10/01/2025:(Special Wednesday Edition)

Tuesday Mortgage Memo: Your Weekly Market Highlights

With yesterday marking Canada’s National Day for Truth and Reconciliation, our memo comes to you today, reflecting on both the significance of the holiday and the latest developments in the mortgage and economic landscape.

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

With U.S. shutdown risks, critical jobs data, and Canada’s next CPI still weeks away, markets are bracing for volatility. Bond yields are whipsawed between safe-haven flows and inflation concerns, while lenders continue to watch spreads closely. This is a pivotal week for brokers to stay proactive—helping clients secure rate holds, weigh short-term flexibility, and prepare for policy moves on both sides of the border.

1️⃣ Bond Yields React to U.S. Shutdown Fears

Markets are on edge as the U.S. government faces an 83% probability of shutting down this week. Canadian 5-year bond yields slipped modestly (-2 bps) early Monday, echoing U.S. 10-year treasuries as investors shifted into safe-haven assets. While the Fed recently cut rates, stubborn inflation has prevented yields from falling further.

Source:

RMG Monday Morning Bru: America in Shutdown? Jobs Data in Focus – Sept 29, 2025

🔑 Broker Strategy: Highlight to clients that shutdown-related volatility can drive temporary dips in yields. Advise locking rate holds swiftly before jobs data later this week swings markets in the other direction.

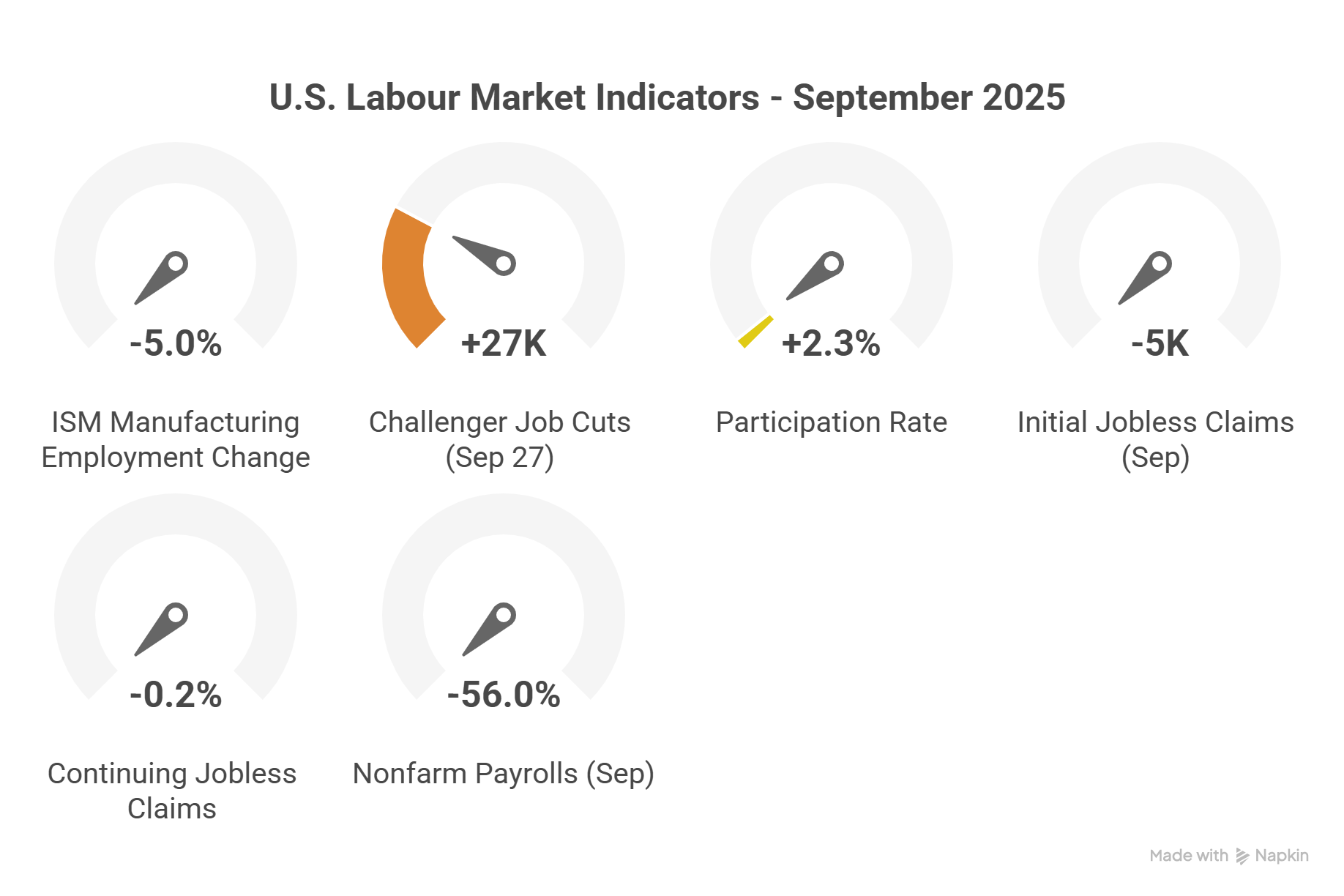

2️⃣ U.S. Jobs Data in the Spotlight (Visual Insight)

This week’s U.S. labour market calendar is packed: JOLTs, ADP employment, Challenger job cuts, and Nonfarm Payrolls. Consensus estimates point to weaker hiring but sticky unemployment near 4.3%. Canadian fixed mortgage rates remain tethered to these U.S. outcomes, as softer prints may open the door for further yield declines.

Source:

RMG Monday Morning Bru: America in Shutdown? Jobs Data in Focus – Sept 29, 2025

Below is a snapshot of U.S. Labour Market Indicators for September 2025, illustrating cracks forming in employment despite headline job creation.

🔑 Broker Strategy: Share this with rate-sensitive buyers. Explain how softer jobs data may bring temporary rate relief, but stress the importance of locking in before CPI and Canadian jobs releases mid-October.

3️⃣ Canadian Economy: Inflation Quiet Before October Data

Canada’s CPI release isn’t due until Oct. 21, but markets are closely watching whether the September jobs report (due Oct. 10) confirms the labour softening trend. A weaker print could tilt BoC toward deeper cuts, though credit spreads remain wide and could mute the impact on fixed rates.

Source: Mortgage Logic News – Sept 29, 2025

🔑 Broker Strategy: Prep renewal clients now. Even if BoC eases further, lenders may not fully pass savings along. Stress-test scenarios with spread assumptions baked in.

4️⃣ Fixed vs. Variable: Still a Tight Call

Models show only a slim cost advantage for variables over the most competitive 2–3 year fixed terms. With bond yields volatile, many clients may find short fixed terms the “least wrong” option until inflation convincingly moderates.

Source: Integrated Mortgage Planners – Sept 29, 2025

🔑 Broker Strategy: Lead with flexibility. Position short fixed or hybrid solutions as hedges against both inflation stickiness and rate-cut scenarios into 2026.

5️⃣ Operational Edge: Digital Tools Driving Client Confidence

With fall’s housing season underway, brokers are seeing more clients asking for digital pre-approval tools and faster response times. Platforms like Velocity and lender portals are adding enhancements that let brokers generate instant affordability insights, while also integrating compliance checks in real-time. This gives brokers both a speed and trust advantage.

Source:

DLC Network News – Your Network News: 09.30.2025

🔑 Broker Strategy: Highlight to clients that your team can deliver not just approvals, but also instant insights into borrowing power. Position these digital tools as an edge in a competitive housing market—speed and certainty can often make the difference in a winning offer.

📢 Final Thought:

This week is a balancing act between shutdown fears, pivotal U.S. jobs data, and Canada’s upcoming inflation releases. The signals are mixed—yields are bouncing on safe-haven flows while spreads keep lenders cautious. For brokers, the edge lies in timing: securing holds before data hits, guiding clients toward flexible terms, and being ready to pivot once the results are in. The brokers who act before the headlines, not after, will lead the conversation and win client confidence through an uncertain fall market.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 50: Behind the Broker with Anil Kumar

Guest: Anil Kumar

Anil Kumar, top-producing mortgage broker with A Better Way Mortgage Group and Mortgage Architects, shares how his journey from sales and marketing to mortgage brokering has been shaped by resilience, relentless learning, and a passion for client relationships.

In this episode, Anil reflects on how becoming a broker in 2018 gave him the flexibility to balance family, travel, and career—while still building one of the most client-first practices in the industry. He explains why long, meaningful conversations are the cornerstone of his approach, how persistence through multiple lender declines pays off, and why “never giving up” has become his personal motto.

Anil also highlights the power of mentorship, product knowledge, and consistent follow-up as the keys to both client confidence and referral partner trust. From creating harmony between work and family life to mentoring the next generation of brokers, his story is one of service, growth, and giving back to both his community and his industry.

This episode is a candid look at what it means to succeed as a modern mortgage broker: not by chasing shortcuts, but by doubling down on relationships, knowledge, and resilience.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.