12/10/2025:

BoC Holds at 2.25%: Stability Takes Centre Stage as Canada Enters 2026

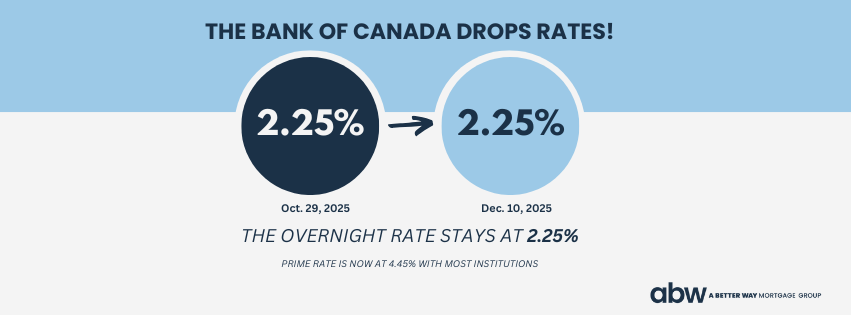

Today, the Bank of Canada (BoC) held its overnight rate at 2.25%, maintaining the Bank Rate at 2.50% and the deposit rate at 2.20%. After October’s widely expected rate cut, today’s decision confirms a shift in stance: the Governing Council believes policy is “at about the right level” to guide inflation back to target while supporting an economy undergoing structural adjustment.

This hold marks the first step into Canada’s rate-stabilization phase—a period where economic data, not policy momentum, will drive market direction.

Economic Context and Market Impact

Global Backdrop: Resilience With Risk

Major economies continue to absorb the shockwaves of U.S. trade protectionism, but impacts vary:

- United States: Growth is holding up, fuelled by strong consumption and a surge in AI-driven business investment. Tariffs continue to apply upward pressure on inflation. A prolonged government shutdown distorted quarterly data releases.

- Euro Area: A surprisingly robust services sector is lifting growth above expectations.

- China: Persistent housing weakness and soft domestic demand weigh on overall momentum.

Canada: A Stronger Q3, But Not a Trend

Canada posted a surprising 2.6% GDP expansion in Q3—though mostly due to volatile trade flows, not underlying domestic strength.

- Final domestic demand was flat, reflecting cautious consumer and business spending.

- The BoC expects weaker GDP in Q4, as net exports reverse.

- Growth is projected to pick up in 2026, but volatility may continue given trade-related shocks.

Labour Market: Gradual Improvement

- Employment has grown steadily over the past three months.

- The unemployment rate dipped to 6.5% in November.

- However, trade-exposed sectors remain soft, and hiring intentions remain subdued.

Inflation: Moving in the Right Direction

- Headline CPI: 2.2% (October), helped by falling gas prices and slower food inflation.

- Core Measures: Still between 2.5%–3.0%, with underlying inflation assessed at ~2.5%.

- Temporary upward bumps are expected due to last year’s GST/HST holiday, but the Bank believes economic slack will hold CPI near target through 2026

Financial Markets: Steady Conditions Amid Policy Pause

Financial markets have taken today’s hold largely in stride, with minimal movement in bond yields and credit spreads. Investors had already priced in a pause, and the BoC’s reaffirmation that policy is “at about the right level” supports expectations for a stable rate environment heading into early 2026. Funding conditions remain broadly unchanged, reinforcing a backdrop where fixed mortgage rates are likely to experience only modest fluctuations in the near term.

Business Confidence and Investment Outlook

Business sentiment remains cautious but stable as firms adjust to ongoing trade uncertainty and shifting global supply chains. While hiring intentions are subdued, the Bank notes that investment tied to technological modernization continues to provide some support, echoing trends seen in the U.S. AI sector. Overall, the BoC expects business activity to remain soft in the short term but improve gradually as economic conditions firm later in 2026.

Impact on Borrowers

Variable-rate mortgage and HELOC holders will see no change to payments as today’s hold keeps prime at 4.45%. The stability offers an opportunity for borrowers to reassess amortization and repayment strategies now that the easing cycle appears to be on pause. Fixed-rate borrowers can expect rate stability in the near term, with limited upward pressure unless bond yields drift higher. Those with static-payment variable products may see gradual improvements in amortization as rates stabilize. Adjustable-rate variable borrowers will experience no payment changes but benefit from increased predictability heading into 2026.

What’s Next?

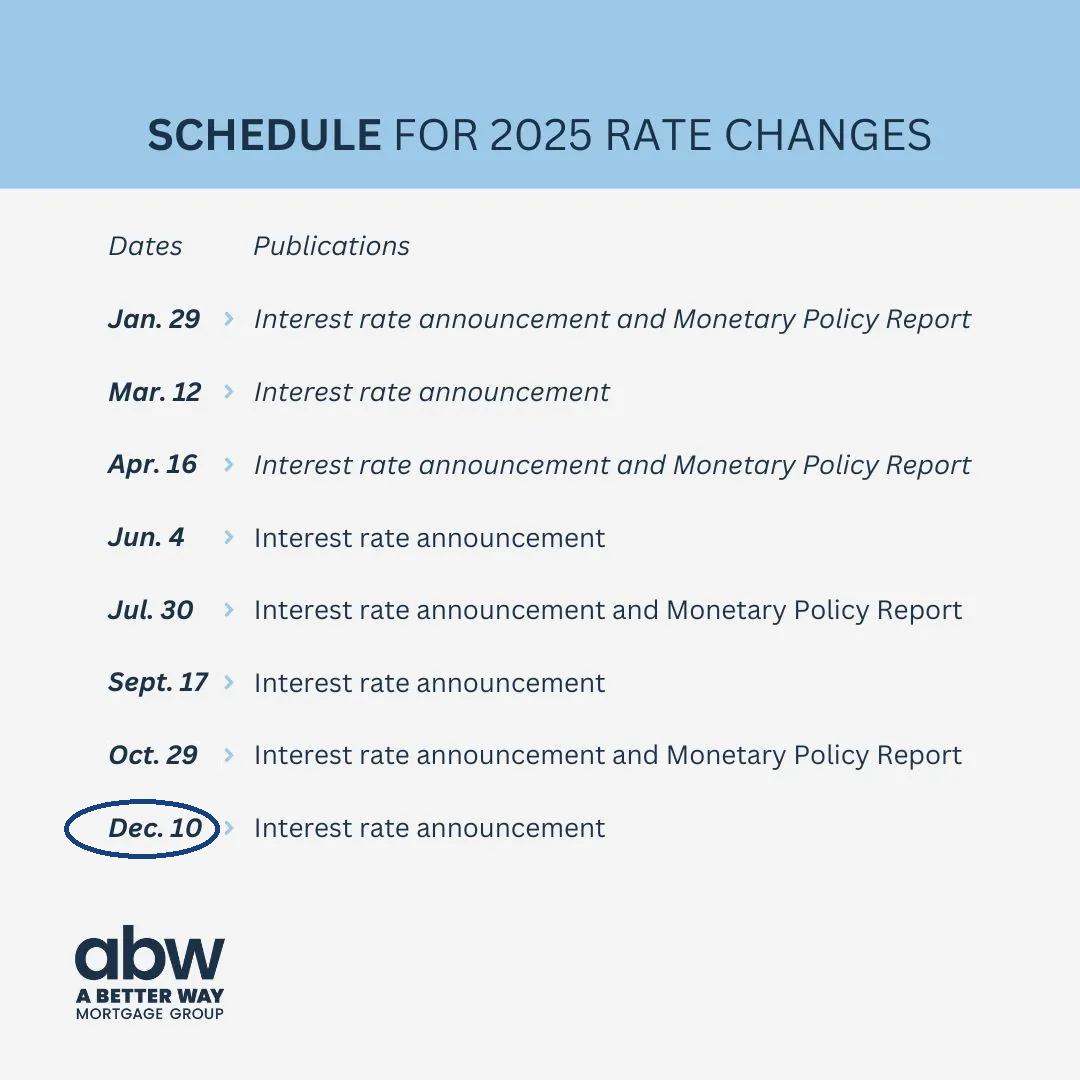

The next BoC meeting is scheduled for January 28, 2026, and market expectations for a rate cut are minimal. With policymakers emphasizing that the current rate is appropriate for maintaining inflation near target, the consensus is that the BoC has entered a holding phase unless economic conditions deteriorate significantly.

Upcoming inflation data will be critical, particularly core readings, as markets look for further confirmation that price pressures remain contained. As Canada moves into 2026, the focus is shifting away from rate movements and toward how the economy adapts to ongoing trade reconfiguration and global uncertainty.

Opportunities for Mortgage Brokers

Today’s hold — and the BoC’s signal that policy is now “at about the right level” — creates a strategic moment for brokers to help clients adjust expectations as Canada enters a period of rate stability:

- Proactive Client Outreach: Connect with variable-rate and HELOC clients to explain what today’s hold means for their payments and amortization. Reinforce the message that stability is returning to the rate environment, and use this moment to prompt early renewal conversations for clients coming up in 2026.

- Educational Content: Share simple, visual explanations of why the BoC is shifting into a stabilization phase. Highlight improving inflation trends, the flat domestic demand picture, and the Bank’s confidence that CPI will remain near target. These updates help clients understand why sharp rate swings are less likely in the near term.

- Targeted Marketing: Focus outreach in regions showing renewed buyer interest, particularly Ontario and British Columbia. Emphasize that stable policy rates provide clarity for planning, and encourage clients to secure pre-approvals while fixed-rate pricing remains steady.

- Renewal & Refinance Strategy: Guide clients within 120 days of renewal to review options early. With rates holding steady, borrowers can make informed decisions about term selection, payment strategy, and potential debt consolidation. The current environment is also well-suited for clients looking to improve cash flow or consolidate higher-interest consumer debt.

- Stay Ahead of the Data: Continue monitoring upcoming inflation prints, labour market reports, and global trade developments. Core inflation drifting lower would reinforce the BoC’s hold stance, while unexpected trade disruptions could shift market expectations. Keep an eye on the 5-Year Canada Bond and key U.S. Treasury yields for signs of fixed-rate movement heading into 2026.

TAKE ACTION!

At ABW Mortgage Group, we’re here to help you make the most of this period of renewed stability. Whether you’re buying, refinancing, or renewing, our experts can guide you through today’s shifting landscape with clarity and confidence.

Now is the perfect time to leverage the benefits of a steady rate environment — secure favourable terms, protect your borrowing power, and plan strategically for 2026.

maximize the rate cut’s benefits!

55: Behind the Network with Chad Gregory, Dominion Lending Centres

Guest: Chad Gregory

Hosts: Dean Lawton & Jason Marshall

Chad Gregory, VP of National Sales at Dominion Lending Centres, joins Behind the Network to share how DLC grew from a small startup into Canada’s largest mortgage brand. Chad reflects on DLC’s early days—building the network from the ground up in Ontario, knocking on doors, pitching real estate brokerages, and pushing a bold vision: establish the first nationally recognized mortgage-broker brand. He explains how DLC’s branding strategy, recruiting efforts, and relentless belief in the model helped shift consumer behaviour from 88% bank loyalty to a near 50/50 split between banks and brokers today.

The conversation dives into the tools that now fuel DLC’s competitive edge, including Velocity, the My Mortgage Toolbox app, and the Gold Rush CRM. Chad details how secure document portals, refinance analyzers, automated campaigns, and emerging AI integrations are helping brokers become more efficient, more professional, and better equipped to convert and retain clients. He emphasizes that in a fast-changing market, brokers who embrace technology—and invest in systems that buy back their time—will outperform those who resist change.

Chad also shares timeless sales and business-development strategies, from handwritten cards and emotional deposits to using scripts, practicing role plays, and delivering unexpected post-close touches. These simple habits, he says, turn clients and referral partners into long-term raving fans. Looking ahead, Chad believes DLC’s biggest years are still to come, driven by innovation, consumer demand for advice, and a network committed to helping brokers grow.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.