10/28/2025

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

It’s a pivotal week with both the Bank of Canada and the U.S. Federal Reserve set to announce rate decisions Wednesday morning. Markets overwhelmingly expect synchronized 25-basis-point cuts, but the tone of each announcement will drive the outlook for the rest of 2025. For brokers, this week is about timing, client confidence, and preparation.

1️⃣ BoC Poised to Cut to 2.25% — But Debate Persists

Economists expect Governor Macklem to deliver a 25-bps cut to 2.25%, marking the lowest policy rate since 2022. Markets are pricing 82% odds of a move, driven by soft growth and rising unemployment, even as headline CPI (2.3%) and core inflation (3.1%) remain above target. Some analysts argue a pause might better protect credibility, but the risk of inaction amid slowing demand is rising. Pre-pandemic, the benchmark rate was 1.75%, a reminder that policy remains restrictive by historical standards.

Source:

RMG Monday Morning Bru – “Wednesday is Bank of Canada Day & What Are the Odds” (Oct. 27, 2025).

🔑 Broker Strategy: Prep clients for both outcomes. A cut would favor short fixed terms for flexibility; if the BoC holds, reinforce payment stability and renewal readiness.

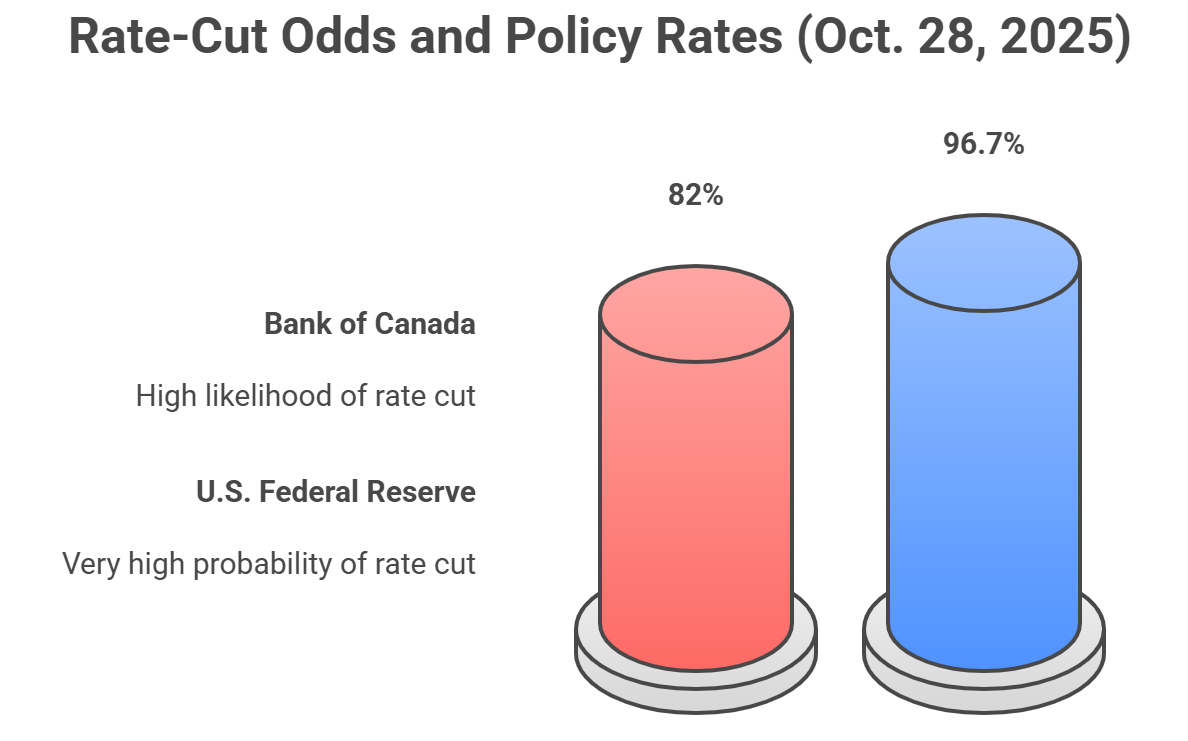

2️⃣ Rate-Cut Odds: BoC vs. Fed — A Tale of Two Central Banks

Global rate markets show a 96.7% chance of a U.S. Fed cut versus 82% for the BoC, reflecting differing confidence in each central bank’s stance. Inflation remains above targets, but slowing job growth and weaker consumer spending are pushing both institutions toward easing. The Fed’s urgency is clearer, while the BoC’s tone will likely stay cautious to preserve inflation credibility. This “confidence gap” could shape the yield curve and short-term funding spreads into year-end.

Source:

RMG Monday Morning Bru (Oct. 27, 2025); CBS Market Forecast; CME FedWatch.

Markets expect synchronized 25-bps cuts — the Fed leads on conviction while the BoC balances caution.

🔑 Broker Strategy: Use these probabilities to position clients. If both banks cut, expect mild downward pressure on short-term fixed rates — a potential opportunity for quick action.

3️⃣ Inflation Moderation: Early Signs of Cooling, But Not Relief Yet

Since mid-October, new CPI data have shown tentative moderation — energy and food prices have softened, while shelter inflation remains sticky. The headline CPI is trending closer to 2.2%, and bond markets are treating this as confirmation that price momentum has peaked. However, the core measures (trim/median) are still near 3%, implying the BoC won’t accelerate cuts beyond this week’s likely move. Wage growth remains resilient, suggesting inflation could stay above target into Q2 2026.

Source: Dominion Lending Centres – Market Commentary: “Inflation Moderates, But Shelter Still Sticky” (Oct. 24, 2025).

🔑 Broker Strategy: Keep expectations realistic — rate relief may come slower than hoped. Encourage clients to prioritize total affordability and consider early renewals where fixed-rate discounts appear.

4️⃣ Bond and Mortgage Markets in Pre-BoC Pause Mode

Markets have entered a holding pattern ahead of Wednesday’s decision. The 5-year Canada bond yield has held in a tight band near 2.64–2.68%, reflecting cautious optimism. Fixed mortgage rates have flattened after last week’s small decline, and lenders are unlikely to move significantly until after the BoC’s press conference. Variable products remain stable around 3.9%, suggesting that any post-cut reaction will be measured. Meanwhile, swap spreads imply markets expect no further cuts until Q1 2026 unless inflation drops sharply.

Source: Mortgage Logic News – “Bonds to Trump: We’ve Moved On, Thanks” (Oct. 25, 2025).

🔑 Broker Strategy: Treat this as a “wait-and-react” window. Advise clients to finalize approvals and prepare for quick updates — rates could shift midweek depending on BoC language.

5️⃣ Broker Outlook: A Calm Before a Coordinated Pivot

Industry sentiment has stabilized after weeks of mixed data. With both the Fed and BoC expected to act this week, brokers are entering a short window of potential rate normalization. The tone across industry commentary — from RMG to Mortgage Logic — suggests that a single cut won’t spark a surge in affordability but could mark the turning point toward a gentler 2026. As one strategist put it, “The cuts won’t move mountains, but they may move minds.

Source:

RMG Morning Bru (Oct. 27, 2025)

🔑 Broker Strategy: Emphasize calm and confidence in client communications. Focus on relationship retention, renewal planning, and illustrating the bigger picture of stabilization rather than sensational rate drops.

📢 Final Thought:

As both central banks prepare to pivot, the biggest shift this week isn’t just in rates — it’s in tone. If both the BoC and Fed deliver the anticipated cuts, markets will look for cues on 2026, not celebration in 2025. Brokers who translate this nuance clearly will set themselves apart. Update your pre-approvals, refresh lender matrices, and be ready to move quickly Wednesday morning.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 52: Behind the BrokerAGE with justin noda

Guest: Justin Noda

Justin Noda—A Better Way’s new Chief Compliance & Operations Officer—joins the show to launch Behind the Brokerage, a series unpacking the systems, regulations, and operational playbooks that protect brokers and power scalable growth.

With 18 years in the industry across brokering, underwriting, and leadership (ClearTrust, Origin Mortgages, The Mortgage Center, CFS), Justin explains why a true “culture of compliance” is now a competitive edge. He shares how ABW is translating complex rules—FinTrack, evolving AML expectations, and BC’s coming Mortgage Services Act—into clear, broker-friendly processes, tools, and training that make daily work easier, not harder.

Justin also outlines what the new series will cover: practical FinTrack readiness, MSA timelines and implications, inter-provincial differences (BC/AB/ON) and how to stay compliant across borders, lender relations and deal-desk ops, and why every agent should know (and use) their brokerage’s policies & procedures. Throughout, he keeps a broker-first lens—balancing regulation with real-world deal flow, client service, and efficiency.

This episode sets the tone for ABW’s next chapter: transparency, education, and operations that protect agents while elevating professionalism across the industry.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.