11/12/2025

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

Bond markets remain orderly while the data pulse heats up. A stronger Canadian jobs print complicated near-term cut odds even as arrears stay historically low and federal policy tilts further toward multi-unit supply. Here’s what matters now—and how to turn it into client wins.

1️⃣“Mortgage Crisis” Narratives Don’t Match the Data

OSFI notes rising delinquencies in fixed-payment variables (FPVs), but arrears across banks are still well below the long-run average (~0.24% in August vs ~0.40% historical). FPV arrears have moved from ~40% lower than fixed-rate arrears in 2022 to ~50% higher now—yet from a very small base (on the order of a few thousand loans nationwide). Key rates snapshot shows the 5-yr GoC ~2.74%, and headline retail rates edged down following October’s policy cut.

Source: The Mortgage ‘Crisis’ Canada’s Banks Barely Felt – Mortgage Logic News (Nov 12, 2025)

🔑 Broker Strategy: Don’t avoid FPVs categorically. Focus on suitability and LTV, and use arrears context to counter sensational headlines when advising risk-tolerant, cash-flow-sensitive borrowers.

2️⃣ Strong Jobs Print Takes a December BoC Cut Largely Off the Table

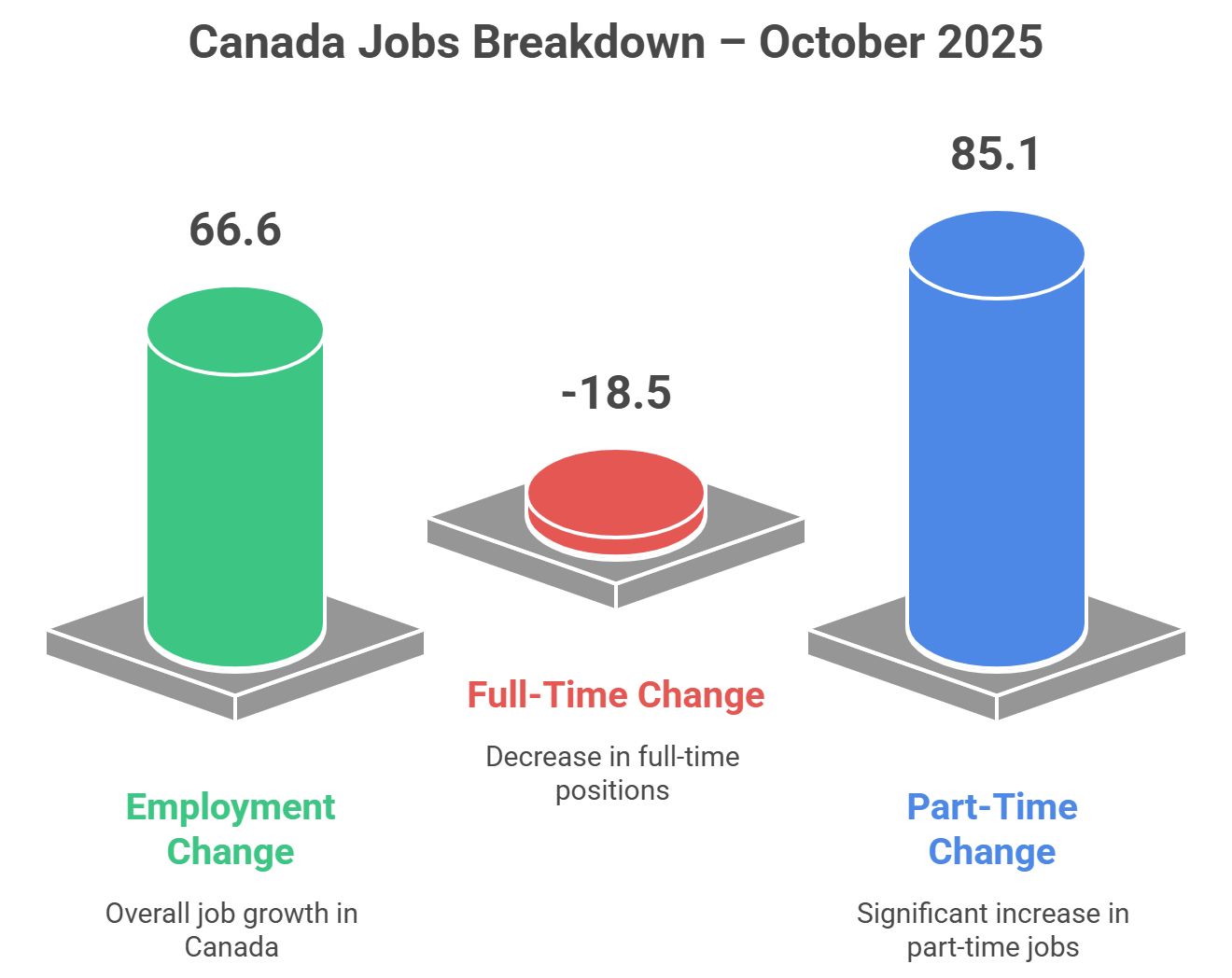

Canada added ~66.6k jobs in October (consensus –2.5k), with unemployment down to 6.9%—but quality skewed to part-time (+85.1k) while full-time fell (–18.5k). Several newsletters assess that this strength has reduced odds of a December BoC cut, shifting attention to early-2026 timing.

Source: RMG Your Monday Morning Bru – Nov 10, 2025; Integrated Mortgage Planners (Nov 10, 2025)

October’s headline beat was driven by part-time gains while full-time work contracted—one reason lenders aren’t racing to reprice lower.

🔑 Broker Strategy: Use the jobs bump window to refresh pre-approvals and rate holds. Explain to clients that headline strength + weaker full-time mix can keep fixed rates range-bound near-term; a soft CPI/retail-sales run would be the catalyst for deeper lender discounting.

3️⃣Budget Watch: CMB Expansion Points to More Purpose-Built Rentals

Industry analysis highlights the CMB program rising to $80B (from $60B), with the entire +$20B aimed at multi-unit this time—supporting rental construction and liquidity for lenders active in multi-unit. That tilt implies fewer owner-occupied starts and sustained demand for rentals in 2026.

Source: BTBB Sunday Blog – “2025 Federal Budget: What It Means for You and Your Clients” (Nov 9, 2025)

🔑 Broker Strategy: Guide investor and builder clients toward insured multi-unit programs and CMHC-backed executions; for first-time buyers, set expectations that owner-occupied supply relief may lag.

4️⃣ Rates & Spreads: Calm Funding Backdrop Aids Pricing Discipline

MLN’s key-rates board shows 5-yr GoC ~2.74%, 4-yr swap ~2.45%, and benchmark retail rates slipping after October’s policy move. Lenders are largely holding spreads, waiting for confirmation from CPI and retail sales before deeper cuts.

Source: Mortgage Logic News – Key Rates panel (Nov 12, 2025).

🔑 Broker Strategy: Lock 1–3 year fixed for flexibility where budgets are tight; keep a watchlist of lenders with sharper uninsured specials as year-end volumes push for quota closes.

5️⃣ Under the Hood of the Jobs Report: Sector Mix Matters

RMG’s breakdown flags that the gains leaned on retail/wholesale/transport & warehousing (~71k combined), while construction fell (~–15k) and average hourly wages ~4.0% YoY. The composition argues for steady BoC near-term—strong enough to avoid an emergency cut, soft enough to keep the easing cycle narrative alive into 2026.

Source:

RMG Your Monday Morning Bru – (Nov 10, 2025)

🔑 Broker Strategy: For renewals, pair a short fixed with a mid-2026 review plan. For pre-approvals, stress-test affordability using today’s payments and a mild spread-widening scenario.

📢 Final Thought:

Ignore the noise, translate the data. A sturdier headline jobs print has paused the “December cut” story, but with arrears still tame and funding calm, opportunity remains in short fixed terms, insured solutions, and multi-unit financing. Equip clients with context on job-quality and policy trends, and you’ll control the narrative—whatever the next data release brings.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 53: Behind the LENDER with Jesse Bobroski, Calvert Home Mortgage

Guest: Jesse Bobroski

Jesse Bobroski, Vice President at Calvert Home Mortgage, joins Behind the Lender to pull back the curtain on one of Canada’s longest-standing private lenders. With 50 years in business, Calvert has built its reputation on speed, transparency, and a deep understanding of both broker and borrower needs.

In this episode, Jesse shares his journey from bartending in Ontario to leading one of the country’s most innovative mortgage investment corporations. He explains how Calvert’s in-house valuations and after-repair value lending set them apart—allowing for faster approvals, lower costs, and smarter risk management.

The conversation dives into how Calvert supports real estate investors, adapts to new compliance rules, and leverages data and AI to streamline operations. Jesse also offers insight into emerging market trends, multifamily opportunities, and why Calvert’s “make-sense” underwriting culture keeps both clients and brokers coming back.

A must-listen for brokers who want to understand how private lenders think—and how collaboration, innovation, and service excellence can redefine lending in Canada.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.