09/16/2025:

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

With the Bank of Canada announcement tomorrow, markets are finely balanced between weak labour prints, sticky inflation risks, and growing pressure to deliver cuts. Funding costs have eased slightly, but spreads remain volatile. Here’s what matters most this week—and how to turn it into actionable strategies.

1️⃣ Yields Steady Into BoC Decision

Canadian bond yields held largely unchanged at the start of the week, with the 5-year GoC hovering around recent lows. Lenders appear reluctant to trim further ahead of Wednesday’s BoC call, leaving most 5-year fixed offers in wait-and-see mode.

Source:

Mortgage Logic News – Market Preview Ahead of BoC (Sept 15, 2025)

🔑 Broker Strategy: Manage client expectations: while rate cuts are likely, lender spreads may limit immediate relief. Encourage borrowers to secure holds today rather than gamble on post-decision moves.

2️⃣ Labour Market Weakness Driving Rate-Cut Bets

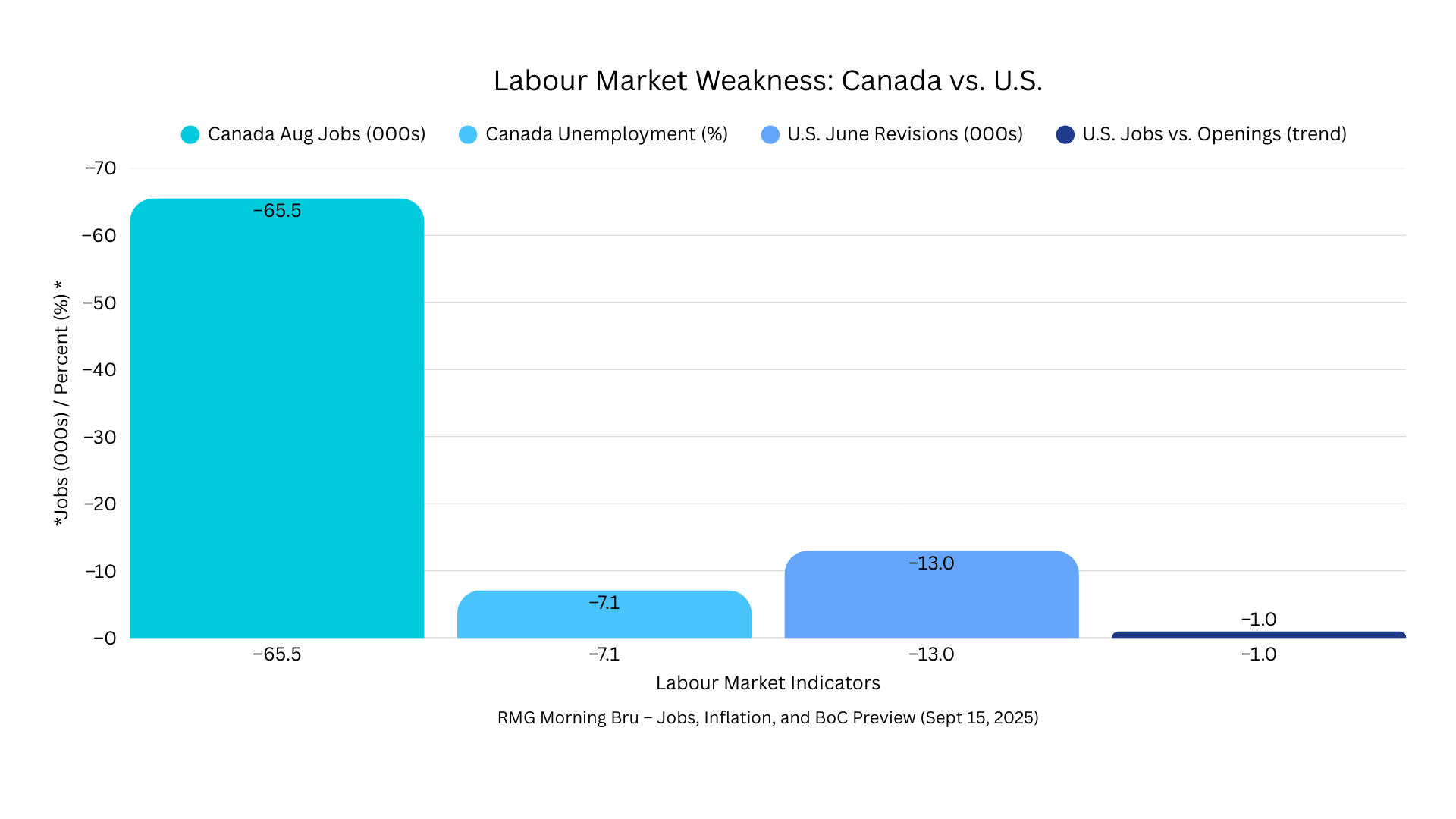

August’s labour shock—Canada shedding 65,500 jobs, unemployment at 7.1%—has sharpened focus on structural cracks. South of the border, revisions flipped June into a net loss, and job openings have fallen below unemployed totals for the first time in over four years. These signals frame tomorrow’s BoC and next week’s Fed decisions.

Source:

RMG Morning Bru – Jobs, Inflation, and BoC Preview (Sept 15, 2025)

This chart comparing Canada’s job losses with U.S. revisions (2023–2025) can show the depth of labour market fragility and explain why central banks are under pressure.

🔑 Broker Strategy: Explain to clients that weak employment data often leads to easier monetary policy. Position variable-rate borrowers for prime reductions, but warn fixed borrowers that spreads may blunt pass-through savings.

3️⃣ Inflation Data Still in the Way

Despite softer growth, inflation remains sticky. Canada’s trimmed-mean CPI is still near 3%, and the U.S. core PCE stands at 2.6%—both above comfort zones. This is limiting how aggressive policymakers can be, even as labour slack builds.

Source: Integrated Mortgage Planners – Inflation and Policy Divergence (Sept 15, 2025)

🔑 Broker Strategy: Use this to show clients the delicate balance: cuts are coming, but if inflation fails to ease, deeper rate relief could stall. Recommend layered strategies—short-term fixed plus later float options.

4️⃣ Fixed vs. Variable: Margins Narrow, Suitability Wins

Models suggest only a modest edge for variables compared with competitive 2- or 3-year fixeds. Funding spreads mean lenders aren’t passing along the full market dip. For many clients, short fixed or hybrid solutions provide the best balance of protection and flexibility.

Source: Mortgage Logic News – Rate Models Point to Small Variable Advantage (Sept 15, 2025)

🔑 Broker Strategy: Frame conversations around suitability, not just price. Demonstrate scenarios where a short fixed locks security but still leaves room to benefit if the easing cycle extends.

5️⃣ Broker Edge: Training and Outreach Tools

DLC’s fall training series continues this week with sessions on compliance, digital submissions, and leveraging Autopilot CRM for seasonal campaigns. At the same time, the network’s September client newsletter is live—focused on housing affordability and budgeting strategies.

Source:

DLC Network News – Your Network Update (Sept 15, 2025)

🔑 Broker Strategy: Use these tools now—build a 3-touch campaign around BoC day (pre-decision, same-day, post-announcement). Leverage training to tighten file flow during the busy fall market.

📢 Final Thought:

Markets are staring down a critical policy moment. Weak jobs point to cuts, but inflation insists on caution. Lenders remain margin-sensitive, which means clients won’t see all the benefit immediately. Stay proactive this week: prepare them for tomorrow’s BoC outcome, explain the spread dynamic clearly, and position files early for flexibility after the announcement.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 49: Mentorship and Growth – Inside the Broker Relationship Manager Role

Guests: Chris Pughe & Danny Duong

In this episode of the Mortgage Broker Podcast, Chris Pughe and Danny Duong join Dean Lawton and Jason Marshall to unpack the creation of A Better Way’s new Broker Relationship Manager (BRM) role—an initiative designed to support bankers and brokers transitioning into the channel with confidence.

Drawing from their own journeys from banking to brokering, Chris and Danny explain how the BRM role bridges a critical gap: guiding new agents through setup, lender access, compliance, and client continuity while also easing the emotional hurdles of change. From “day-one” logistics like securing a laptop or navigating Velocity, to helping agents manage the anxiety of leaving the bank world, the BRM program ensures no one feels alone in the process.

What makes this role unique is that both Chris and Danny remain active, high-producing brokers themselves. They bring lived experience to each conversation—offering tactical support, practical shortcuts, and the reassurance that success is possible on the other side of the transition. Along the way, they also share stories of new brokers who nearly gave up but found their footing with the right mentorship.

This episode shines a light on how culture, collaboration, and peer-to-peer mentorship can transform onboarding, strengthen community, and set the stage for long-term success in the mortgage industry.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.