08/19/2025:

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

With inflation divergence, bond market volatility, and renewed global uncertainty, this week offers both risk and opportunity. Brokers who lean into pre-approvals, watch credit spreads, and communicate the rate path clearly will be best equipped to guide clients. Here’s what you need to know:

1️⃣ Fixed Rates Edge Higher Despite Softer Data

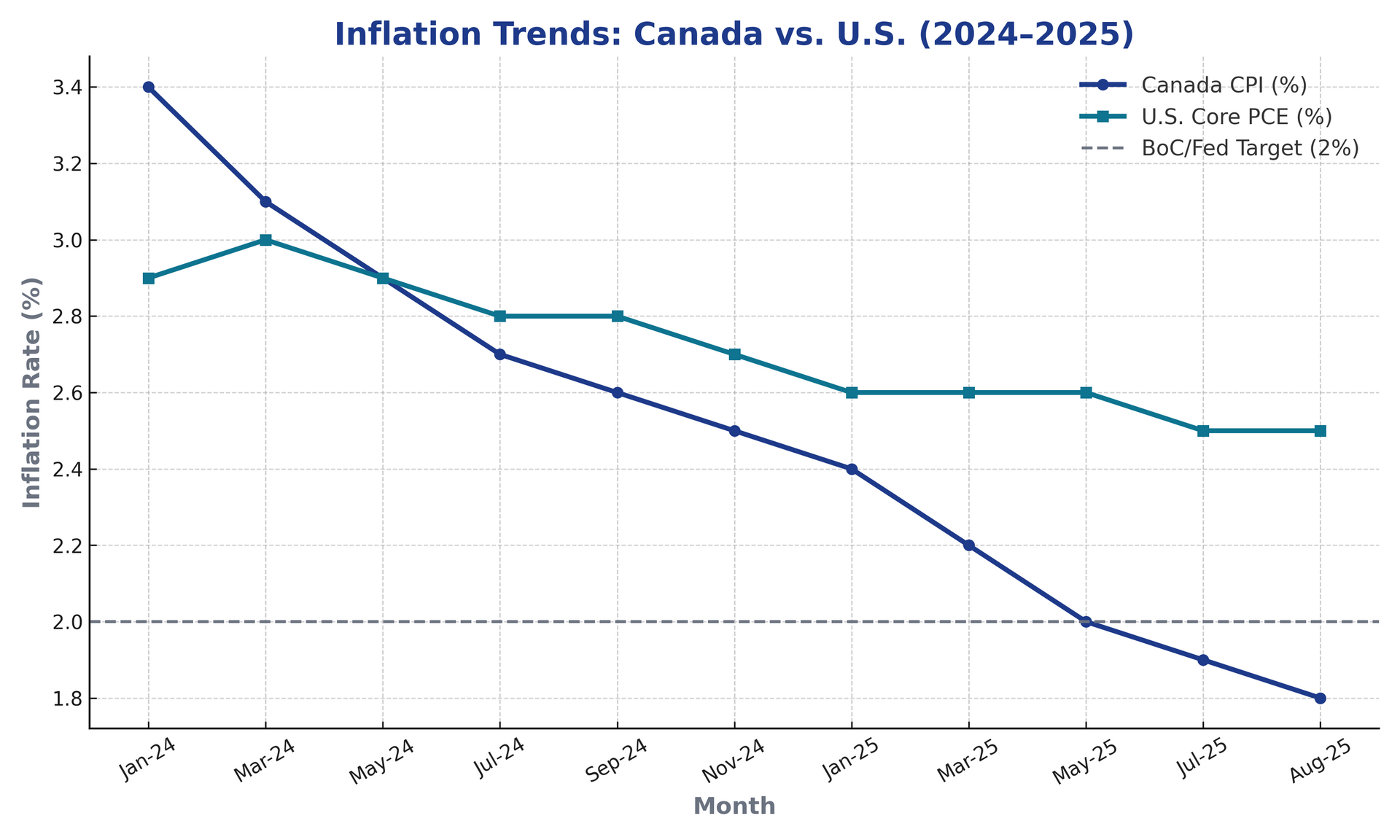

Canada’s inflation continues to drift closer to the BoC’s 2% target, while U.S. core inflation is proving stickier, keeping the Fed cautious. This divergence is creating a split in monetary policy outlooks: Canada is signaling potential cuts, while the U.S. may hold longer. For brokers, this divergence could mean volatility in CAD-USD exchange rates and a wider gap in bond yields.

Source:

Mortgage Logic News – August 18, 2025

🔑 Broker Strategy: Advise clients that lenders remain reluctant to cut despite softer data. Pre-approvals and holds remain critical—clients waiting for official BoC cuts may miss better opportunities.

2️⃣ Inflation Divergence Between Canada and the U.S. is Widening

While headline CPI may look contained, Core CPI and trimmed-mean inflation remain elevated—hovering near or above 2.5%. In the U.S., Core PCE inflation is also trending higher. This underlying trend is creating a widening policy gap: the BoC is approaching a potential easing cycle while the Fed holds firm, wary of lingering inflation.

Source:

Bruno’s Weekly Lender Update – August 18, 2025

Below is a snapshot comparing Canadian CPI and U.S. Core PCE from 2024–2025, illustrating how Canada is moving toward target while the U.S. remains elevated:.

🔑 Broker Strategy: Use this divergence to highlight timing risks with rate cuts. Suggest shorter fixed terms or hybrid strategies to clients unsure about locking in while policy paths remain out of sync.

3️⃣ Rising Credit Spreads Keep Lenders Defensive

Even with stable Government of Canada bonds, widening credit spreads are pushing lenders to maintain higher fixed rates. This trend is especially pronounced in uninsured and jumbo products. Promotional offers are becoming scarcer, showing lenders’ unwillingness to sacrifice margins.

Source: RMG Monday Morning Bru – August 18, 2025

🔑 Broker Strategy: For clients with larger mortgages, consider insured products or break down how a slightly smaller down payment could reduce spreads and lead to better all-in costs.

4️⃣ Market Eyes U.S. Data for Direction

All eyes are on U.S. retail sales and jobless claims later this week, both of which will influence global rate sentiment. Stronger data could reinforce the Fed’s cautious stance and push Canadian yields higher in sympathy, even as domestic data remains weak.

Source: Bank Trade & Bond Bulletin (BTBB) – August 18, 2025

🔑 Broker Strategy: Position clients to act before Thursday’s data. If U.S. numbers come in hot, lenders may widen spreads again, pulling advertised rates higher within days.

5️⃣ Variable vs. Short Fixed: The Debate Resurfaces

While variable rates remain elevated, clients are increasingly weighing them against short-term fixed options. With BoC dovish signals, variable looks more attractive—but volatility in U.S. markets is keeping short fixed in play. Brokers are recommending blended solutions to capture both flexibility and protection.

Source: Mortgage Market Round-Up (MMRU) – August 18, 2025

🔑 Broker Strategy: Present layered strategies—mixing short fixed and variable exposures—to balance client risk. Stress that timing the absolute bottom is nearly impossible, but flexibility can capture opportunities as they come.

📢 Final Thought:

The growing divergence between Canada and U.S. policy paths is the story of the week—and possibly the quarter. For brokers, this creates opportunities to show clients why strategy matters as much as rate. With credit spreads widening and lenders hesitant, being proactive on structure and timing will separate the prepared from the reactive.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 47: Behind the Broker with Chris Pughe

Guest: Chris Pughe

Chris Pughe, veteran mortgage broker at A Better Way Mortgage, shares how her decades-long career—from collections and underwriting at Vancity to building a thriving referral-based business—has been fueled by relationships, adaptability, and a genuine love for helping people.

In this episode, Chris reveals how she quadrupled her volume in just one year by embracing training, adopting new tools, and stepping outside her comfort zone. She discusses her “out-care the competition” philosophy, the power of phone calls in a digital world, and why a small, trusted referral network beats spreading yourself too thin.

From using the “Dreams and Goals” strategy to help clients pay off mortgages years early, to balancing efficiency with human connection, Chris offers insights brokers can put into action immediately. Her journey shows that when you lead with care, stay curious, and keep improving, success follows.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.