10/07/2025

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

With shutdown disruptions, muted yields, and shaky labour data dominating the headlines, this week offers both caution and opportunity. Brokers who translate uncertainty into actionable strategies—like securing holds early, watching employment metrics, and helping clients stay level-headed—will be best positioned in volatile markets.

1️⃣ U.S. Shutdown Freezes Market Data, But Bonds Stay Calm

The U.S. government shutdown has effectively paused key data releases, including last week’s Non-Farm Payrolls. Despite that, U.S. 10-year yields are flat at 4.15%, and Canada’s 5-year sits near 2.75%. Bond traders are “flying blind,” relying on private payroll estimates to gauge direction.

Source:

RMG Morning Bru – “The Silence of the BLS, Bond Yields, and Job Numbers” (Oct 6, 2025)

🔑 Broker Strategy: Advise clients that short-term volatility is possible once U.S. data resumes. Reassure fixed-rate borrowers that funding costs remain steady for now, while variable-rate clients should be prepared for possible yield spikes if shutdown resolution sparks risk appetite.

2️⃣ U.S. Job Loss Momentum Deepens — Canada Holds Steady

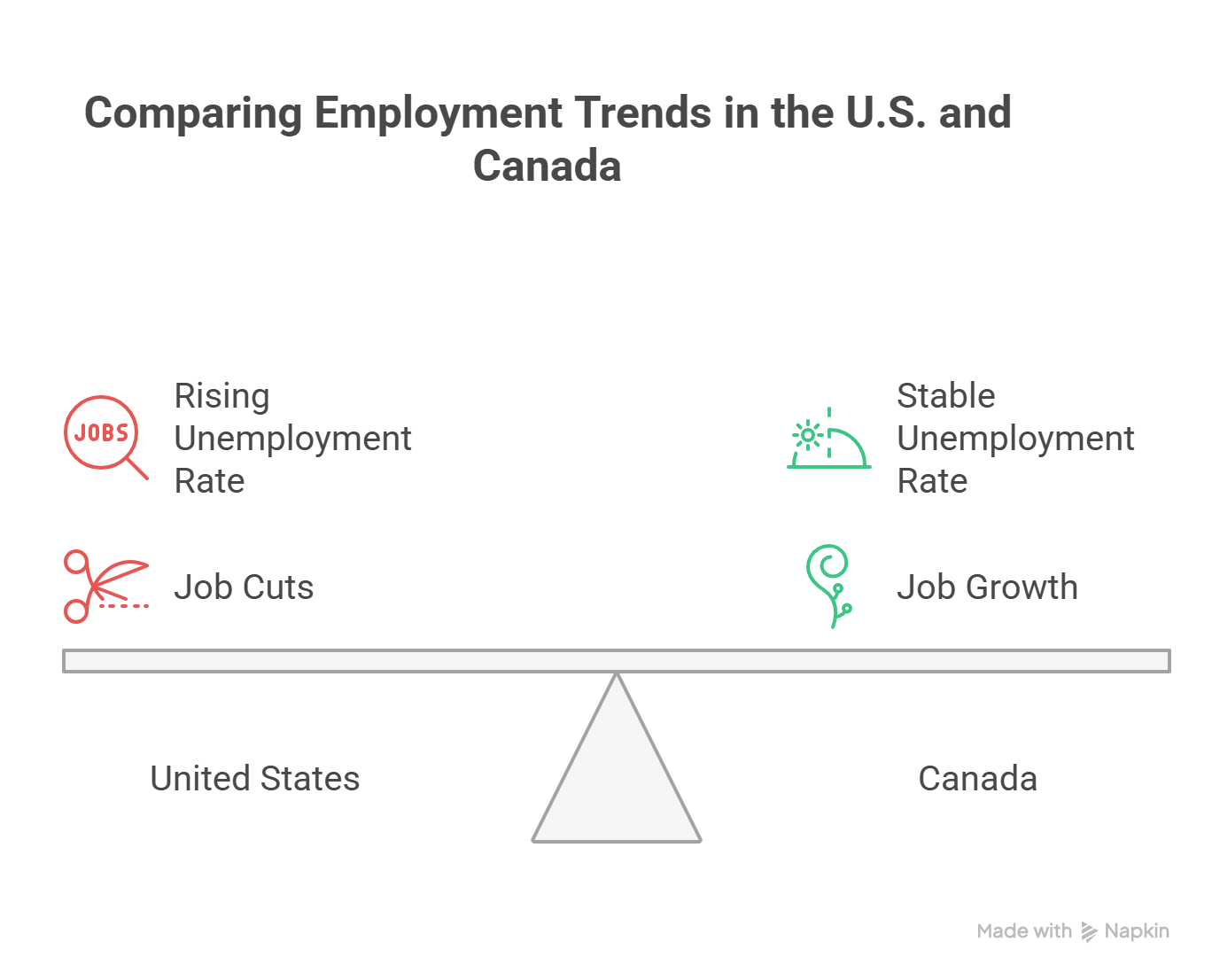

Private sector job losses in the U.S. continue to mount, with back-to-back declines signaling slowing demand and rising unemployment pressure. Meanwhile, Canada’s employment landscape appears steadier, though hiring momentum has clearly cooled. The two economies are diverging—America’s labour market showing visible cracks, while Canada maintains a cautious balance between stability and stagnation.

Source:

RMG Monday Morning Bru: America in Shutdown? Jobs Data in Focus – Sept 29, 2025

Below is a snapshot comparing employment trends across the U.S. and Canada, illustrating how job cuts and rising unemployment in the U.S. contrast with modest job growth and a stable jobless rate north of the border.

🔑 Broker Strategy: Use this divergence to guide rate discussions—Canada’s relative stability suggests more room for gradual rate moderation, while persistent U.S. weakness could exert downward yield pressure globally.

3️⃣ Canada Job Report on Deck – Low Expectations

Markets expect just 2.8K new jobs in Friday’s release, with unemployment steady at 7.1%. Labour softness continues to offset sticky wage growth. For now, markets anticipate the Bank of Canada will remain patient, especially given that U.S. economic signals are clouded by shutdown delays.

Source: TradingEconomics.com – Canada Labour Market Forecast (Oct 6, 2025)

🔑 Broker Strategy: Prep clients early this week to capitalize on stability before Friday’s release. Weak data could push yields lower temporarily—creating a window for last-minute rate locks.

4️⃣ Foreclosure Activity Rising in Toronto – A Red Flag to Watch

New Power of Sale listings in Toronto have surged to record highs, reflecting strain among households facing variable-rate resets and declining affordability. While this remains a localized issue, it’s an early signal that household debt stress is spreading beyond smaller markets

Source: RMG Morning Bru – “A Red Flag in Toronto” (Oct 6, 2025)

🔑 Broker Strategy: Use this as an educational moment with clients. For owners under pressure, explore refinance or consolidation solutions before delinquencies worsen. Proactive brokers can prevent panic by presenting debt management options.

5️⃣ Fixed vs. Variable: Calm Before the Data Storm

With bond yields muted and major economic data in flux, the cost gap between 3-year fixed and variable products has narrowed again. Most lenders have left rates unchanged this week, awaiting Friday’s Canadian jobs data and any U.S. shutdown updates.

Source:

Mortgage Logic News – Market Rate Snapshot (Oct 7, 2025)

🔑 Broker Strategy: Encourage rate discussions now. Shorter fixed terms remain the sweet spot for flexibility amid uncertainty. Advise clients that lender reactions can be swift once the next data wave hits.

📢 Final Thought:

Between the U.S. shutdown silence and Canada’s cautious labour rebound, markets are balancing patience with anxiety. The next 10 days could reshape expectations on both sides of the border. Stay proactive—protect clients with pre-approvals, monitor spreads closely, and turn uncertainty into trusted guidance.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 51: Behind the Broker with Ruby Bains

Guest: Ruby Bains

Ruby Bains, veteran mortgage professional and one of A Better Way’s original Mortgage Architects brokers, joins Behind the Broker to share how a 25-year banking career laid the foundation for her thriving, relationship-driven business today.

In this episode, Ruby reflects on her evolution from branch manager to independent broker, revealing how the shift from managing teams to managing client expectations transformed her perspective on service, communication, and leadership. Her approach—rooted in trust, education, and empathy—has helped her build a loyal client base across BC and Alberta.

Ruby also opens up about work-life balance as a mom of three, the power of clear communication and speed in deal management, and why returning to the office reignited her focus and productivity. She shares her routines for personal growth—from meditation and goal-setting to staying current with industry and technology trends—and why mindset, consistency, and authenticity remain her biggest success factors.

Through stories of connection, mentorship, and long-term vision, Ruby offers a grounded and inspiring look at what it means to build a mortgage career that thrives on integrity, visibility, and human touch in a digital age.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.