09/23/2025:

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

With last week’s surprise rate cuts from both the BoC and Fed, bond markets sent mixed signals as yields rose on renewed inflation worries. The path ahead is anything but smooth: stagflation risks, sticky inflation, and global divergences are shaping broker strategies. Here’s what matters most this week:

1️⃣ Rate Cuts Land, But Yields Rise

Both the Bank of Canada and the Federal Reserve cut rates by 25 bps last week. However, instead of easing, bond yields climbed—reflecting concerns that inflation remains elevated. The 5-year GoC yield ticked up from 2.72% to 2.77% post-decision, while the U.S. 10-year moved from 3.99% to 4.08%.

Source:

RMG Your Monday Morning Bru – Bank of Canada and Fed Decreased, So Why Are Bond Yields Up? (Sept 22, 2025)

🔑 Broker Strategy: Explain to clients that rate cuts don’t always mean lower fixed mortgage rates. Funding costs are still tied to bond yields, and lenders are pricing defensively against inflation risks. Encourage rate holds where available.

2️⃣ Inflation & Growth Divergence in Canada vs. U.S.

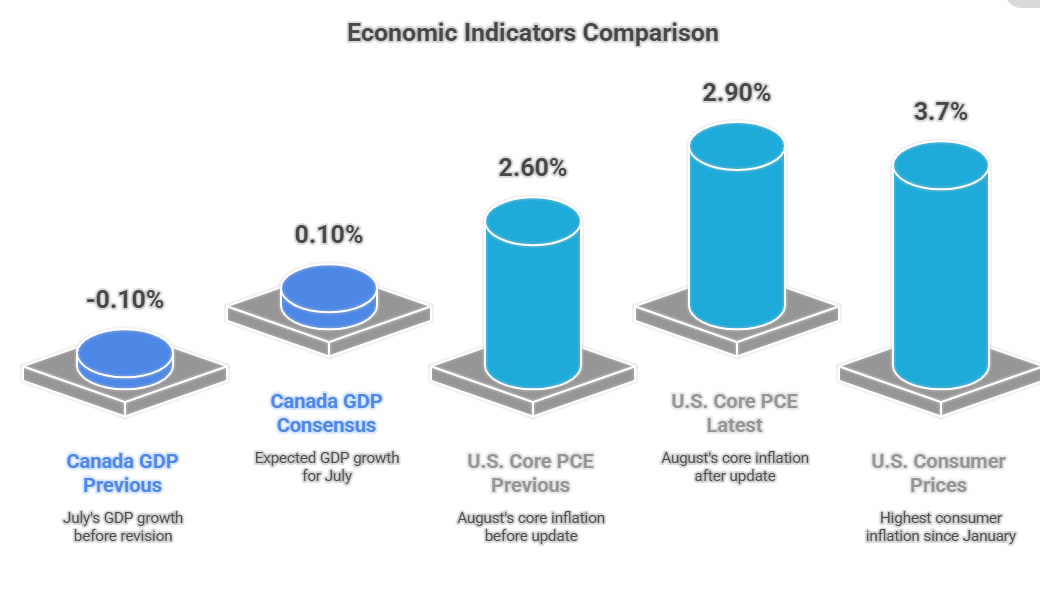

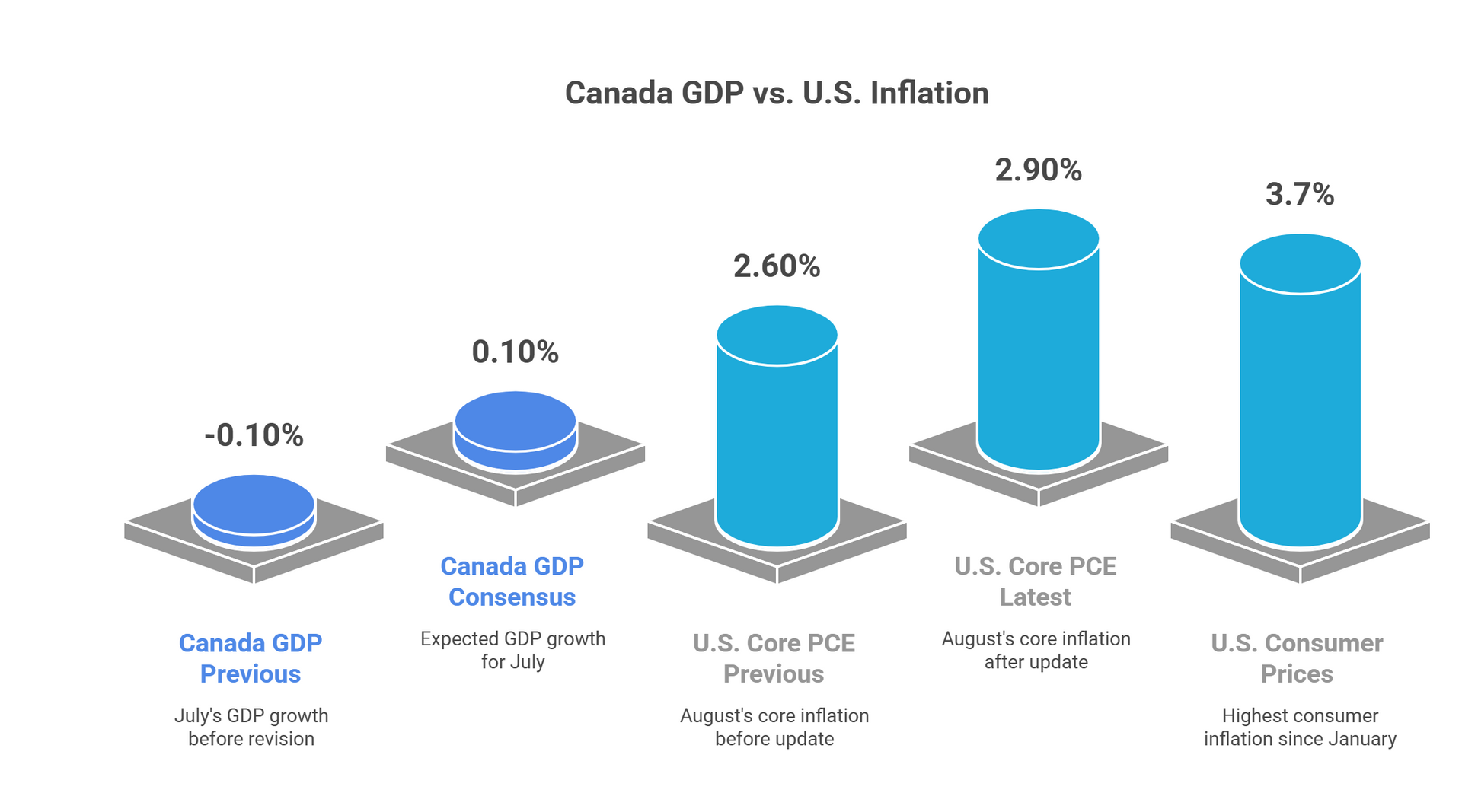

Canadian GDP growth remains fragile, with July GDP expected at just +0.1% after a -0.1% prior reading. Meanwhile, U.S. inflation is proving sticky: the Fed raised its outlook for PCE and Core PCE into 2026. With U.S. consumer prices rising at their fastest pace since January, stagflation fears are growing.

Source:

RMG Your Monday Morning Bru – Bank of Canada and Fed Decreased, So Why Are Bond Yields Up? (Sept 22, 2025)

This chart highlights Canada’s weak growth against persistently elevated U.S. inflation, underscoring the widening policy divergence that brokers must watch closely.

🔑 Broker Strategy: Use this divergence to frame client conversations. Highlight that Canadian cuts may come sooner, but U.S. inflation could pull our yields higher again. A short-term fixed strategy can protect against swings.

3️⃣ Stagflation Risks Back on the Radar

Markets are increasingly nervous that slowing growth plus persistent inflation could morph into stagflation. U.S. housing and food costs drove August’s price surge, while Canada’s labour market has softened further, leaving policymakers caught in a squeeze.

Source: RMG Your Monday Morning Bru – Bank of Canada and Fed Decreased, So Why Are Bond Yields Up? (Sept 22, 2025)

🔑 Broker Strategy: Prepare clients for volatility. Stagflation fears tend to support safe-haven flows, which can swing yields daily. Use these windows to lock favourable fixed terms quickly.

4️⃣ Fixed vs. Variable Sentiment Shifts Again

Rate cuts typically boost variable-rate appeal, but rising yields and lender spreads are keeping 1–3 year fixeds in demand. Many clients are asking about hybrids—part fixed, part variable—as a way to balance protection with potential upside.

Source: Mortgage Logic News – Weekly Rate Moves Recap (Sept 22, 2025)

🔑 Broker Strategy: Lead with education. Short fixeds still offer the clearest value, but keep variable as a discussion point for long-term optimists. Stress-test scenarios to help clients feel confident.

5️⃣ Broker Edge: Rested Brokers Win More

This week’s BTBB blog focused on broker performance: cancel unnecessary meetings, take breaks, and treat rest as a competitive advantage. Burnout leads to sloppy calls and poor judgment, while rest sharpens decision-making and client impact.

Source:

BTBB Sunday Blog – Be Intentional With Your Time (Sept 21, 2025)

🔑 Broker Strategy: Block time for recovery as strategically as you block client calls. Energy and clarity translate directly into better submissions, smoother client interactions, and stronger closes.

📢 Final Thought:

Markets are in a rare state: central banks are cutting, but yields are rising. Inflation fears are reasserting themselves, and stagflation risk is in the air. Brokers who stay proactive—arming clients with strategies for both fixed and variable paths—will stand out. Protect with holds, lean into short terms, and position as the voice of calm in a volatile landscape.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 50: Behind the Broker with Anil Kumar

Guest: Anil Kumar

Anil Kumar, top-producing mortgage broker with A Better Way Mortgage Group and Mortgage Architects, shares how his journey from sales and marketing to mortgage brokering has been shaped by resilience, relentless learning, and a passion for client relationships.

In this episode, Anil reflects on how becoming a broker in 2018 gave him the flexibility to balance family, travel, and career—while still building one of the most client-first practices in the industry. He explains why long, meaningful conversations are the cornerstone of his approach, how persistence through multiple lender declines pays off, and why “never giving up” has become his personal motto.

Anil also highlights the power of mentorship, product knowledge, and consistent follow-up as the keys to both client confidence and referral partner trust. From creating harmony between work and family life to mentoring the next generation of brokers, his story is one of service, growth, and giving back to both his community and his industry.

This episode is a candid look at what it means to succeed as a modern mortgage broker: not by chasing shortcuts, but by doubling down on relationships, knowledge, and resilience.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.