7/29/2025:

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

This week, housing and bond markets are recalibrating expectations after a mix of soft data, global rate divergences, and modest lender changes. Brokers must balance near-term rate risk with mid-term positioning. Let’s dive in:

1️⃣ Lenders Holding Steady, But Discounting Slows

While bond yields have dropped marginally in the past week, lenders are slow to follow with new rate promotions. The high spread between swap rates and posted rates continues to cushion lender margins, allowing rate sheets to remain sticky. Brokers are reporting fewer discretionary exceptions, especially on uninsured files.

Source: Bruno’s Weekly Lender Update – July 28, 2025

🔑 Broker Strategy: Suggest rate holds for preapprovals and emphasize insured files where pricing remains sharper. Position this plateau in pricing as a potential prelude to autumn discounting.

2️⃣ Economic Divergence Widens Between Canada and the U.S.

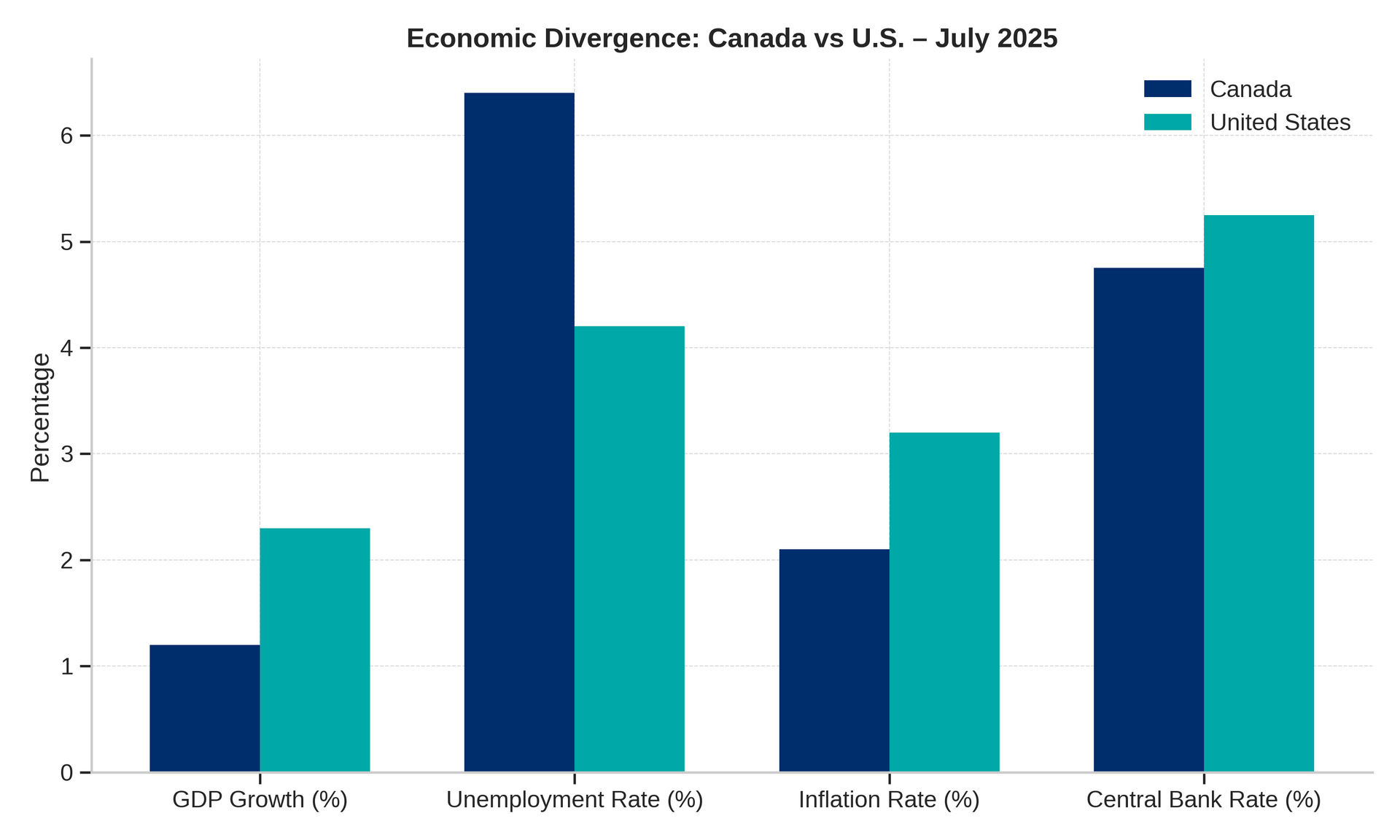

Canada’s economic slowdown is becoming more pronounced, with stagnant GDP growth and rising unemployment contrasting with the U.S.’s still-robust job market. This divergence is fueling speculation that the Bank of Canada may cut rates sooner or deeper than the Fed—potentially pulling Canadian mortgage rates lower independently.

Source: 5 Weekly Economic Updates, July 29, 2025

This chart illustrates the growing economic divergence between Canada and the U.S. as of July 2025.

While Canada faces slowing GDP growth and rising unemployment, the U.S. economy continues to show resilience, with stronger growth and steadier job markets. These contrasting trends are shaping differing interest rate paths for the two countries.

🔑 Broker Strategy: Leverage the Canada–U.S. rate divergence story in client discussions. This divergence can mean unique timing for fixed vs. variable decisions. Use economic context to empower informed choices.

3️⃣ Summer Market Slows but Signals Stabilization

National resale housing data shows a consistent, albeit slow, recovery. Listings are up across most metros, while price corrections have decelerated. Market watchers believe the worst of the correction is behind us. Buyer urgency remains low, but affordability signals are improving as wage growth outpaces home price inflation.

Source: RMG Weekly Market Roundup – July 26, 2025

🔑 Broker Strategy: Encourage fence-sitting buyers to act now rather than wait for the fall surge. Use affordability metrics and recent price stability as confidence boosters in conversations.

4️⃣ U.S. Fed Expected to Hold—BoC Still in Play

Markets now price in a 90% chance that the U.S. Fed holds rates steady in its upcoming meeting. But Canadian economists remain divided on a possible cut by the BoC in September, especially if August inflation data trends down. Bond traders are positioning for possible divergence in monetary policy.

Source: BMO and RBC Rate Strategy Notes, July 26–29, 2025

🔑 Broker Strategy: For rate-sensitive clients, recommend 1- to 3-year fixed terms as a middle path. If Canada cuts ahead of the U.S., these shorter terms will offer prime renewal opportunities.

5️⃣ Mortgage Market Sentiment: Back to Basics

With discounting limited and qualification still tight, brokers report that clients are returning to pragmatic considerations—affordability, flexibility, and payment stability. Short-term fixed remains the go-to, but variable inquiries have increased as clients bet on 2026-2027 rate cuts.

Source: Bruno’s Weekly Lender Update – July 28, 2025

🔑 Broker Strategy: Structure layered solutions where appropriate—combining term options or using step-down products. Simpler products with transparent terms are winning over complex incentives in today’s climate.

📢 Final Thought:

As the economy cools and housing stabilizes, brokers must lead with insight—not just rate. This period rewards preparation over prediction. Stay data-driven, stay calm, and stay visible to your clients.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 46: Behind the Broker with Vy Tri Truong

Guest: Vy Tri Truong

Vy Tri Truong, mortgage broker and licensed financial advisor at A Better Way Mortgage, shares how blending comprehensive financial planning with mortgage strategy can create life-changing outcomes for clients. In this episode, Vy walks us through his journey from failed broker to trusted advisor, revealing the lessons learned along the way—and how his planning-first approach reshapes client conversations from “rate shopping” to long-term wealth building.

From navigating reverse mortgages and tax-efficient investing to retiring clients with creative RRSP leverage, Vy brings a level of thoughtfulness and expertise rarely seen in the mortgage world. He also dives into mentorship, his minimalist tech stack, health habits, and why giving back to the brokerage community keeps him motivated.

Vy’s story is proof that when you lead with value, do the right thing, and treat clients like family, business follows.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.