08/26/2025:

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

With inflation cooling, central bankers signaling dovish tones, and rate cut probabilities climbing, this week marks a turning point. Bond yields, jobless claims, and client behavior all provide critical cues. Brokers who lean into clarity and strategy will seize opportunities amid uncertainty. Here’s what you need to know:

1️⃣ Cooling Canadian Inflation Opens the Door for BoC Cuts

Canada’s CPI dropped to 1.7% in July from 1.9% in June, below expectations. Core measures also eased, reinforcing a steady disinflationary trend. This provides the Bank of Canada with more leeway to prioritize growth. Futures now price 40% odds of a cut on September 17.

Source:

Integrated Mortgage Planners – Aug 25, 2025

🔑 Broker Strategy: Highlight to clients that the inflation backdrop is finally aligning with the BoC’s 2% target. Use this window to encourage rate discussions, especially for borrowers considering variables or short-term fixed options.

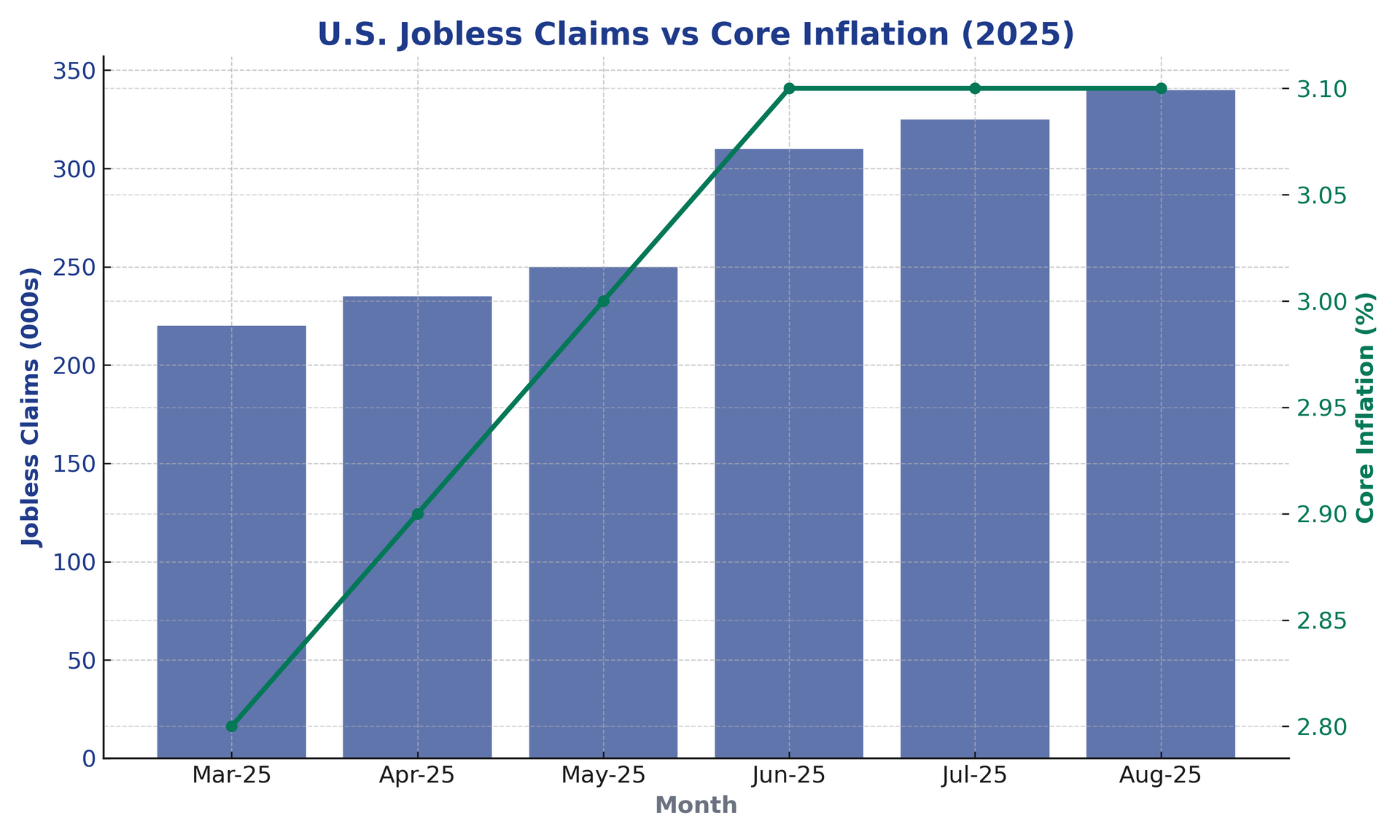

2️⃣ U.S. Jobless Claims Signal Strain — A Visual Story

U.S. jobless claims have climbed by 120,000 since March, reaching their highest level since late 2021. Meanwhile, U.S. core inflation has risen from 2.8% to 3.1%, painting a stagflationary picture. Futures markets now assign a 90% chance of a Fed rate cut in September, but risks remain.

Source:

RMG Your Monday Morning Bru – Aug 25, 2025

Below is a snapshot comparing U.S. jobless claims with core inflation — illustrating why markets are so focused on Fed moves.

🔑 Broker Strategy: Use this chart as a conversation starter with clients. Show how rising unemployment doesn’t always mean immediate rate relief — inflation stickiness complicates policy. Position pre-approvals as essential in this volatile backdrop.

3️⃣ Jackson Hole Delivers a Dovish Powell

At Jackson Hole, Fed Chair Jerome Powell suggested that restrictive policy may soon be adjusted, hinting at rate cuts. Markets took this as dovish, though Powell warned of risks: inflation still leans upward, while employment weakens. The speech set the tone for both U.S. and Canadian bond yields last week, nudging them slightly lower.

Source: RMG Your Monday Morning Bru – Aug 25, 2025

🔑 Broker Strategy: Frame Powell’s words as a signal for opportunity. Explain to clients that while cuts may come, bond markets may not always pass savings along instantly. Act early rather than waiting.

4️⃣ Industry Insights: The Biggest Risk Is You

The latest BTBB Sunday Blog argued that the “biggest threat to your business is yourself.” With tech disruptions, AI, and shifting client expectations, the piece emphasized the importance of proactive habits: security, insurance, cloud adoption, and embracing change.

Source: Bank Trade & Bond Bulletin (BTBB) – August 24, 2025

🔑 Broker Strategy: Share this mindset with your team. Reassure clients that your value isn’t just rates but resilience. Highlight how brokers who adapt to AI and digital tools will deliver more tailored, efficient service.

5️⃣ Fixed vs. Variable — The Debate Reignites

Fixed mortgage rates remain anchored near long-term averages, while variable rates could still prove cheaper over the full term if BoC cuts materialize later this year. The term premium on longer fixed rates is slowly returning, making 5-year terms more attractive than 3-year in some cases.

Source: Integrated Mortgage Planners – Aug 25, 2025

🔑 Broker Strategy: Offer side-by-side comparisons. Suggest hybrid strategies or emphasize 5-year fixed where pricing converges with shorter terms. Encourage variable only if clients have the buffer to handle volatility.

📢 Final Thought:

Cooling inflation, a dovish Fed, and rising jobless claims make for a complex but opportunity-rich environment. Brokers who simplify the noise, use visuals to tell the story, and stress early action will lead their clients with confidence. This is not just about watching rates — it’s about guiding through uncertainty.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 48: Behind the Broker with Danny Duong

Guest: Danny Duong

Danny Duong, Mortgage Architect at A Better Way Mortgage Group, brings nearly two decades of experience to this episode—centered on trust, authenticity, and client-first service. After starting in Human Resources and spending eight years as a mobile mortgage specialist with TD Bank, Danny transitioned into the broker channel in 2014 to better serve his clients’ needs.

He shares how he navigated the shift from institutional banking to entrepreneurial brokering—building a website, marketing himself, and learning the tools needed—one manageable step at a time with mentorship and support.

Danny’s approach to client relationships is marked by honesty and empathy. He listens attentively, provides clear roadmaps and service expectations, and isn’t afraid to tell a client to stick with their current bank if it’s truly their best option. That level of transparency builds deep, lasting trust.

Beyond business, Danny’s version of work-life balance is more about work-life harmony—stepping away when needed, blending work and family time thoughtfully, and staying responsive without losing presence.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.