists now expect Q2 will post outright contraction, fueling expectations that the BoC may be forced to consider further easing later this year.

Source: Canadian GDP Is Set To Contract in Q2 – Dominion Lending Centres, Dr. Sherry Cooper – June 27, 2025

🔑 Broker Strategy: Position softer GDP as a window for rate relief. Reassure clients that a mild contraction typically precedes rate cuts and creates opportunity for buyers to lock in attractive terms.

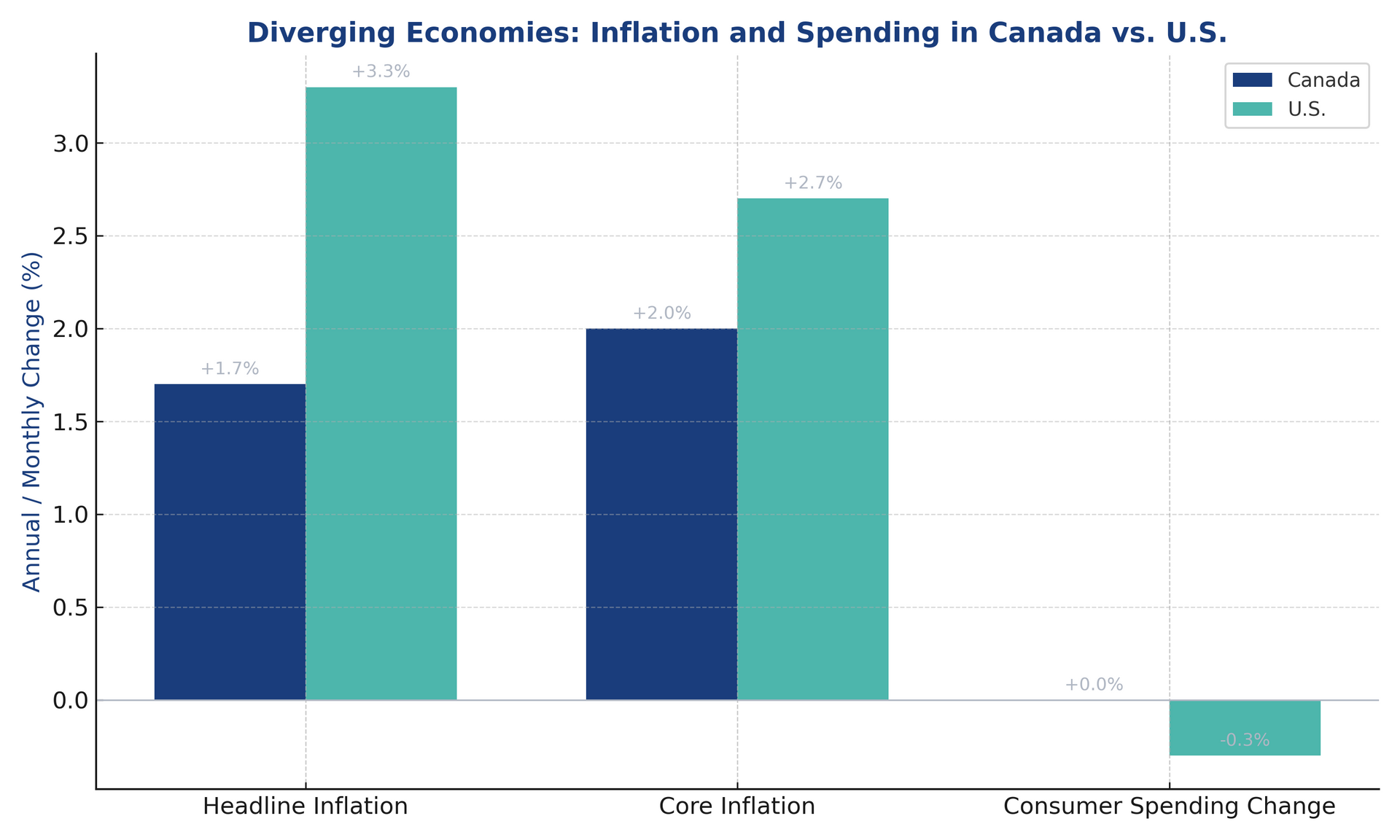

2️⃣ Diverging Inflation and Spending Paint a Murky Picture

Canada’s headline inflation has moderated toward 1.7%, while the U.S. Core PCE climbed to 2.7% last month, exceeding forecasts and underscoring persistent price pressures. At the same time, U.S. consumer spending contracted by 0.3%—the sharpest drop since 2021—while Canadian spending remained flat. This divergence is complicating market expectations for rate cuts and fueling uncertainty about how quickly policymakers can ease without risking renewed inflation.

Source: RMG Your Monday Morning Bru: Inflation & Spending Divergence – Bruno Valko, June 30, 2025

🔑 Broker Strategy: Use this mixed picture to explain why rate cuts are not guaranteed. Show clients how differing economic signals influence bond yields and lender pricing. Reinforce the importance of acting before the next round of inflation data.

3️⃣ Fixed Rates Hold Steady—But Funding Costs Are Creeping Up

Fixed mortgage rates remained unchanged last week, staying near multi-month averages. However, lenders report that funding costs are edging higher as volatility in credit spreads and bond yields persists. Some lenders are warning that rate sheets may adjust quickly if spreads widen further.

Source: Monday Morning Mortgage Rate Update – Integrated Mortgage Planners – June 30, 2025

🔑 Broker Strategy: Recommend clients finalize pre-approvals and rate locks. Emphasize that while rates are stable now, lenders have little room to absorb higher funding costs without passing them on.

4️⃣ U.S. Tariffs and Consumer Weakness Undermine Growth Outlook

The latest U.S. data confirm a slowing economic engine: GDP contracted by 0.5% annualized in Q1, corporate profits fell 3.3%—the steepest decline since the pandemic—and jobless claims remain elevated. New tariffs on autos and goods are compounding pressure. Fed policymakers have signaled openness to rate cuts as early as July if momentum doesn’t improve.

Source: RMG Your Monday Morning Bru – Bruno Valko, June 30, 2025

🔑 Broker Strategy: Keep clients informed that U.S. weakness could drive bond yields lower and create renewed downward pressure on fixed rates. However, caution that tariffs may also reignite inflation, limiting how far rates can fall.

5️⃣ Housing Shortage Worsens as Permits Decline Sharply

Canada’s affordability challenges remain front and center. Single-family housing permits dropped to record lows in BC, while construction activity in Ontario slipped for the third consecutive month. Policymakers are facing mounting pressure to accelerate approvals and subsidies as underbuilding threatens to keep inventory tight despite slower sales.

Source: BTBB Sunday Blog – Dustan Woodhouse – June 29, 2025

🔑 Broker Strategy: Reassure buyers worried about timing that structural supply shortages are likely to support pricing over time. Use this data to illustrate why waiting for deep discounts could prove costly in the long run.

📢 Final Thought:

With GDP contraction, diverging inflation, and tariff uncertainty, this week is a reminder that headlines can pull sentiment in all directions. Brokers who translate the data into clear, actionable advice will stand out as the market’s trusted guides.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 44: BEHIND THE LENDER with Jeff Adamson, Co-Founder of Neo Financial

Guest: Jeff Adamson

Jeff Adamson, Co-Founder of Neo Financial and SkipTheDishes, unpacks how Neo is reshaping Canadian banking and mortgage lending by merging fintech innovation with a relentless focus on user experience. From building custom core banking infrastructure to championing open banking and AI-powered personalization, Jeff shares why modern borrowers expect frictionless, transparent options—and how brokers can thrive by embracing technology, data, and trust to better serve their clients in an era of rapid change.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.