10/21/2025

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

Markets are juggling stronger-than-expected CPI and “dovish” central-bank signals. With both Canada and the U.S. releasing key inflation data, expectations are rising for at least one more BoC cut this quarter—but the messaging may stay hawkish to preserve credibility.

1️⃣ CPI Re-Accelerates: Headline Inflation at 2.4%

Canada’s CPI climbed to 2.4% y/y in September, up from 1.9% in August, driven by a smaller drop in gasoline prices and stronger grocery costs. Core inflation (trim and median) averaged 3.15%, while the share of CPI components above 3% eased slightly to 38%. Shelter inflation rose 2.6%, with rents up nearly 5%. Economists see inflation momentum as uncomfortably sticky, delaying full policy easing.

Source:

Dr. Sherry Cooper – Dominion Lending Centres, Inflation News (Oct. 21, 2025)

🔑 Broker Strategy: Manage rate expectations carefully. Use today’s data to lock holds early this week—headline relief is still months away, and a single strong CPI print can reverse pricing gains quickly.

2️⃣ Key Rates Snapshot — “Cut Hopes vs. Sticky Core”

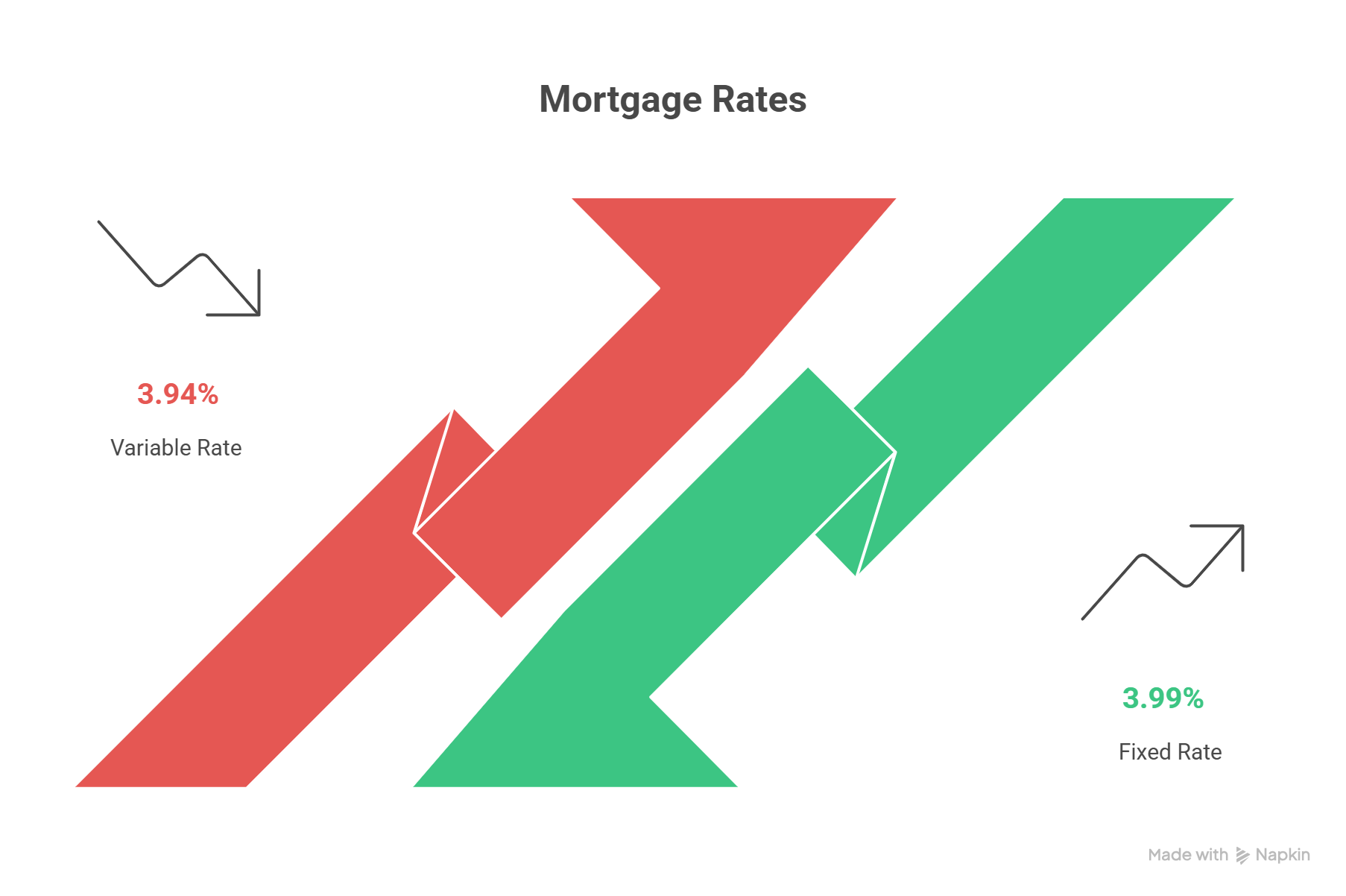

Mortgage Logic News’ command centre shows bonds and fixed rates slipping modestly, while variable products inch lower with rate-cut speculation.

Source:

Mortgage Logic News – Rates Slip Again as BoC Surveys Kill the Vibe (Oct. 21, 2025)

Fixed and variable rates dipped slightly ahead of BoC decision—expect modest relief, not a wave.

🔑 Broker Strategy: Present visuals showing small declines in mortgage benchmarks but caution that deeper cuts depend on sustained inflation cooling. Fixed terms are slightly more attractive this week, but don’t overpromise rate drops.

3️⃣ BoC Survey: Consumers Still “Hawkish”

The Bank of Canada’s Q3 surveys show businesses losing pricing power, while consumers expect higher prices ahead. Five-year inflation expectations rose again to 3.67%, and 70% of consumers believe “the worst is still to come.” Labour-shortage pressure hit its lowest since 2010. The BoC is still battling inflation psychology, not just inflation math.

Source: Mortgage Logic News – The BoC’s Ongoing Headache: Hawkish Consumers (Oct. 20, 2025)

🔑 Broker Strategy: For brokers, emphasize payment predictability and rate caps. Inflation expectations can sway sentiment fast—help clients interpret surveys as data, not destiny.

4️⃣ Economists: Inflation Persistence May Curb Further Cuts

DLC’s Dr. Sherry Cooper notes underlying price pressure remains high despite weaker GDP. The BoC is likely to cut rates to 2.25% in its next move but may need to pair it with hawkish messaging. Traders have reduced the odds of a follow-up cut to 65%.

Source: Dominion Lending Centres – Inflation News (Oct. 21, 2025)

🔑 Broker Strategy: Use this as a talking point for pipeline clients—today’s mild easing is not the start of a deep cycle. Highlight payment buffers and prepayment privileges in all renewal and refinance discussions.

5️⃣ Fed & BoC: Dovish Rhetoric, Hawkish Reality

U.S. Fed Chair Powell’s latest remarks were dovish, citing labour softness and tariff-driven inflation. Markets now price a 97% chance of a 25-bp Fed cut on Oct. 29, while BoC odds stand near 60%. Both central banks are cutting—but reluctantly.

Source:

MRMG Monday Morning Bru – Just Do It, Leading Up to the Bank of Canada (Oct. 20, 2025)

🔑 Broker Strategy: Position clients for flexibility. A “hawkish cut” could move short-term rates without unlocking cheaper funding costs. Reassess floating-rate exposure before month-end.

📢 Final Thought:

This week marks a crossroads moment: inflation remains sticky, rate cuts loom, and consumer psychology is still fighting last year’s ghosts. Strong brokers will guide clients through the noise—anchoring advice on affordability, not headlines. Keep pre-approvals active, focus on credit-ready clients, and prep communications for BoC day.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 52: Behind the BrokerAGE with justin noda

Guest: Justin Noda

Justin Noda—A Better Way’s new Chief Compliance & Operations Officer—joins the show to launch Behind the Brokerage, a series unpacking the systems, regulations, and operational playbooks that protect brokers and power scalable growth.

With 18 years in the industry across brokering, underwriting, and leadership (ClearTrust, Origin Mortgages, The Mortgage Center, CFS), Justin explains why a true “culture of compliance” is now a competitive edge. He shares how ABW is translating complex rules—FinTrack, evolving AML expectations, and BC’s coming Mortgage Services Act—into clear, broker-friendly processes, tools, and training that make daily work easier, not harder.

Justin also outlines what the new series will cover: practical FinTrack readiness, MSA timelines and implications, inter-provincial differences (BC/AB/ON) and how to stay compliant across borders, lender relations and deal-desk ops, and why every agent should know (and use) their brokerage’s policies & procedures. Throughout, he keeps a broker-first lens—balancing regulation with real-world deal flow, client service, and efficiency.

This episode sets the tone for ABW’s next chapter: transparency, education, and operations that protect agents while elevating professionalism across the industry.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.