08/12/2025:

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

With bond markets watching inflation data closely, central banks signaling caution, and lenders adjusting rate strategies, this week brings key pivots for brokers to understand. The mix of inflation persistence, U.S.–Canada policy divergence, and evolving borrower sentiment shows that rate settings and communications must be both informed and agile.

1️⃣ Lenders Place Weight on Margin, Not Just Market Trends

Lender rate sheets are holding firm, even with only minor shifts in underlying yields. Driving this steadiness: credit spread pressure and cautious margin protection. Discounted pricing is becoming increasingly selective—focused on insured, shorter-term, or in-house loyalty options rather than across-the-board marketing campaigns.

Source:

Mortgage Logic News – Lender Rate Updates, August 11, 2025

🔑 Broker Strategy: This is the time to run insured vs. uninsured product comparisons for clients. Securing insurance may unlock better pricing even when base rates remain flat. Educate clients on how these subtle structural differences can significantly impact long-term savings.

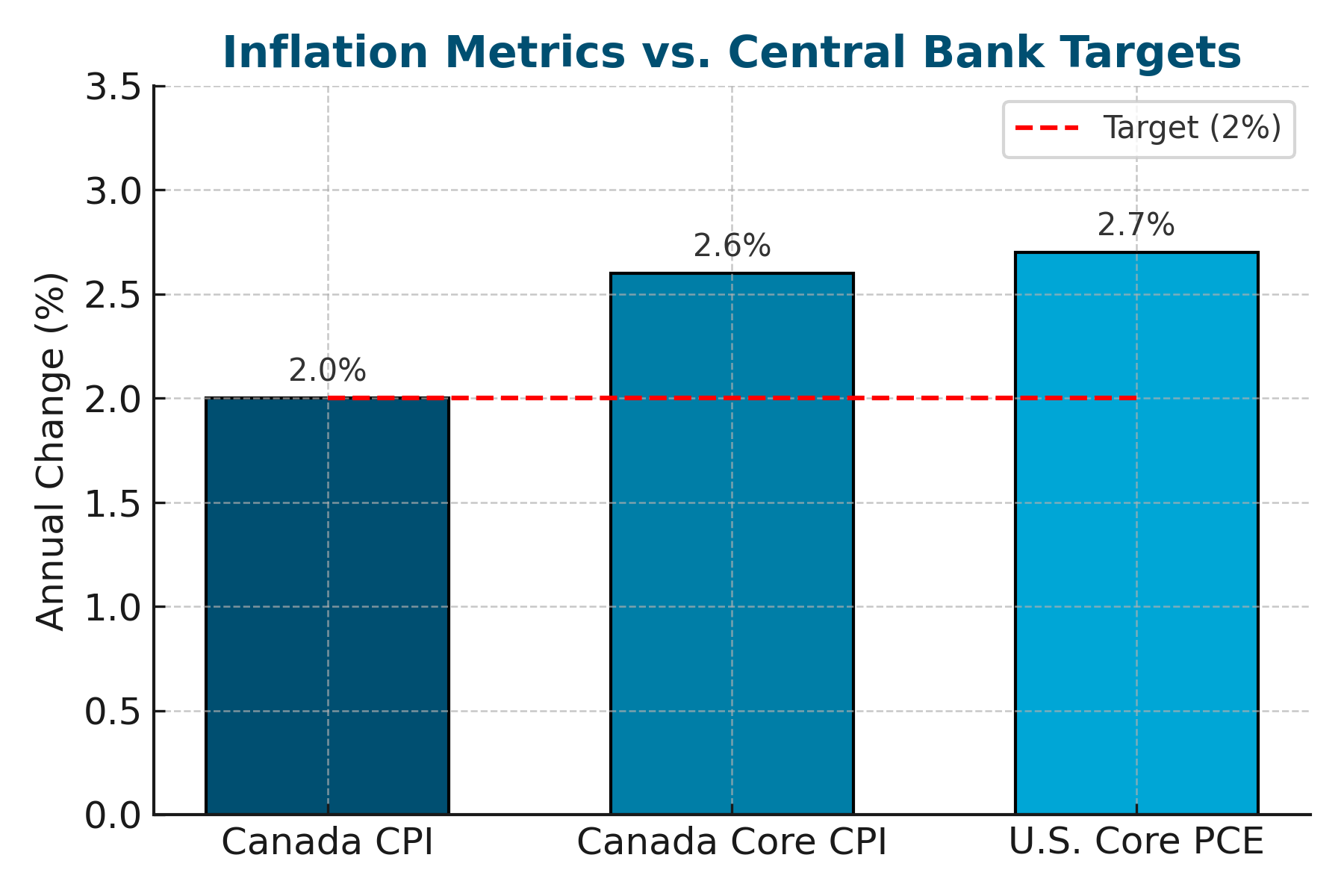

2️⃣ Inflation Still Outpacing Target in Essential Measures

While headline CPI may look contained, Core CPI and trimmed-mean inflation remain elevated—hovering near or above 2.5%. In the U.S., Core PCE inflation is also trending higher. This underlying trend is creating a widening policy gap: the BoC is approaching a potential easing cycle while the Fed holds firm, wary of lingering inflation.

Source: TradingEconomics.com – Inflation & Policy Outlook, August 11, 2025

This chart highlights the persistent gap between headline and core inflation in both Canada and the U.S., underscoring why central banks remain cautious despite progress toward their targets. Sticky core measures are delaying the rate cut timeline.

🔑 Broker Strategy: Help clients see why the headline CPI isn’t the full story. Advising to lock in now protects borrowers from delays in easing due to inflation metrics that matter more to central banks.

3️⃣ Canada–U.S. Diverging Paths Create Optionality

Canada’s economy shows signs of cooling under rate pressure, while the U.S. continues with robust consumption and labor resilience. This divergence translates into stronger U.S. rates compared to Canadian instruments and creates strategic opportunities for savvy rate positioning domestically.

Source: BTBB Lender Commentary – Cross-Border Economic Observations, August 11, 2025

🔑 Broker Strategy: Frame the divergence as a tactical edge: Canadian clients could benefit from short- to mid-term fixed rates before U.S.-influenced tightening pulls market pricing upward again.

4️⃣ Bond Market Pulses Resume After Calm

After weeks of rangebound movement, Canadian 5-year yields saw a renewed 10–12 bps swing. Market drivers included global data flow, renewed debt issuance, and inflation chatter. This volatility demonstrates that even backdrop stability can quickly reverse.

Source: Canadian Bond Market Weekly – August 11, 2025

🔑 Broker Strategy: Promote rate holds as insurance—particularly for clients with pre-approvals or upcoming renewals. Encourage locking in rates to safeguard against sudden market shifts that may catch borrowers off guard.

5️⃣ Client Preferences Soften Toward Hybrid Solutions

Borrower sentiment is diversifying: 1–3 year fixed terms remain popular for stability, while some, especially rate-conscious clients, are tilting toward variable rates. Hybrid mortgages—pairing the two—are growing in appeal as a balanced strategy to navigate drift without sacrificing flexibility.

Source: Bruno’s Weekly Lender Sentiment – August 10, 2025

🔑 Broker Strategy: Offer side-by-side cost modelling for fixed, variable, and hybrid options over 12–24 months. Position hybrid structures to clients who want protection with optionality as market clarity returns.

📢 Final Thought:

Inflation remains persistent, but central banks and global pressures are telling different stories. In an environment where central bank tone, bond volatility, and client psychology intersect, brokers must deliver insight before rate changes. Act with precision, clarity, and conviction—now is a moment for proactive guidance, not reactionary waits.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 47: Behind the Broker with Chris Pughe

Guest: Chris Pughe

Chris Pughe, veteran mortgage broker at A Better Way Mortgage, shares how her decades-long career—from collections and underwriting at Vancity to building a thriving referral-based business—has been fueled by relationships, adaptability, and a genuine love for helping people.

In this episode, Chris reveals how she quadrupled her volume in just one year by embracing training, adopting new tools, and stepping outside her comfort zone. She discusses her “out-care the competition” philosophy, the power of phone calls in a digital world, and why a small, trusted referral network beats spreading yourself too thin.

From using the “Dreams and Goals” strategy to help clients pay off mortgages years early, to balancing efficiency with human connection, Chris offers insights brokers can put into action immediately. Her journey shows that when you lead with care, stay curious, and keep improving, success follows.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.