11/04/2025

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

This week begins with mixed messages: a weakening Canadian growth outlook contrasted by resilient bond markets and cautious lender sentiment. The headlines may sound grim, but lower yields are quietly creating borrower opportunities. Staying proactive on pricing and policy news is key to finishing Q4 strong.

1️⃣Bond Markets Steady Despite Weak Canadian Growth

Canada’s August GDP shrank 0.3%, underperforming the flat forecast and confirming the slowdown is broad-based. Yet, bond markets held firm, with 5-year yields easing just 2 bps and swap spreads stable—signalling that funding stress is low. Fixed-rate lenders continue modest discounting while awaiting Friday’s jobs data.

Source: Bond Markets Are Fine, But Canadian Growth Isn’t – Mortgage Logic News (Nov 3, 2025)

🔑 Broker Strategy: Use yield stability to lock favourable short-term fixed holds. A BoC pause doesn’t mean rates can’t fall—market pricing often leads policy shifts.

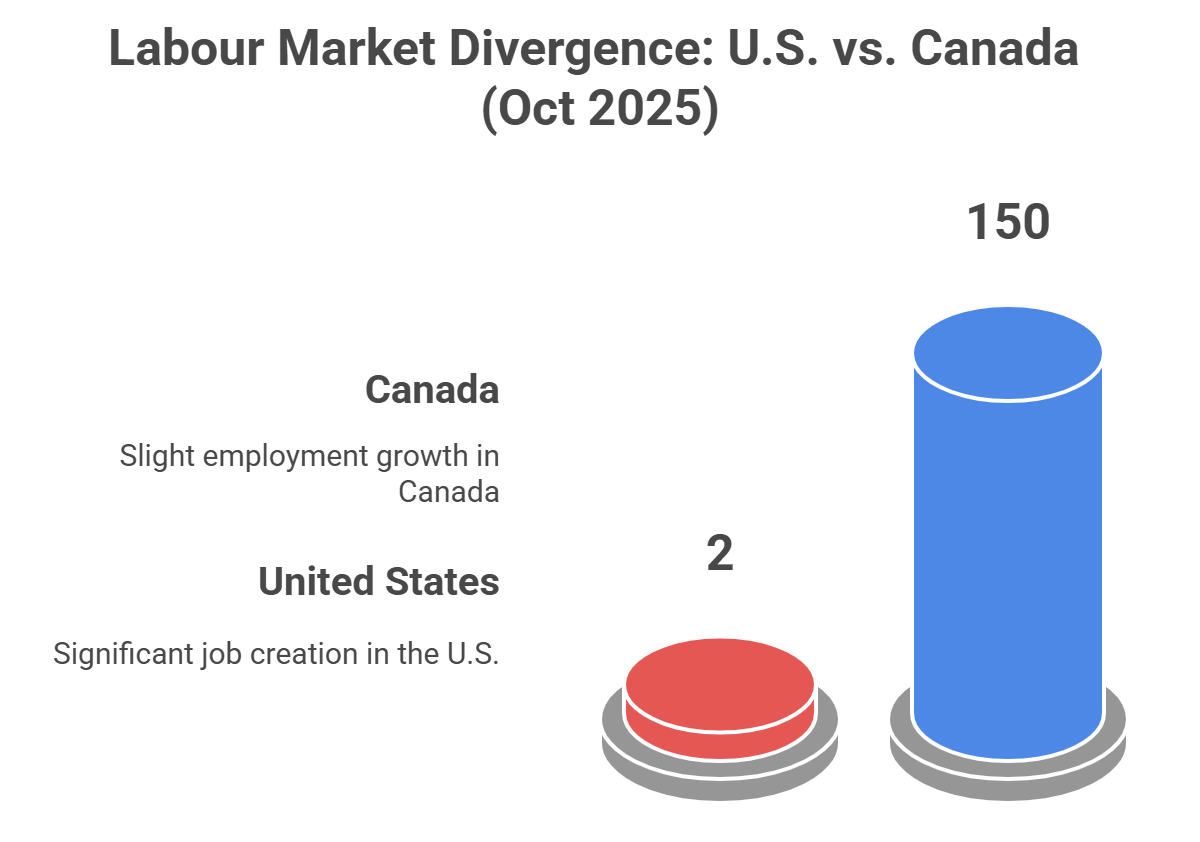

2️⃣ Canadian & U.S. Labour Trends Continue to Diverge

While the U.S. added 150,000 jobs in October, Canada’s labour growth stalled, with unemployment rising to 7.0%. The divergence highlights different economic speeds: U.S. resilience is sustaining global yields, while Canada’s soft data adds pressure for easing by early 2026.

Source: RMG Morning Bru – November 4, 2025

Below is a snapshot of labour market divergence in North America, showing steady U.S. job creation alongside Canada’s slowing employment growth.

🔑 Broker Strategy: Explain to clients that U.S. labour strength may keep Canadian borrowing costs from dropping sharply. Position short fixed terms or hybrids for flexibility in 2026.

3️⃣Federal Budget Fallout: Deficits, Housing & More CMBs

The newly tabled federal budget delivered mixed signals—expanded housing incentives and more Canada Mortgage Bonds (CMBs) issuance, but at the cost of wider fiscal deficits. While new rental construction measures are welcome, markets worry that higher public spending may slow inflation’s descent.

Source: Canadian Federal Budget Revamp – DLC Network (Nov 4, 2025)

🔑 Broker Strategy: Leverage client interest in housing-related programs but caution that policy-driven spending may keep long-term rates sticky.

4️⃣ Swap & Credit Spreads Point to More Discounting

Credit and swap spreads remain tight, suggesting lenders have room to offer sharper fixed-rate pricing in November. The 4-year swap rate rose only 1 bp, while the 5-year GoC yield edged down to 2.71%, leaving lender margins healthy.

Source: Mortgage Logic News – Bond Markets Are Fine, But Canadian Growth Isn’t (Nov 3, 2025)

🔑 Broker Strategy: Encourage pre-approvals now. Spreads like this rarely last when headline risk (jobs, budget, inflation) looms in the same week.

5️⃣ Fixed vs. Variable: BoC Caution Keeps Balance

The Bank of Canada remains in wait-and-see mode, with a 14% chance of a December cut according to market-implied probabilities. While variables are gaining renewed attention, the majority of clients continue favouring short (1–3 year) fixed options.

Source:

Mortgage Logic News – Nov 3, 2025

🔑 Broker Strategy: Lead conversations with rate flexibility. Reinforce that staying short and reassessing mid-2026 may capture the next leg down in borrowing costs.

📢 Final Thought:

Even as growth weakens, stability in bond markets and controlled credit spreads are creating a window for strategic rate holds. The coming jobs data and inflation prints will test this calm—but brokers who act before volatility returns will win client trust and market share.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 53: Behind the LENDER with Jesse Bobroski, Calvert Home Mortgage

Guest: Jesse Bobroski

Jesse Bobroski, Vice President at Calvert Home Mortgage, joins Behind the Lender to pull back the curtain on one of Canada’s longest-standing private lenders. With 50 years in business, Calvert has built its reputation on speed, transparency, and a deep understanding of both broker and borrower needs.

In this episode, Jesse shares his journey from bartending in Ontario to leading one of the country’s most innovative mortgage investment corporations. He explains how Calvert’s in-house valuations and after-repair value lending set them apart—allowing for faster approvals, lower costs, and smarter risk management.

The conversation dives into how Calvert supports real estate investors, adapts to new compliance rules, and leverages data and AI to streamline operations. Jesse also offers insight into emerging market trends, multifamily opportunities, and why Calvert’s “make-sense” underwriting culture keeps both clients and brokers coming back.

A must-listen for brokers who want to understand how private lenders think—and how collaboration, innovation, and service excellence can redefine lending in Canada.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.