7/15/2025:

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

With Canada’s latest inflation surprise, accelerating home sales, and mounting uncertainty around central bank rate cuts, this week’s developments could set the tone for the rest of the summer. Brokers who educate clients proactively will be best positioned to help navigate what could be a volatile few weeks ahead. Here’s what you need to know:

1️⃣ Inflation Surprises to the Upside—BoC Cuts in Question

Canada’s inflation accelerated to 1.9% in June, up from 1.7% in May, with core measures rising to 2.7% and the trimmed mean stuck at 3%. The uptick in price pressures, especially in core readings, signals the Bank of Canada is unlikely to lower rates at its next meeting on July 30. Markets had expected more progress toward the 2% target.

Source: Canadian Inflation Accelerates by 1.9% y/y in June – Dominion Lending Centres, July 15, 2025

🔑 Broker Strategy: Prepare clients for continued rate volatility and higher funding costs. Use this moment to re-engage fence-sitters and secure rate holds. Emphasize that even if headline CPI dips, sticky core inflation may keep rates higher for longer.

2️⃣ Home Sales Are Rebounding—Market Activity Picks Up

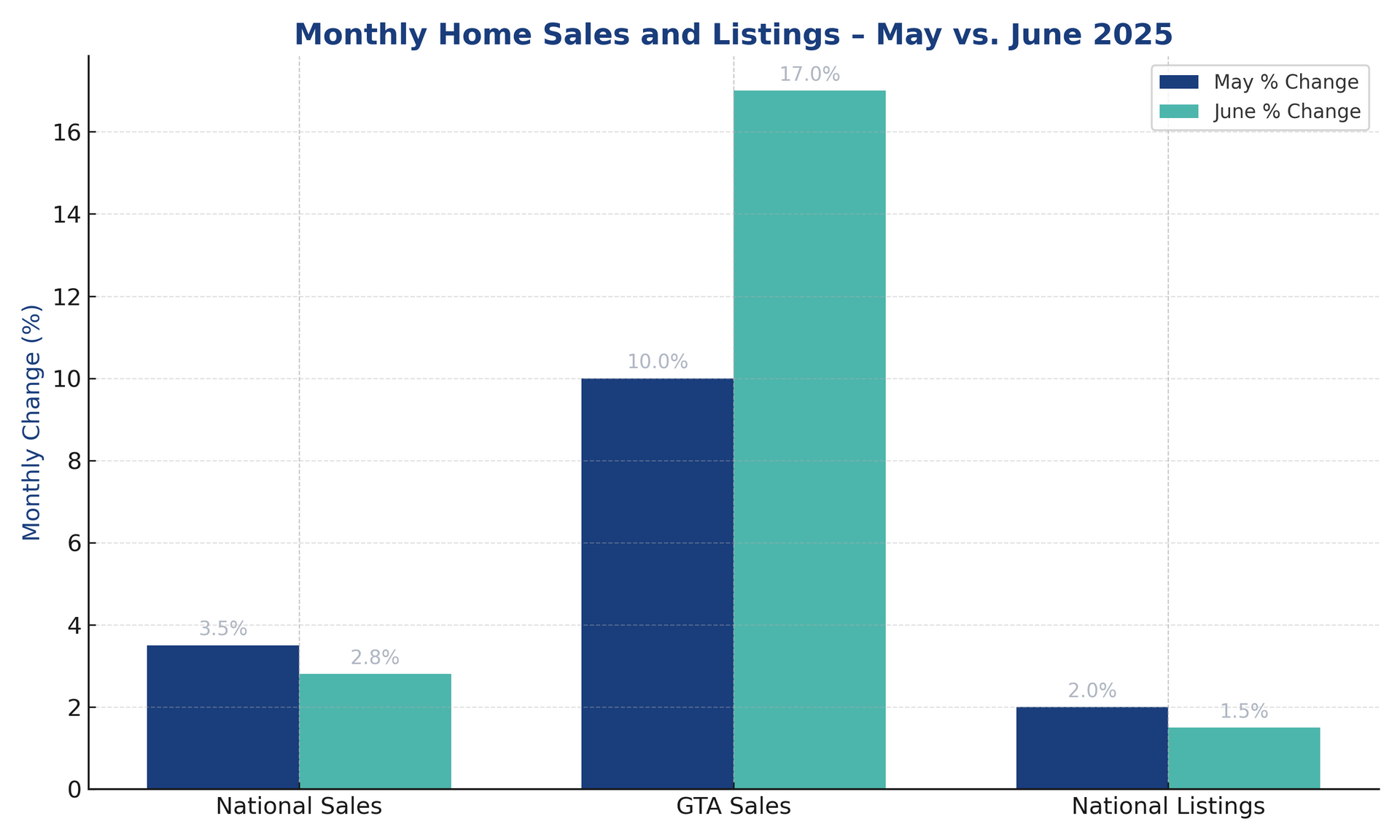

The housing market appears to be turning a corner: Canadian MLS® Systems reported a 2.8% monthly gain in June sales on top of May’s 3.5% rise. In the GTA, transactions are up over 17% cumulatively since April. Prices stabilized after months of decline, suggesting pent-up demand is starting to re-enter.

Source: Canadian Housing Might Be Turning a Corner as Sales Picked Up in June – Dominion Lending Centres, July 15, 2025

Below is a snapshot of the latest monthly home sales and listings performance, illustrating the rebound:

🔑 Broker Strategy: Encourage pre-approvals for buyers who were waiting for more market certainty. Remind clients that rising sales activity can tighten inventory and push prices higher through summer.

3️⃣ Fixed Rates Ticking Higher as Bond Yields Grind Up

Fixed mortgage rates continued to drift upward last week, with multiple lenders raising rates between 5–10 bps. The increases are tied to rising bond yields and credit spreads, reflecting persistent inflation and stronger-than-expected job growth. Fixed rates are now approaching their highest levels since early spring.

Source: Monday Morning Mortgage Rate Update – Canadian Fixed Mortgage Rates Are Increasing – Integrated Mortgage Planners, July 14, 2025

🔑 Broker Strategy: Promote short-term fixed or hybrid options to balance flexibility and rate protection. Reinforce to clients that even modest increases in yields can ripple through mortgage pricing quickly.

4️⃣ U.S. Inflation Remains Stubborn—Cross-Border Impact

U.S. annual inflation accelerated to 2.7% in June from 2.4% in May, the second consecutive monthly rise. Core inflation also moved higher, keeping the Fed on the defensive. This dynamic is strengthening U.S. Treasury yields, which indirectly lifts Canadian funding costs and bond yields.

Source: RMG Your Morning Bru – Inflation Data and Impact on Rates – RMG Mortgages, July 15, 2025

🔑 Broker Strategy: Educate clients on the cross-border effect: even if Canada’s inflation eases later this year, elevated U.S. rates can keep Canadian funding costs sticky. Use this as a talking point to justify urgency for securing competitive rates now.

5️⃣ Housing Market Outlook: Uneven Recovery Continues

While more clients are asking about variable-rate mortgages given the BoC’s eventual easing, the persistent inflation readings and bond market volatility are making short-term fixed terms the most popular choice. Many brokers are recommending 1–3 year fixed rates to ride out uncertainty.

Source: Monday Morning Mortgage Rate Update – Canadian Fixed Mortgage Rates Are Increasing – Integrated Mortgage Planners, July 14, 2025

🔑 Broker Strategy: Position hybrid strategies and short-term fixed terms as flexible hedges against unpredictable rate moves. Provide scenario planning to help clients understand the trade-offs.

📢 Final Thought:

From accelerating inflation to rising sales and cautious lenders, this week underscores the importance of staying nimble. Proactive brokers will educate clients on the nuances driving rates and help them lock in certainty while others wait on the sidelines.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 45: Realtor Panel from The Ascend Conference

Guest: Ally Ballam, Mike Marfori, Ty Corsie & Chase Shymkiw

Ally Ballam, Mike Marfori, Ty Corsie, and Chase Shymkiw—four of Canada’s most recognized Realtors—share an unfiltered look at what it takes to succeed (and stand out) in today’s real estate market. From mastering personal branding and creating compelling social media to building trust with clients and navigating pricing volatility, this episode offers a practical playbook for brokers and agents alike.

You’ll hear firsthand how each panelist built a business rooted in authenticity and consistency, why proactive communication and education are more critical than ever, and how to turn market uncertainty into opportunity. Whether you’re a broker seeking stronger Realtor partnerships or an agent looking to level up your strategy, this candid discussion is packed with insights you can apply right now.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.