09/09/2025:

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

With weak labour prints, pivotal U.S. inflation data, and rising cut odds ahead of next week’s policy meetings, it’s a tactical week. Funding costs eased, but sentiment is fragile. Here’s what matters now—and how to turn it into client wins.

1️⃣ Yields Ease on Lousy Jobs; Funding Costs Dip

Canadian funding benchmarks continued to drift lower after last week’s jobs shock. The 5-year GoC and 5-/10-year CMBs finished down ~4–5 bps Monday, and leading insured 5-year fixed rates trimmed ~5 bps. Markets are laser-focused on Thursday’s U.S. CPI, with cuts already heavily priced.

Source:

5yr Yields Off 4 Bps, Still Spooked By Lousy Jobs Data – Mortgage Logic News (Sept 8, 2025)

🔑 Broker Strategy: Use the dip to refresh pre-approvals and lock short-term fixed holds where suitable. Flag to clients that CPI could reverse gains quickly if it surprises hot.

2️⃣ Labour Market Cracks Deepen—Revisions in Focus

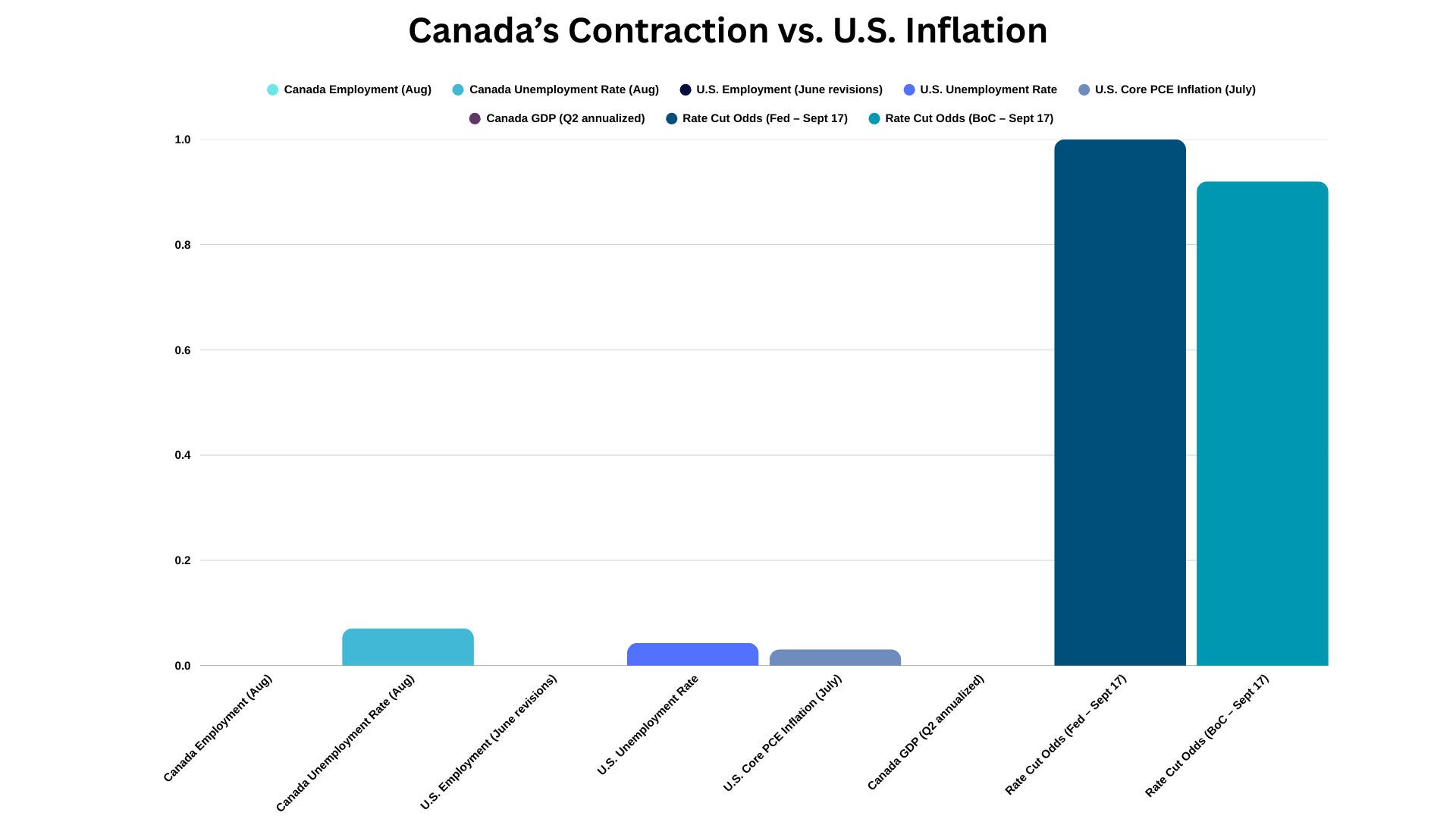

Canada shed 65,500 jobs in August and unemployment climbed to 7.1%. In the U.S., June revisions flipped to a –13k net loss and job openings have fallen below the number of unemployed for the first time in 4+ years—setting the stage for high-impact annual revision data and this Thursday’s CPI (consensus 2.9% YoY; core was 3.1% in July).

Source:

RMG Morning Bru: Inflation, the Job Market & BoC on Sept. 17 (Sept 8, 2025)

This chart highlights Canada’s GDP contraction alongside sticky U.S. inflation, underscoring the policy divergence.

🔑 Broker Strategy: Re-engage fence-sitters before data hits. Explain how softer employment + benign CPI can nudge discounted fixed rates lower; conversely, a hot print can lift lender costs within days

3️⃣ Rate-Cut Odds Surge for Sept 17

Futures now imply a 100% chance of a 25 bps Fed cut next Wednesday and roughly 92% odds of a 25 bps BoC cut the same day, as traders weigh growth risks over sticky prices.

Source: 5yr Yields Off 4 Bps, Still Spooked By Lousy Jobs Data – Mortgage Logic News (Sept 8, 2025).

🔑 Broker Strategy: Prep variable-rate clients for potential prime reductions and payment relief scenarios. For fixed borrowers renewing soon, secure holds now; spreads and lender funding costs can still cap post-cut discounts.

4️⃣ Fixed vs. Variable: The Value Gap Is Narrow

Despite easing expectations, models show only a small theoretical cost edge for today’s prime-minus variables versus competitive short fixed terms; three-year fixeds remain compelling relative to five-year variables in many scenarios. Bond yields could even firm if cuts arrive amid rising inflation concerns.

Source: Mortgage Logic News (Sept 8, 2025) and Integrated Mortgage Planners: Weak US & Canadian Employment Reports Fuel Rate-Cut Speculation (Sept 8, 2025)

🔑 Broker Strategy: Lead with suitability: short fixed (1–3 yr), or hybrid structures for clients seeking flexibility with downside participation if cuts extend into 2026.

5️⃣ Operational Edge: Ready-Made Client Content & Training

DLC’s September client newsletter (Fall Housing Forecast + Back-to-School Budgeting) is live in Autopilot/VelocityCRM. A slate of Velocity training sessions runs Sept 15–17 to sharpen submissions, docs, and CRM workflows—perfect timing ahead of policy week.

Source:

DLC Network News – Your Network News: 09.09.2025

🔑 Broker Strategy: Push the newsletter today and build a 3-touch campaign through Sept 17 (pre-CPI note ➜ policy-day explainer ➜ post-decision options). Use training to streamline file flow during the fall surge.

📢 Final Thought:

Markets are balancing a weakening labour backdrop against inflation that refuses to fall fast enough. That tension is why cut odds are high—even as lenders remain spread-sensitive. Keep clients focused on process: protect with holds, choose terms for flexibility, and be ready to pivot after Thursday’s CPI and next Wednesday’s decisions.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 49: Mentorship and Growth – Inside the Broker Relationship Manager Role

Guests: Chris Pughe & Danny Duong

In this episode of the Mortgage Broker Podcast, Chris Pughe and Danny Duong join Dean Lawton and Jason Marshall to unpack the creation of A Better Way’s new Broker Relationship Manager (BRM) role—an initiative designed to support bankers and brokers transitioning into the channel with confidence.

Drawing from their own journeys from banking to brokering, Chris and Danny explain how the BRM role bridges a critical gap: guiding new agents through setup, lender access, compliance, and client continuity while also easing the emotional hurdles of change. From “day-one” logistics like securing a laptop or navigating Velocity, to helping agents manage the anxiety of leaving the bank world, the BRM program ensures no one feels alone in the process.

What makes this role unique is that both Chris and Danny remain active, high-producing brokers themselves. They bring lived experience to each conversation—offering tactical support, practical shortcuts, and the reassurance that success is possible on the other side of the transition. Along the way, they also share stories of new brokers who nearly gave up but found their footing with the right mentorship.

This episode shines a light on how culture, collaboration, and peer-to-peer mentorship can transform onboarding, strengthen community, and set the stage for long-term success in the mortgage industry.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.