10/14/2025

Tuesday Mortgage Memo: Your Weekly Market Highlights

A Note of Thanks

We hope you enjoyed a restful Thanksgiving weekend! As markets reopen this week, we’re seeing a mix of cautious optimism and rate recalibration. Data flow is light but impactful—especially as inflation updates and funding shifts continue to guide sentiment heading into Q4.

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

1️⃣ Bond Yields Rebound Slightly After Holiday Calm

After drifting lower late last week, both Canadian and U.S. bond yields edged higher Tuesday morning. The 5-year GoC sits near 2.81%, while the U.S. 10-year Treasury hovers just above 4.25%. Analysts attribute the move to thin post-holiday trading and anticipation of U.S. CPI data later this week.

Source:

RMG Morning Bru – “Markets Stir After Thanksgiving Lull” (Oct 14, 2025)

🔑 Broker Strategy: Advise clients that small yield bumps may appear this week but remain within the broader downtrend. Short-term fixed rates continue to present an ideal balance between cost and flexibility.

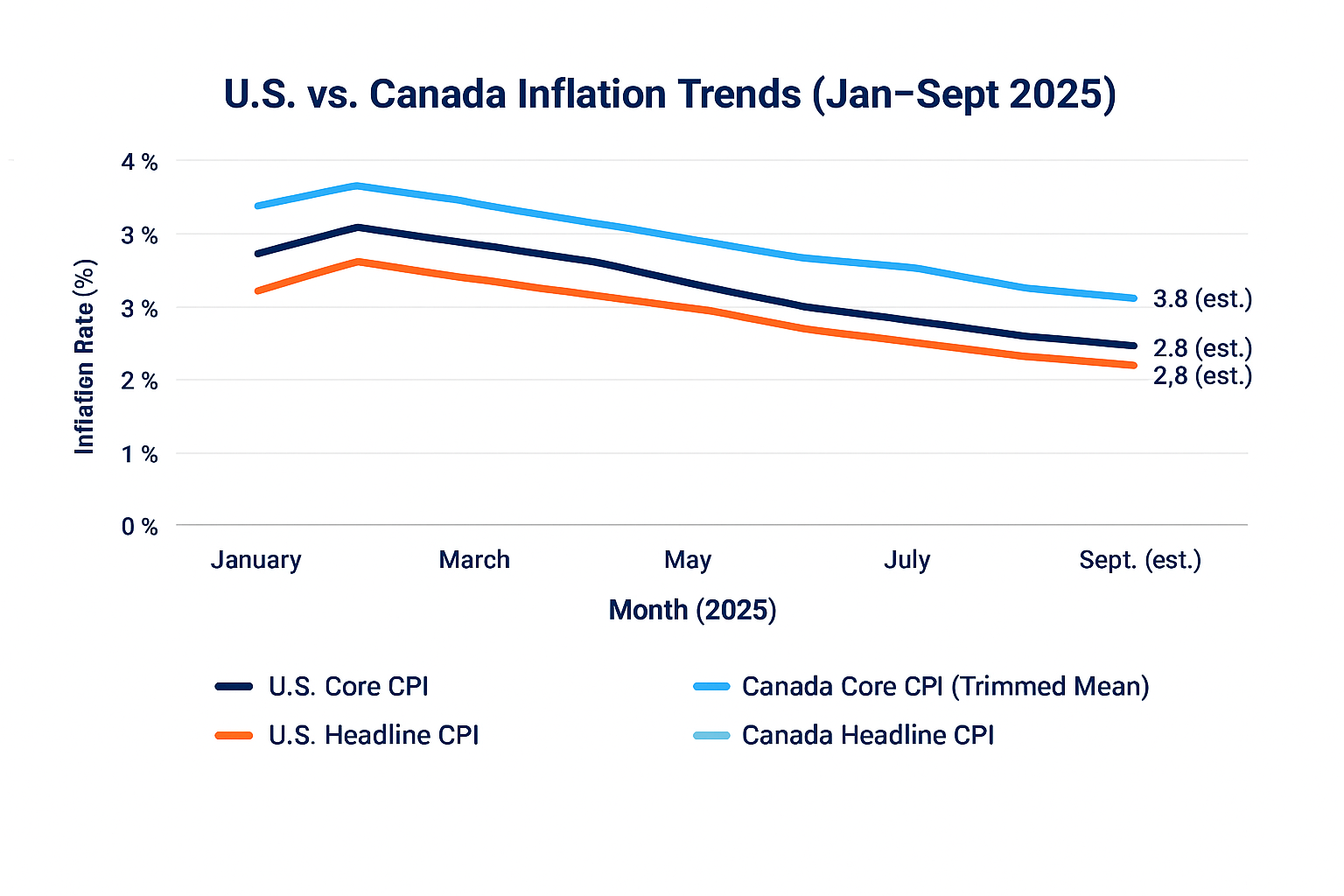

2️⃣ Inflation Outlook Split: U.S. Cooling, Canada Holding Firm

While U.S. core CPI is expected to ease slightly to 2.8%, Canada’s inflation metrics remain sticky—headline CPI last printed at 2.9% with the BoC’s core-trimmed measure steady near 3.0%. The contrast underscores diverging policy paths: the Fed leans dovish, while the BoC stays cautious amid persistent shelter costs and mortgage renewals impacting households.

Source:

Mortgage Logic News – “Inflation Divergence Across Borders” (Oct 14, 2025)

Below is a snapshot comparing U.S. vs. Canada Inflation Trends (Jan–Sept 2025), showing the U.S.’s gradual disinflation against Canada’s plateaued core metrics.

🔑 Broker Strategy: Use the inflation gap to frame client discussions around timing. Rate cuts could arrive earlier in the U.S., but domestic fixed-rate relief depends on when the BoC sees core measures fall consistently toward 2%. Encourage pre-approvals and early renewals to hedge against sticky pricing.

3️⃣ Fixed Rates Hold Steady Amid Spread Tightening

Most major lenders have kept fixed rates unchanged this week. Spreads between funding benchmarks and posted rates have narrowed slightly as lenders compete for Q4 volume. However, smaller non-bank lenders are pulling back on deep discounts, reflecting thinner margins after last quarter’s volatility.

Source: Mortgage Logic News – “Market Rate Watch: October Trends” (Oct 13, 2025)

🔑 Broker Strategy: Reassure clients that lender competition remains healthy. Highlight insured or hybrid options for cost efficiency, and track funding spreads—these often predict early rate shifts before BoC action.

4️⃣ Housing Inventory Climbs, But Demand Stays Regional

New listings rose 5% month-over-month nationally in September, driven by Ontario and B.C., while sales activity held steady. Prairies markets continue to outperform as affordability and stable employment attract migration. Analysts expect continued soft landings rather than a correction as the fall market progresses.

Source: RMG Morning Bru – “Listings Up, Demand Holds” (Oct 14, 2025)

🔑 Broker Strategy: Emphasize affordability dynamics. For buyers facing tighter credit, use insured mortgage options and budget refreshes to keep them market-ready amid changing price dynamics.

5️⃣ Lender Operations: Fall Efficiency Push

Several top lenders are rolling out underwriting and automation upgrades to improve document turnaround times during peak renewal season. Expect slight delays this week as integrations finalize. DLC brokers report smoother VelocityCRM integrations following last week’s patch update.

Source:

DLC Network News – “Operational Updates and CRM Enhancements” (Oct 13, 2025)

🔑 Broker Strategy: Keep clients informed about processing timelines and highlight proactive file submissions. Faster underwriting windows can help lock favourable rates before inflation data triggers volatility.

📢 Final Thought:

As post-holiday trading resumes, markets are looking for confirmation that inflation is indeed cooling. Bond yields remain data-sensitive, and lender spreads are compressing again—a sign of renewed stability. Continue to help clients read the signals, protect rate options early, and position confidently for Q4.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 51: Behind the Broker with Ruby Bains

Guest: Ruby Bains

Ruby Bains, veteran mortgage professional and one of A Better Way’s original Mortgage Architects brokers, joins Behind the Broker to share how a 25-year banking career laid the foundation for her thriving, relationship-driven business today.

In this episode, Ruby reflects on her evolution from branch manager to independent broker, revealing how the shift from managing teams to managing client expectations transformed her perspective on service, communication, and leadership. Her approach—rooted in trust, education, and empathy—has helped her build a loyal client base across BC and Alberta.

Ruby also opens up about work-life balance as a mom of three, the power of clear communication and speed in deal management, and why returning to the office reignited her focus and productivity. She shares her routines for personal growth—from meditation and goal-setting to staying current with industry and technology trends—and why mindset, consistency, and authenticity remain her biggest success factors.

Through stories of connection, mentorship, and long-term vision, Ruby offers a grounded and inspiring look at what it means to build a mortgage career that thrives on integrity, visibility, and human touch in a digital age.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.